Hi...

(insert timid entrance into thread here....)

I am looking to replace my SW Visa card (not sure specifically which one it is, but it has a $69 AF) with another card that will offer the best rewards that I can redeem towards flights on ANY airline. I have used up almost all of my RR points and so it is really time to cut the cord with SW. I have no issue with them, but because I always seemed to have RR points, it was always cheaper to fly SW. Now that my points are almost gone, I would like to get a CC that will allow me to at least consider other airlines.

I read the stickies so I am going to try and provide as much info as I can....

First, I have not applied for any credit CARDS in the past 24 months.

Second, I currently have the following cards (monthly average spend included)

- Apple Card ($3500)

- Chase Disney Visa ($1000) *this is the card with the longest history...21 years.

- Chase Disney Visa ($500) *This card can be closed after my next trip in October, once I use the points

- SW Visa *$69 AF ($1500)

- AMEX Blue Sky ($0...only use it if there is a reward available)...second-oldest card with a 20-year history

- Target RedCard ($300...not sure if I was supposed to include this one or not

)

)

- BestBuy Visa (There is currently a balance of about $1200 on this card at 0% that will be paid off before the end of the promo) *This card is only used to make major purchases (currently paying off an iPad and iPhone) and only at 0% paid in full before interest accrues.

Third, my DH is not a fan of the number of CC's we have. We accumulated $50K in CC debt due to an uninsured disaster at our home in 2013. We used some of his retirement fund to pay it off in its entirety in 2018. Since then, we have never carried a balance and pay everything in full every month. That being said, DH is the primary "shopper" in the household and he will only use the Apple Card. I am not willing to close the

bolded cards. I would prefer to keep the AMEX, but if there is a valid reason to close it, I am open to suggestions.

- What airport(s) do you typically fly out of? GRR is about 10 minutes from home. DTW is a little over 2 hours and we would spend the night before any flight to avoid any driving delays/mishaps

- Do you have a preference of Frequent Flyer program? No...I have <500 Delta SkyMiles and about 2500 RR points.

- Does SOUTHWEST Airline service your airport? Yes, both GRR and DTW, but nothing non-stop and usually terrible times

- Do you have a Hotel Rewards program preference? Marriott/Bonvoy, but not enough travel to justify a co-branded card

- Do you currently have travel points or miles in any program? *See above*

- What at your specific goals for churning credit cards? I don't really want to "churn". I just want to have a dedicated card that I can use to put the rewards towards my airfare expenses.

- When do you plan to take these trips? I typically take one trip per year to WDW and/or HHI. DH and I do not travel much as I am still working full-time. We both consider travel as a "luxury" so I make sure that we have the money in the bank for the trip BEFORE we travel. I try to maximize my "cash" cost by utilizing as much "free" money (from rewards/rebate programs) as possible.

- Who does your travel party consist of? Typically, I am travelling to WDW with my friend. Sometimes, I will go with one of my daughters, but now that they are 21 (working full time) and 18 (starting college in the fall), I don't see more trips with them in the future...at least none that I am paying for

.

.

Another tidbit to add...I have a DVC membership (100 AKV, 50 HHI) so lodging is not an expense that I have to worry about when paying for my trips. When we travel to HHI (once every three years), we stay in Marriott properties along the way since we drive. I also make a few overnight trips to Detroit during the summer to watch my Tigers play baseball so I earn a few rewards with those stays. I have never reached 10 nights in a year.

I do not particularly want an AF, but since I would be replacing a card that has a $69 AF, I would consider it *IF* the benefits are worth it to me.

If it matters, my credit score is >800...

