DonkeyHoTay

I see stuff that isn’t there

- Joined

- Apr 29, 2024

- Messages

- 605

I've heard this as well from other sources here, curious as to why they do that? Is there some benefit to them for not reporting?

I would think the opposite is true - DVC can wield more influence over defaults by reporting to the agencies. But, it's a nice benefit for customers not to be burdened by more debt reported on their credit reports.

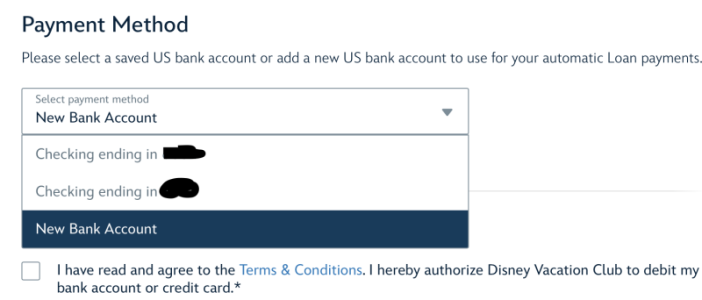

? If so, you are absolutely correct. For the dues, they have to be bank drafts if paid monthly.

? If so, you are absolutely correct. For the dues, they have to be bank drafts if paid monthly.