I am one of the split contracts delayed closings you speak of. I bought day one and spilt 200 points 50-50-50-50 and closed 60 days later.In the first 5 days of VDH deeds there were 459 deeds recorded (457 VDH and 2 VGC that are hard to filter out).

On those 459 deeds, there are 443 unique grantees and 16 repeated grantees.

Of the 16 repeated grantees, there are actually 12 unique grantees within those 16:

- 1 grantee buying 4 contracts

- 250pt, split 75-75-50-50

- 2 grantees buying 3 contracts

- 180pt, split 100-50-30

- 150pt, split 50-50-50

- 9 grantees buying 2 contracts

- 490pt, split 245-245

- 250pt, split 150-100

- 200pt, split 100-100

- 200pt, split 100-100

- 175pt, split 110-65 (this is my favorite, good job whoever this is)

- 175pt, split 100-75

- 170pt, split 85-85

- 150pt, split 100-50

- 150pt, split 75-75

Adds up to:

- 431 grantees buying 1 contract

- 9 grantees buying 2 contracts

- 2 grantees buying 3 contracts

- 1 grantee buying 4 countracts

I think there's a case to be made that the most knowledgable buyers (who are more likely to split contracts) also are more likely to do delayed closings and not show up, but if we're comparing early VDH vs. early PVB2, it's probably apples to apples? @maui22 you wanna do the PVB2 analysis? (is this even feasible? I'm not very familiar with occompt)

Anyway, the small avg contract size at VDH was very much an early buyer thing. It's over a year later now and the average over the last 3 months is over 180pts/contract:

View attachment 904591

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

DVCNews September 2024 sales information

- Thread starter maui22

- Start date

Ah, downsizing options.... good to know. That's helpful. Thanks @ehhAll personal opinion:

I think if you're going to split the contracts that they should be asymmetrical so you have downsizing options in the future.

In this case, this buyer bought 175 but if plans change they could downsize to 110 or 65 in the future, which are meaningfully different amounts. Something like an 85/90 split is not.

But they also shouldn't be wildly different (e.g., 125-50). Car backseats get it right, with a 40/60 split!

I also like the 175pt purchase amount (same amount I bought in week 1).

And I also don't like excessive splitting. For example, splitting 250pts to 75-75-50-50 is an excessive amount of splitting in my opinion. Does it make financial sense if you sell? Probably, but you also have to live with it until then and it's just a teeny bit more to manage (my spreadsheets would probably be the biggest drag).

I will say the 180pt 100-50-30 is the most interesting. Mostly because they somehow got permission to go below the 50pt line.

aammtt20

Mouseketeer

- Joined

- Oct 21, 2023

- Messages

- 158

The original Poly points were from before the current 50pt minimum on new resorts, back when there was a only 25 pt minimum. I know the minimums have fluctuated over time, I believe when OKW was the only DVC option - and it wasn't even called that back then - the minimum was 230 pts, which is why that can be a common number for OKW contracts on resale sites. Also 160 pts for AKV, I believe, is a common amount on resale as that was the minimum for a time when that resort was on sale.How did they subvert the 50pt. Super interesting!

VGCgroupie

Im in this photo

- Joined

- May 29, 2017

- Messages

- 11,926

Since this is VDH it carries a 50 point minimum so they shouldn't have been able to get a 30 point contract.The original Poly points were from before the current 50pt minimum on new resorts, back when there was a only 25 pt minimum. I know the minimums have fluctuated over time, I believe when OKW was the only DVC option - and it wasn't even called that back then - the minimum was 230 pts, which is why that can be a common number for OKW contracts on resale sites. Also 160 pts for AKV, I believe, is a common amount on resale as that was the minimum for a time when that resort was on sale.

- Joined

- Nov 15, 2008

- Messages

- 48,497

Since this is VDH it carries a 50 point minimum so they shouldn't have been able to get a 30 point contract.

I have heard that some have gotten around it due to FW? Not sure if it would apply here or not.