Hi and

you will find we have a very nice group of people that post on this thread. The group is also very diverse in their travel styles and goals as well as how we go about reaching them. I, along with other on this thread made mistakes when it came to credit cards and debt. Lessons learned, I moved on to using credit responsibly and paying in full each month and the last 12 years have been playing the travel hacking game. I think we are fortunate to have such a diverse group when it comes to travel goals, styles and methods of travel hacking. Sharing our methods, goals, thought process and experiences is beyond valuable because allows for different perspectives that can actually be a game changer. I know I have learned quite a bit from folks who do things differently than I do with different travel goals that have been super helpful to me and my goals just because it allowed me to see it from a different angle. So, I'm going to add my two cents in case it helps you as you begin looking at your options to get the most bang for your buck. There may be a few cards and card combos from different banks that would provide a better return and options for your normal annual spending.

Personally, I find variable points that can be transferred to airlines or certain hotels (Chase UR, Amex MR, Citi TYP etc) to be more valuable than cash back and I like to have options and not be trapped with one program. This of course is directly due to my personal travel goals. I like international flights in lie flat seats and I like bougee hotel/resort experiences too. Cash back earned each year on our spend won't pay for hotels that are over $1500 a night or flights that are over $10K a few times a year and quite frankly, neither will I

I bring this up because I am forced to assign a potential value range on my points. Cent per point value is subjective but my bare minimum with variable points that can be transferred to airlines or hotels is generally 1 cent per point if I were to use my points for a statement credit. I would never do that, but it's a rough minimum and I gotta start somewhere. Then, I factor in what would I likely use those points for (flights or resorts) and how much can they purchase for me. Next, I need to factor in how many points I am spending each year on flights and hotels, replacing those points as I go and having enough points in enough programs to switch gears should my plans for booking a specific trip a certain way not fall in place. This has happened a few times

With that in mind, my strategy is to be working on an MSR for a new bonus most of the time. Failing that, maxing out bonus categories on existing cards. I shoot for 5x. Looking at your travel goals and desire not to churn or carry many cards, I would suggest looking at one or two cards that earns more than 1x on all spend or bonus spend that has no AF and one variable point earning card to pair with it with an AF that allows for your no AF card points to be transferred or combined into that account.

On a yearly basis you are likely getting $840~ in cash back on the Apple card, $180 in Disney rewards, 18,000 SW RR (worth about $270) miles adding in the spend for the Target card which earns 1% out side of Target that's $36 a year. It's roughly over $80k spend per year. So you are earning about $1340ish back each year with some of it trapped in Disney, Target and SW.

Some suggestions:

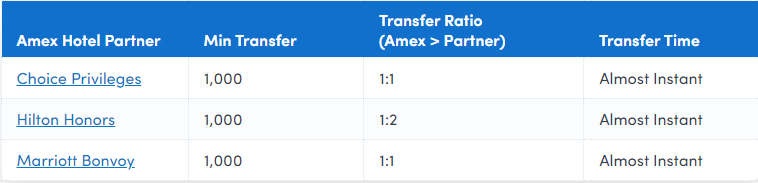

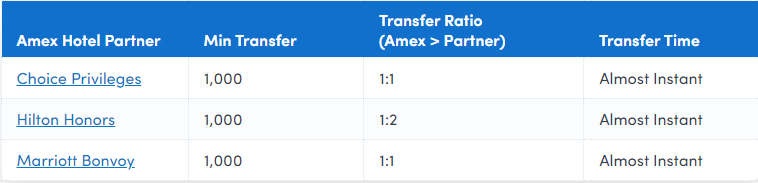

The Amex Blue Business Plus card. It has no annual fee and earns 2x on up to $50k in spend each year. Those points can be directly transferred to these airlines and hotels. It's an easy one card with no AF strategy. You can qualify for a business card for just about anything. You would apply as a sole proprietor, your ss# instead of an EIN and using your name and that would also be your business name. If you have ever held a garage sale, sold things on Ebay or FB marketplace then congrats, you have a business. If you sign up for Rakuten and earing MRs you can use that shopping portal to earn extra MRs online.

