wabbott

DIS Veteran

- Joined

- Aug 4, 2021

- Messages

- 6,940

https://www.investopedia.com/disney...te-yahoo&utm_source=yahoo&utm_medium=referral

Disney Q4 Results Likely to Get Lift From Theme Parks

Streaming service will also be in focus

By Igor Greenwald

Published November 04, 2022

Key Takeaways

The operator of theme parks and resorts, television networks including ESPN and ABC, film studios, and the Disney+ digital streaming service is expected to post adjusted earnings per share (EPS) of $0.57, up from $0.37 a year earlier, based on the average estimate of analysts tracked by Visible Alpha. Revenue is expected to have gained 14%, bolstered by booming travel demand and the return of movie theater audiences.1

The Disney Parks, Experiences and Products operating segment, which accounted for a third of Disney's revenue and more than half its operating income over the first nine months of 2022, is expected to deliver record revenue.

Meanwhile, Disney's media and entertainment division is coping with the effects of the intense competition for viewers and digital subscriptions from other media conglomerates. Cord-cutting by cable subscribers has crimped growth at Disney's flagship sports programmer ESPN, which also faces escalating programming rights fees. Days after Disney posted third-quarter results in August, Disney investor and hedge fund manager Daniel Loeb released a public letter to Disney CEO Bob Chapek calling on the company to cut high costs and to spin off ESPN into an independent company.2

The Disney+ digital streaming service also faces competition from the likes of Netflix, Inc. (NFLX) as well as Paramount Global (PARA) and Warner Bros. Discovery, Inc. (WBD). Analysts are likely to seek out further details about the competitive positioning of Disney+ as the streaming service raises prices and adds an advertising-supported service tier next month, following in the steps of Netflix.3

Chapek's leadership is likely to remain an issue as well, in the third year of the CEO's frequently rocky tenure. While Disney's board voted unanimously to extend Chapek's contract for three years in June, he remains a lightning rod for controversy amid executive turnover.456

Chapek is facing heat as investors demand that he cut costs, while a union representing its theme park workers in Florida campaigns for a 20% raise and a minimum wage of $18 per hour.7 Some longtime theme parks patrons are already complaining that Disney's high hospitality and maintenance standards have deteriorated as a result of staff cuts during the pandemic.8