VGCgroupie

Im in this photo

- Joined

- May 29, 2017

- Messages

- 11,926

I bought a FW and was told it had to be over 50 points. I am going to check again though since I may be adding more points before my 90 days is up at the end of month.I have heard that some have gotten around it due to FW? Not sure if it would apply here or not.

VGCgroupie

Im in this photo

- Joined

- May 29, 2017

- Messages

- 11,926

I talked to my guide today. He is somewhat of an OG from what I understand. Bill Koontz. He said even with a split week I cannot get a contract that is under 50 points. I was really hoping I could.

They must be very confident they'll never want/need to sell.Someone bought a 1,000 point deed at SSR and another person bought 600 points at SSR! Yiiiikes.

JackosinDIS

DIS Veteran

- Joined

- Jun 15, 2023

- Messages

- 1,705

Just for fun, there were 99 new Poly deeds recorded today.

Total of 12,961 points.

Average contract size 131 points.

Total for the 6 days so far is 331 deeds. Based on todays average that is approx 43k points.

Total of 12,961 points.

Average contract size 131 points.

Total for the 6 days so far is 331 deeds. Based on todays average that is approx 43k points.

aammtt20

Mouseketeer

- Joined

- Oct 21, 2023

- Messages

- 158

Thanks for the analysis. Do we know how many points (apprx) will be sold in total from the tower?Just for fun, there were 99 new Poly deeds recorded today.

Total of 12,961 points.

Average contract size 131 points.

Total for the 6 days so far is 331 deeds. Based on todays average that is approx 43k points.

ehh

the sound a shrug makes

- Joined

- Aug 3, 2019

- Messages

- 1,526

Based on the 2025 points chart and approximate room breakdowns, looking like 3.6mil ± 100k, but unconfirmed by Disney.Thanks for the analysis. Do we know how many points (apprx) will be sold in total from the tower?

Brian Noble

Gratefully in Recovery

- Joined

- Mar 23, 2004

- Messages

- 19,830

At some point an early adpoter will post the public offering statement--it should be in there, no?

- Joined

- Nov 15, 2008

- Messages

- 48,497

At some point an early adpoter will post the public offering statement--it should be in there, no?

I think it’s already out there…

10/16/24 deeds

42 for 5156 points

That's an average of 122.7619 points/deed.

Range was 25-300 points.

0 Favorite week deeds.

Units 88A, 88D, and 88E.

42 for 5156 points

That's an average of 122.7619 points/deed.

Range was 25-300 points.

0 Favorite week deeds.

Units 88A, 88D, and 88E.