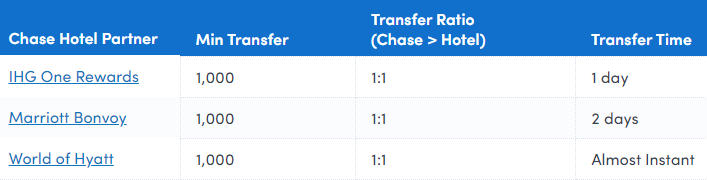

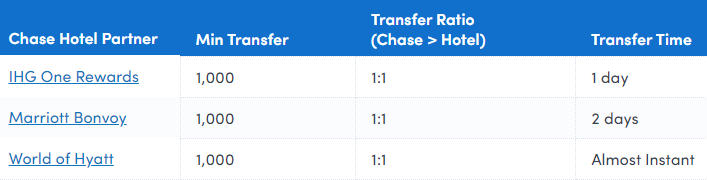

If you are not comfortable with a business card or more comfortable with the Chase ecosphere and ability to transfer to SW RR then I would suggest a Chase Sapphire Preferred at $95 AF which is 3x on dining and travel with pretty decent travel protections, $50 hotel credit if booked through Chase travel portal, and transfers to the following. Pair this with the Chase Freedom Unlimited that has no AF and allows 1.5x on all spend and the Chase Freedom Flex with no AF and has 5x quarterly rotating categories. If you are in fact comfortable with a business card, then the Chase Ink Cash with no AF and earns 5x on Office Supply stores, internet, cable and phone up to $25k annually is a good bet. You can purchase gift cards at office supply stores for other stores/merchants where you shop and are then getting 5x on that spend. If you purchase through the Ultimate rewards portal using those merchant gift cards you can earn extra UR points.

Next up would be the Citi TYP ecosphere. A Citi Double cash card has no AF and effectively earns 2x on spend. Pair that with a Citi Strata card that has the $95 AF to combine points. Double cash points combined are only good for 90 days once you transfer them to the Strata TYP so keep them in the double cash account until you are ready to use them for a transfer. The Strata earns 10x on hotels, cars and attractions booked through Citi travel. It also earns 3x on dining, groceries, gas, EV stations, hotels and air travel. Transfer partners below.

Hope this helps you out with your journey

(insert timid entrance into thread here....)

(insert timid entrance into thread here....) )

) .

. you will find we have a very nice group of people that post on this thread. The group is also very diverse in their travel styles and goals as well as how we go about reaching them. I, along with other on this thread made mistakes when it came to credit cards and debt. Lessons learned, I moved on to using credit responsibly and paying in full each month and the last 12 years have been playing the travel hacking game. I think we are fortunate to have such a diverse group when it comes to travel goals, styles and methods of travel hacking. Sharing our methods, goals, thought process and experiences is beyond valuable because allows for different perspectives that can actually be a game changer. I know I have learned quite a bit from folks who do things differently than I do with different travel goals that have been super helpful to me and my goals just because it allowed me to see it from a different angle. So, I'm going to add my two cents in case it helps you as you begin looking at your options to get the most bang for your buck. There may be a few cards and card combos from different banks that would provide a better return and options for your normal annual spending.

you will find we have a very nice group of people that post on this thread. The group is also very diverse in their travel styles and goals as well as how we go about reaching them. I, along with other on this thread made mistakes when it came to credit cards and debt. Lessons learned, I moved on to using credit responsibly and paying in full each month and the last 12 years have been playing the travel hacking game. I think we are fortunate to have such a diverse group when it comes to travel goals, styles and methods of travel hacking. Sharing our methods, goals, thought process and experiences is beyond valuable because allows for different perspectives that can actually be a game changer. I know I have learned quite a bit from folks who do things differently than I do with different travel goals that have been super helpful to me and my goals just because it allowed me to see it from a different angle. So, I'm going to add my two cents in case it helps you as you begin looking at your options to get the most bang for your buck. There may be a few cards and card combos from different banks that would provide a better return and options for your normal annual spending.