Ok, so I think I have a gameplan.

1) just SM'd chase to confirm if I close SW Prem account prior to statement closing, I will still get my points for this month. Assuming they say yes, I will close it today.

2) Once it updates on my CR, I will app for the SW Biz...hopefully in a few days. (I saw DH's updated quickly when I closed his last month.) I have alot of credit extended with chase...which is why I want to wait for this step to app.

3)Once SW biz is approved, app for SW deluxe (name?). I am considering a DD here with another SW personal. What do we think about that? It would put me 4/24 until next summer.

4)Sometime early 2019 CIC?

5)July or Aug 2019 CSR/CSP DD

**Throw in some amex biz cards here and there to help pass the time. Also, will come up with plan for DH that will be thrown in between my apps.

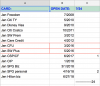

View attachment 343718

OK, so critiques?

Goals...Build back up UR and RR. Need some URs for pre/post cruise stay in Dec. Need RR for spring break ski trip. Possibly Hawaii summer 2019 since we have the marriott cert to use up.

I realized if I hold out on the SW CP to post in Jan, I will get more use out of it. However, we have 2 more flights before end of 2018 and having it for those will save me at least 40k points based on current pricing. I know we will use it in 2019 for the ski trip, possibly Hawaii, flights to SC to house hunt in April, maybe MI to visit the inlaws. I don't think I will use it as much in 2020 since we are moving to SC...with no flights needed anymore for disney or to fly home to see my family. So I am ok with going ahead with it now. Just wish I had realized this several months ago. Oh well.

You can apply for the CSP now, no need to wait. Just be sure to follow Step 4 and do it from a different browser etc etc.

You can apply for the CSP now, no need to wait. Just be sure to follow Step 4 and do it from a different browser etc etc.

Yeah, I always like reading the TR thread. I feel like it's generally friendlier and has some really useful information.

Yeah, I always like reading the TR thread. I feel like it's generally friendlier and has some really useful information.