First, it appears what way? That the head of FHFA decided on his(?) own to raise rates? Then why does the article you're quoting keep using the word "we"?

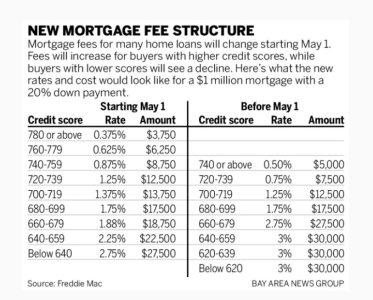

Second, according to the chart, those people with a credit score of 780+ WILL pay more in fees. On a $1 MILLION dollar loan, they will pay an extra $1250. (Going from $3750 to $5000). That will increase their monthly payment by $9, on a $1 MILLION dollar loan.

On a $500,000 loan, they pay an extra $4.50/month? Let's see... $500,000 * 0.375% (old rate)= $1875.0. $500,000 * 0.5% = $2500. $2500-$1875 = $625 more. Over the life of the loan... yup, $4/month. Obviously the lower the loan, the less that cost will be. Sorry, I can't feel sorry for them, and that includes me.

OK, everyone else pays less in fees than they did before, BUT still more than those with 780+ credit ratings.