https://finance.yahoo.com/news/major-streamers-stack-subscribers-revenue-131500586.html

How the Major Streamers Stack Up in Subscribers and Revenue | Charts

by Lucas Manfredi

Tue, May 28, 2024, 8:15 AM CDT

The first quarter of 2024 was another big win for

Netflix, but starting in 2025 the game will change.

After building a steady lead over its legacy media competitors for the past several quarters, Netflix revealed it will no longer disclose its quarterly subscriber or average revenue per paid member starting in the first quarter of 2025 as it shifts its focus to revenue, operating margins and engagement.

The decision comes as two of its major competitors — Warner Bros. Discovery and Disney — have made significant strides in streaming profitability.

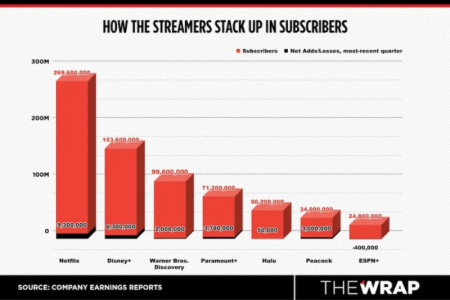

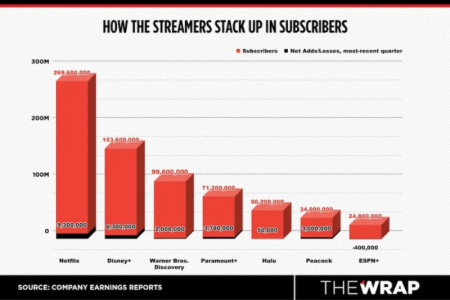

With the exception of ESPN+, all of the major streamers saw subscriber increases during the quarter.

In unsurprising news, Netflix finished the quarter on top on the subscriber front. Disney continued to hold the second place spot when looking at both

Disney+ on its own and its three streaming services on a combined basis.

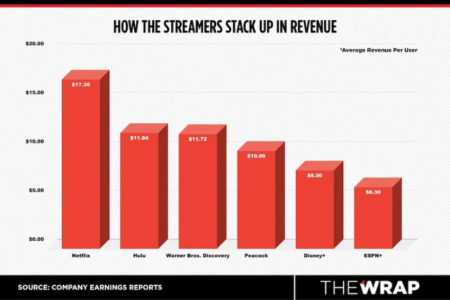

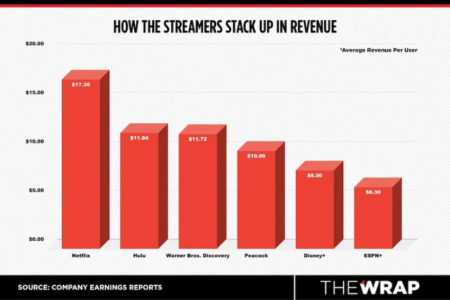

In average revenue per user, Netflix has continued to extend its lead over its legacy media competitors. Warner Bros. Discovery is closing the ARPU gap with Hulu as it looks to take over the second place spot, while Disney+ slipped slightly compared to the previous quarter.