| DOC# | Recorded Date | Palm Tree Date | Unit | UY | Points | |

| 1 | 20240588206 | 10/16/24 | 10/2/24 | 88D | Sep | 125 |

| 2 | 20240588211 | 10/16/24 | 10/2/24 | 88D | Dec | 75 |

| 3 | 20240588213 | 10/16/24 | 10/2/24 | 88E | Sep | 75 |

| 4 | 20240588217 | 10/16/24 | 10/2/24 | 88E | Aug | 250 |

| 5 | 20240588224 | 10/16/24 | 10/2/24 | 88E | Feb | 150 |

| 6 | 20240588498 | 10/16/24 | 10/2/24 | 88E | Apr | 75 |

| 7 | 20240588519 | 10/16/24 | 10/3/24 | 88E | Mar | 200 |

| 8 | 20240588522 | 10/16/24 | 10/3/24 | 88E | Oct | 75 |

| 9 | 20240588539 | 10/16/24 | 10/3/24 | 88E | Dec | 50 |

| 10 | 20240588542 | 10/16/24 | 10/3/24 | 88A | Dec | 200 |

| 11 | 20240588543 | 10/16/24 | 10/3/24 | 88D | Jun | 25 |

| 12 | 20240588545 | 10/16/24 | 10/2/24 | 88D | Apr | 300 |

| 13 | 20240588580 | 10/16/24 | 10/3/24 | 88A | Aug | 25 |

| 14 | 20240588591 | 10/16/24 | 10/2/24 | 88E | Feb | 100 |

| 15 | 20240588665 | 10/16/24 | 10/3/24 | 88E | Oct | 150 |

| 16 | 20240588716 | 10/16/24 | 10/3/24 | 88D | Dec | 50 |

| 17 | 20240588755 | 10/16/24 | 10/2/24 | 88E | Aug | 100 |

| 18 | 20240588768 | 10/16/24 | 10/3/24 | 88E | Feb | 200 |

| 19 | 20240588789 | 10/16/24 | 10/3/24 | 88E | Aug | 150 |

| 20 | 20240588794 | 10/16/24 | 10/2/24 | 88D | Jun | 100 |

| 21 | 20240588800 | 10/16/24 | 10/3/24 | 88D | Feb | 100 |

| 22 | 20240588890 | 10/16/24 | 10/2/24 | 88D | Aug | 80 |

| 23 | 20240588893 | 10/16/24 | 10/3/24 | 88D | Sep | 50 |

| 24 | 20240588900 | 10/16/24 | 10/2/24 | 88E | Oct | 50 |

| 25 | 20240588909 | 10/16/24 | 10/3/24 | 88D | Mar | 75 |

| 26 | 20240588915 | 10/16/24 | 10/3/24 | 88E | Mar | 200 |

| 27 | 20240588917 | 10/16/24 | 10/3/24 | 88D | Jun | 150 |

| 28 | 20240588922 | 10/16/24 | 10/3/24 | 88E | Jun | 150 |

| 29 | 20240588931 | 10/16/24 | 10/3/24 | 88E | Feb | 211 |

| 30 | 20240588933 | 10/16/24 | 10/3/24 | 88E | Mar | 200 |

| 31 | 20240588943 | 10/16/24 | 10/3/24 | 88E | Jun | 150 |

| 32 | 20240588946 | 10/16/24 | 10/2/24 | 88E | Aug | 300 |

| 33 | 20240588953 | 10/16/24 | 10/3/24 | 88A | Apr | 75 |

| 34 | 20240588961 | 10/16/24 | 10/3/24 | 88E | Feb | 75 |

| 35 | 20240589009 | 10/16/24 | 10/3/24 | 88E | Sep | 150 |

| 36 | 20240589026 | 10/16/24 | 10/3/24 | 88E | Aug | 150 |

| 37 | 20240589070 | 10/16/24 | 10/3/24 | 88D | Apr | 200 |

| 38 | 20240589089 | 10/16/24 | 10/3/24 | 88E | Feb | 50 |

| 39 | 20240589103 | 10/16/24 | 10/3/24 | 88D | Aug | 65 |

| 40 | 20240589135 | 10/16/24 | 10/3/24 | 88E | Oct | 50 |

| 41 | 20240589153 | 10/16/24 | 10/3/24 | 88D | Apr | 100 |

| 42 | 20240589294 | 10/16/24 | 10/3/24 | 88D | Dec | 50 |

foodiddiedoo

DIS Veteran

- Joined

- Oct 12, 2017

- Messages

- 1,962

That was me, I bought 450 direct haha. I got enough credit card points for about 5 flights, and hit Premier 1k on United because of it. I also was a first time DVC buyer and wanted to just do my first purchase entirely direct.I saw on the BLT owners thread someone said that last month they bought 400 points direct. To each their own! I hope they at least racked up lots of credit card points

I also did a 200-250 split in case I don’t want all those points down the line when my parents stop coming with us on the regular.

Last edited:

ehh

the sound a shrug makes

- Joined

- Aug 3, 2019

- Messages

- 1,526

As best as I can tell, neither the Island Tower nor Total Polynesian points are listed in the updated Poly Public Offering Statement: https://cdn1.parksmedia.wdprapps.di...ral-docs/POLYV_POS_Rev_04_2024_10-01-2024.pdfAt some point an early adpoter will post the public offering statement--it should be in there, no?