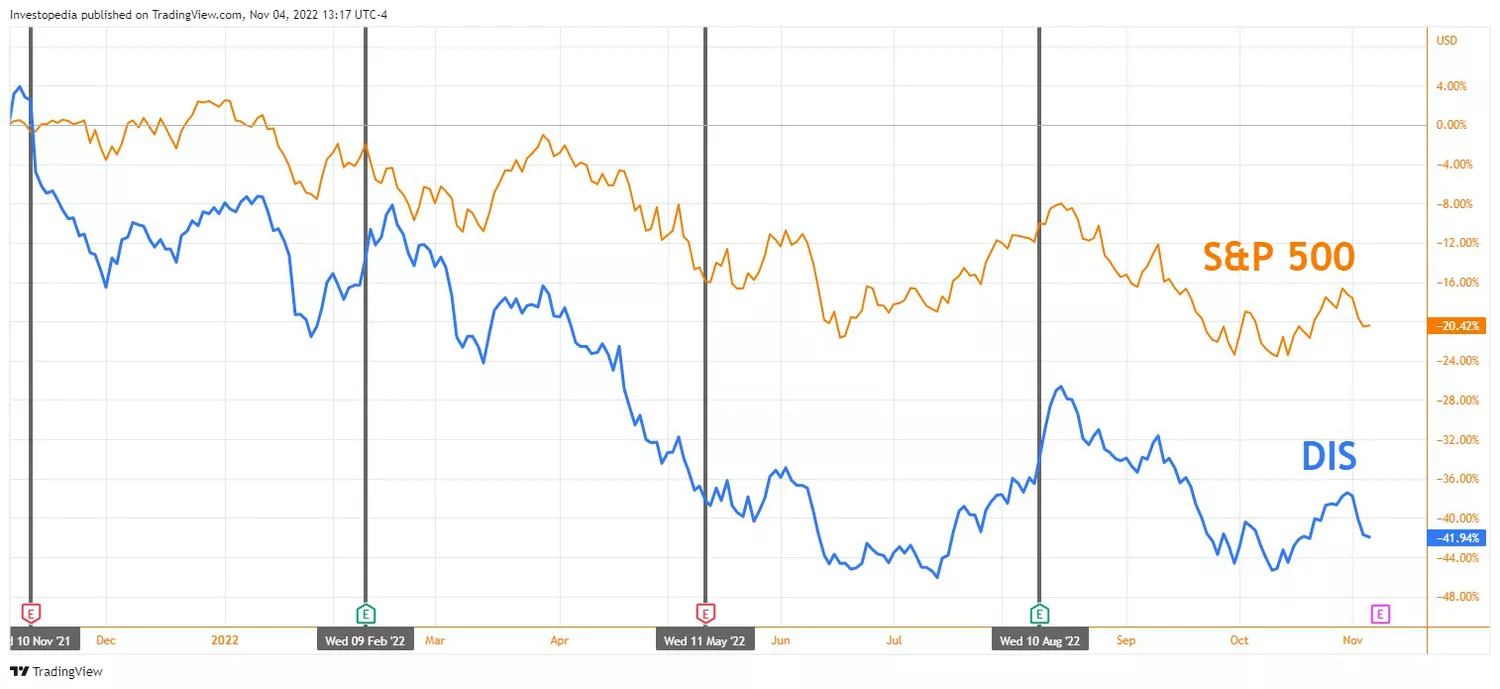

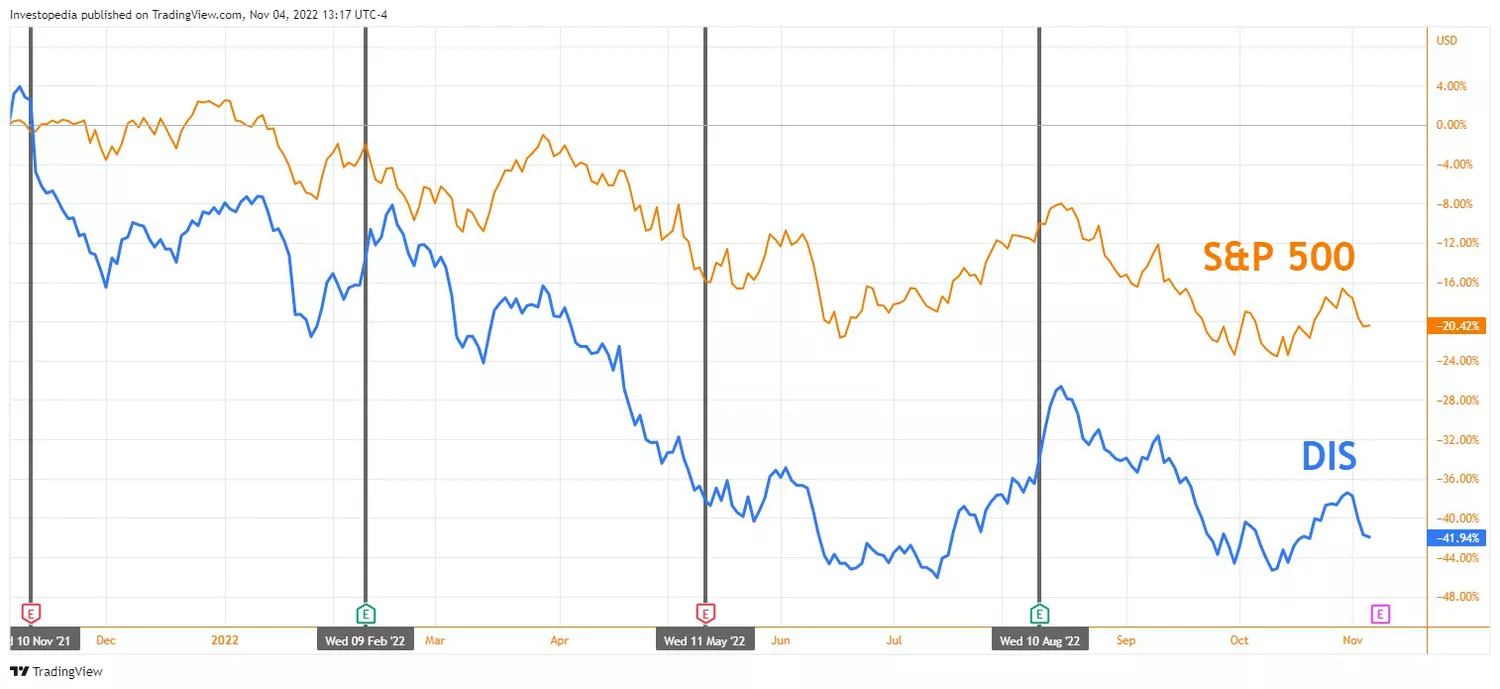

Disney's stock is down 36% in 2022, compared with a 22% decline for the S&P 500 Index. Over the past year, Disney's share price is down 42%, versus a 20% loss for the S&P 500 Index.

Source: TradingView.

Source: TradingView

The company missed expectations for the second quarter in May for earnings and revenue, while revenue at its Parks, Experiences and Products segment and Disney+ subscriptions beat estimates. The stock slipped 0.9% the following day.

Source: Visible Alpha

Parks, Experiences and Products includes 12 theme parks and 53 resorts at six resort destinations, the Disney Cruise Line, Disney Vacation Club timeshare sales, two guided tours companies, the Imagineering division that develops Disney's theme parks, merchandise licensing, and retail sales.1011

The COVID-19 pandemic took a toll on Disney theme park revenues. Parks, Experiences, and Products revenue plummeted from $6.9 billion in Q4 FY 2019 to $1.1 billion nine months later. The segment is expected to post record revenue of $7.4 billion for Q4 FY 2022, marking a nearly full recovery for Disney's theme parks and resorts, aided by price hikes on admissions and concessions.

