https://www.fool.com/investing/2023/09/23/disney-stock-turnaround-closer-than-you-think/

A Disney Stock Turnaround Could Be Closer Than You Think

By

Jeremy Bowman–Sep 23, 2023 at 7:25AM EDT

Key Points

Disney is exploring a sale of its linear TV assets, including ABC.

Bob Iger's plan to bring storytelling back to the center of the business seems to be coming into focus.

With the stock at a nine-year low, good news like an asset sale could help spark a turnaround.

A sale of ABC and other legacy media assets could help the company reposition itself.

Seasoned investors know that

Walt Disney (

DIS -1.79%) is more than just the theme parks and content associated with the Disney brand name. The entertainment conglomerate also owns Marvel, Pixar,

Star Wars, ESPN, ABC, Hulu, and a slew of cable networks, including those it gained from

Fox in its 2018 deal.

For years, ABC was a core component of Disney's media empire. In fiscal 2019, its broadcasting division brought in $8.3 billion in revenue and $1.35 billion in segment-operating income, about 9% of its total segment-operating income that year.

Now, with profits from its linear TV ecosystem drying up, and the company in a hurry to turn a profit from streaming, Disney seems to be preparing to sell ABC and other legacy-media assets, including several local TV affiliates.

In an interview back in July, CEO Bob Iger said that TV and cable assets, including ABC, "may not be core" to the business, and earlier this month, Bloomberg reported that Disney had held "exploratory talks" with

Nexstar Media Group, a local TV broadcaster, about selling the ABC network and its TV stations.

Other parties also seem to be interested in acquiring ABC. Media mogul Byron Allen has held discussions with Disney as well, reportedly making a $10 billion bid for ABC along with FX and

National Geographic cable channels.

Disney has stressed that the talks are preliminary and that it may not sell ABC or any of the related assets.

Let's make a deal

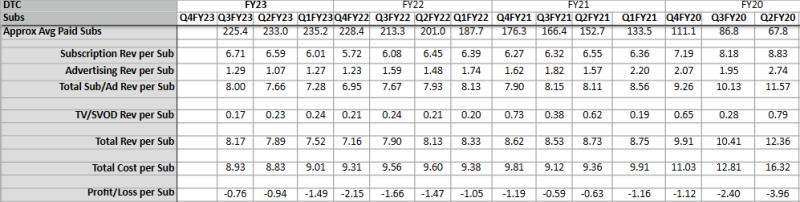

There's no doubt that Disney is facing a wide range of challenges in its media and entertainment. The traditional pay-TV ecosystem is shrinking, and the company is still reporting wide losses from streaming, though those have narrowed in recent quarters. Disney has also promised to launch a streaming version of its flagship ESPN network, but that may not even come until 2025.

The entertainment giant now has roughly $47 billion in debt on its books, and it added substantial borrowings when it acquired Fox's entertainment assets in 2018. An asset sale would help the company pay down some of that debt and free up cash to invest in the parts of the business that are central to its growth.

The company just said that it would nearly double its capital expenditures in its parks division over the next 10 years to $60 billion. Increasing spending on streaming doesn't seem to be a priority when the company is trying to flip the direct-to-consumer business from a loss to a profit, but taking the flagship ESPN network over the top is likely to require some capital spending as well as an initial marketing push. Additionally, Disney aims to buy the remaining third of Hulu it doesn't own from

Comcast next year, which will cost at least $9 billion.

Disney's next steps

Reading between the lines of Iger's comments, Disney seems eager to sell off its linear TV assets, at least for the right price.

When he returned to the helm at Disney, Iger promised to put storytelling at the center of the business again, and it's clear that ABC, which contains a sizable news organization, doesn't fit in with his concept of storytelling, which is why he's deemed it "non-core."

When Iger talks about storytelling, he is referring to the branded intellectual property that he spent his years as CEO assembling, acquiring Pixar, Marvel,

Star Wars, and Fox's entertainment assets. The prioritizing of storytelling is also why the company is doubling its spending on the parks, and it leaned into that relationship in the announcement, teasing theme park worlds based on

Frozen or

Black Panther.

Selling off ABC and the related assets seems like a fitting coda for Iger's career as doing so would free up cash for the company and allow it to focus on the streaming business, eliminating a distraction that sometimes competes with its direct-to-consumer goals as we saw with

the dispute with

Charter Communications.

Taking the flagship ESPN to streaming is a natural part of that process, and that could mark a windfall for the company as cord-cutters right now have few good options for watching sports.

A turnaround might not be far away

Disney stock popped about 1% when Bloomberg first reported the talks with Nexstar, a sign investors would view an ABC sale favorably.

Though there's a palpable frustration with the losses in the streaming division, the company is aiming for profitability in the direct-to-consumer segment by next fiscal year, and the round of price hikes coming in October should help move the company significantly closer to that goal.

By this time next year, Disney may be in a much stronger position than it is currently. We could see it strengthen its balance sheet after selling ABC and other non-core broadcast and cable assets. The flagship ESPN channel could be available to cord-cutters. Disney will likely fully own Hulu as it's allowed to buy out the 33% stake that Comcast currently owns next year, and its streaming division should be profitable by then.

If Disney can deliver on those goals, much of the pessimism that's now baked into the stock and has pushed it to a nine-year low will have evaporated.

The company will have emerged from the streaming transition with several popular options, shed its declining legacy media assets, and be able to present itself to investors as a business clearly focused on growth in streaming and in the complementary parks business.

The bottom line could take a short-term hit as it loses profits from linear TV, but that will be well worth the trade-off to present a faster-growing company built around storytelling, as Iger promised.

Keep your eye out for any news around the ABC deal. That could be the first step in the long-awaited turnaround for Disney stock as it reinvents itself under Iger once again.