I also cannot find it in the updated MS-POS: https://cdn1.parksmedia.wdprapps.di...ering_Statement_Rev_05_16_2024_10-01-2024.pdf

EDIT:

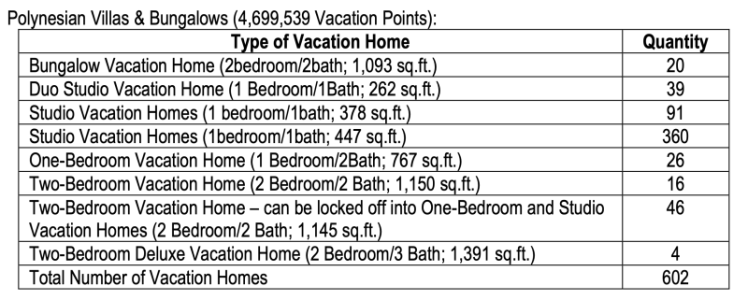

The California Public Resort (for 11 resorts) (https://cdn1.parksmedia.wdprapps.di...alifornia_Combined_Public_Report-09-06-24.pdf) does have this figure:

But the 4.7mil has to be either a typo (7,699,539 would make a lot of sense) or something else (just OG PVB + declared Island Tower?)...rationale:

- OG PVB is 4.03mil, so 4.7mil is too few for combined

- 4.7mil is also too big to be just Island Tower

- We know the points chart and total room count, but not view breakdown

- If the entire Island Tower inventory were Theme Park View, it'd be ~4.2mil points

Last edited:

Duckbug.Ducktales

Listening to the music to Fantasmic!

- Joined

- Feb 5, 2020

- Messages

- 5,399

I love BLT. Mostly because I love the Contemporary and BLT has great views of it plus the magical view of the park and 7 Seas Lagoon. You might end up keeping all the points when your parents stop traveling and just go more often!That was me, I bought 450 direct haha. I got enough credit card points for about 5 flights, and hit Premier 1k on United because of it. I also was a first time DVC buyer and wanted to just do my first purchase entirely direct.

I also did a 200-250 split in case I don’t want all those points down the line when my parents stop coming with us on the regular.

CastAStone

Business nerd. Good at math. Bad at spelling.

- Joined

- Jun 25, 2019

- Messages

- 5,989

That’s what the list of rooms is so I’d guess that.or something else (just OG PVB + declared Island Tower?)

There should be a document in the POS with the 2024 dues breakdown and that should have the new total number of points included. Weird it’s not there.

ehh

the sound a shrug makes

- Joined

- Aug 3, 2019

- Messages

- 1,526

The list of rooms is all rooms, OG PVB + full Island Tower, though. Not just a portion of Island Tower.That’s what the list of rooms is so I’d guess that.

There should be a document in the POS with the 2024 dues breakdown and that should have the new total number of points included. Weird it’s not there.

Brian Noble

Gratefully in Recovery

- Joined

- Mar 23, 2004

- Messages

- 19,830

If the POS includes the maximum reallocation figure, you can get the total points from that plus the room counts. It excludes view, season, and weekend vs weekday variance. I don’t have the energy to do it right now though.

-

Disney Magic Merch Finds: Celebrating the Original Disney Cruise Line Ship

-

Anxious About Disney? Here Are 5 Myths Busted Before You Go

-

How Disney Pricing Changed in 2003 and Never Looked Back

-

Two Pieces of Disneyland History Now Rotate Daily on Main Street

-

New 'Tangled' Look at Disney Springs PhotoPass Studio

-

Disney Character Meals Are Not Automatically Worth the Price

-

Route Update for Disney Starlight Parade at Magic Kingdom

New Threads

- Replies

- 5

- Views

- 508

- Replies

- 1

- Views

- 490

- Replies

- 7

- Views

- 2K

- Replies

- 1

- Views

- 1K

New Posts

-

I love credit cards so much! v7.0 - 2025 (see first page for add'l details)

- Latest: TheOneWithTheTriplets

-

-

-

-

New Posts

- Replies

- 8K

- Views

- 867K

- Replies

- 9K

- Views

- 262K

- Replies

- 27K

- Views

- 598K

- Replies

- 6

- Views

- 4K

- Replies

- 309

- Views

- 96K