All the company's parks and resorts were open during Q4, although Shanghai Disneyland, which reopened on June 30 after a three-month shutdown, closed again on Oct. 31 after local authorities blocked visitors from leaving for hours for COVID-19 screening following a positive test for a resort guest.121314

Disney Q4 Results Likely to Get Lift From Theme Parks

Streaming service will also be in focus

By Igor Greenwald

Published November 04, 2022

Key Takeaways

- Walt Disney is expected to post Q4 FY 2022 adjusted earnings per share of $0.57, a year-over-year gain of 54%, aided by strong theme parks revenue, when it reports on Nov. 8.

- The company faces questions about the future of its TV properties after one prominent investor recently demanded spin off the ESPN cable sports network.

- The Disney+ streaming platform will also be in focus as it hikes prices and adds an ad-supported tier.

- CEO Bob Chapek will have to deal with demands for pay raises from a union representing Disney's theme park workers in Florida.

The operator of theme parks and resorts, television networks including ESPN and ABC, film studios, and the Disney+ digital streaming service is expected to post adjusted earnings per share (EPS) of $0.57, up from $0.37 a year earlier, based on the average estimate of analysts tracked by Visible Alpha. Revenue is expected to have gained 14%, bolstered by booming travel demand and the return of movie theater audiences.1

The Disney Parks, Experiences and Products operating segment, which accounted for a third of Disney's revenue and more than half its operating income over the first nine months of 2022, is expected to deliver record revenue.

Meanwhile, Disney's media and entertainment division is coping with the effects of the intense competition for viewers and digital subscriptions from other media conglomerates. Cord-cutting by cable subscribers has crimped growth at Disney's flagship sports programmer ESPN, which also faces escalating programming rights fees. Days after Disney posted third-quarter results in August, Disney investor and hedge fund manager Daniel Loeb released a public letter to Disney CEO Bob Chapek calling on the company to cut high costs and to spin off ESPN into an independent company.2

The Disney+ digital streaming service also faces competition from the likes of Netflix, Inc. (NFLX) as well as Paramount Global (PARA) and Warner Bros. Discovery, Inc. (WBD). Analysts are likely to seek out further details about the competitive positioning of Disney+ as the streaming service raises prices and adds an advertising-supported service tier next month, following in the steps of Netflix.3

Chapek's leadership is likely to remain an issue as well, in the third year of the CEO's frequently rocky tenure. While Disney's board voted unanimously to extend Chapek's contract for three years in June, he remains a lightning rod for controversy amid executive turnover.456

Chapek is facing heat as investors demand that he cut costs, while a union representing its theme park workers in Florida campaigns for a 20% raise and a minimum wage of $18 per hour.7 Some longtime theme parks patrons are already complaining that Disney's high hospitality and maintenance standards have deteriorated as a result of staff cuts during the pandemic.8

Disney's stock is down 36% in 2022, compared with a 22% decline for the S&P 500 Index. Over the past year, Disney's share price is down 42%, versus a 20% loss for the S&P 500 Index.

Source: TradingView.

Source: TradingView

Walt Disney Earnings History

Walt Disney posted Q3 FY 2022 results above market expectations in August, with adjusted EPS, revenue, and Disney+ subscriber numbers all topping analysts' consensus estimates. The stock gained 4.7% the next day and gave it all back within three weeks.The company missed expectations for the second quarter in May for earnings and revenue, while revenue at its Parks, Experiences and Products segment and Disney+ subscriptions beat estimates. The stock slipped 0.9% the following day.

Walt Disney Key Stats

| Estimate for Q4 FY 2022 | Q4 FY 2021 | Q4 FY 2020 | |

| Adjusted Earnings Per Share ($) | 0.57 | 0.37 | -0.20 |

| Revenue ($B) | 21.2 | 18.5 | 14.7 |

| Parks, Experience and Products Revenue ($B) | 7.4 | 5.5 | 2.7 |

Source: Visible Alpha

The Key Metric

Walt Disney is divided into two reporting segments: Media and Entertainment Distribution and Parks, Experiences and Products.9Parks, Experiences and Products includes 12 theme parks and 53 resorts at six resort destinations, the Disney Cruise Line, Disney Vacation Club timeshare sales, two guided tours companies, the Imagineering division that develops Disney's theme parks, merchandise licensing, and retail sales.1011

The COVID-19 pandemic took a toll on Disney theme park revenues. Parks, Experiences, and Products revenue plummeted from $6.9 billion in Q4 FY 2019 to $1.1 billion nine months later. The segment is expected to post record revenue of $7.4 billion for Q4 FY 2022, marking a nearly full recovery for Disney's theme parks and resorts, aided by price hikes on admissions and concessions.

All the company's parks and resorts were open during Q4, although Shanghai Disneyland, which reopened on June 30 after a three-month shutdown, closed again on Oct. 31 after local authorities blocked visitors from leaving for hours for COVID-19 screening following a positive test for a resort guest.121314