I hope that peak expenditures have been reached. I know Chapek is a belt-tightening guy, so that will help. Also, the sooner the debt is under manageable levels, the sooner a dividend can return, which will help the stock take off like a rocket ship.As you stated he was essentially just renewed so they won't do anything immediately. Based on everything they have presented since Disney Plus was announced in 2019, they have met or exceeded all projections up to this point. They have blown past subscriber projections years ahead of what they said they would have in 2024. The problem is that all of that growth has costed Disney billions more than what they were projecting at the time. During the Disney Plus announcement, it was stated that peak losses would happen during FY 2022 and profitability would be FY 2024. To me, if peak losses have indeed just happened and they are able to achieve profitability in the next 2 years, its not only a win for Chapek but he'll probably be kept on for the long haul (assuming nothing crazy happens in the other divisions of the company).

If someone thinks that Disney has indeed reached peak losses and will start to narrow losses going forward before hitting profitability with the next 8 quarters, I think the price is very attractive. If you are someone who thinks streaming will continue to not be profitable for many years, the stock probably has some more downside to go between that and fears of a recession.

In some good news, Disney continues to lower their debt even with the sink that is streaming. It will still take some time to get back to manageable levels but I'm hopeful that once this is achieved, we will see more investments in the parks.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

DIS Shareholders and Stock Info ONLY

- Thread starter hhisc16

- Start date

AvidDisReader

DIS Veteran

- Joined

- Mar 24, 2019

- Messages

- 1,073

And then we have this: CFO McCarthy said Tuesday that Disney is looking for “meaningful efficiencies” and actively examining the company’s cost base. Look out Parks, there is going to be more short staffing. I am beginning to believe that the parks are short staffed NOT because the cannot hire more people, but they do not want to hire more people to keep staffing lower. So if I am going to be a Debbie Downer, how are expenses going to look when the new Union contract is signed with an increase in hourly wages to a projected $20 an hour in 4 years. Do not forget, once the contract is approved, Disney is going to have to go back and pay all its employees at the new payrate from the date the current contract expired to when the new one is signed--- millions of dollars in back pay. This will cause even more cuts.I do think Chapek has frittered away another quarter to get streaming into the black. Another quarter or two like this one, he'll be in trouble. And I STILL don't like looting money from parks to prop up ABC/ESPN. Was not/is not/never will be a good strategic fit for the company.

In my humble opinion.

wabbott

DIS Veteran

- Joined

- Aug 4, 2021

- Messages

- 6,944

Sound analysis. You asked is there a PROFITABLE future in steaming? A very good question. I mean, it ain't like DIS has the patent on it. Anyone can do it, so it's basically a commodity now. If I recall my economics 101, it's called 'ease of entry.' Remember when My Space was the go to of social media? And then Facebook came along and took them out. Meta/Facebook now looks like it may go the way of the dinosaurs.As you stated he was essentially just renewed so they won't do anything immediately. Based on everything they have presented since Disney Plus was announced in 2019, they have met or exceeded all projections up to this point. They have blown past subscriber projections years ahead of what they said they would have in 2024. The problem is that all of that growth has costed Disney billions more than what they were projecting at the time. During the Disney Plus announcement, it was stated that peak losses would happen during FY 2022 and profitability would be FY 2024. To me, if peak losses have indeed just happened and they are able to achieve profitability in the next 2 years, its not only a win for Chapek but he'll probably be kept on for the long haul (assuming nothing crazy happens in the other divisions of the company).

If someone thinks that Disney has indeed reached peak losses and will start to narrow losses going forward before hitting profitability with the next 8 quarters, I think the price is very attractive. If you are someone who thinks streaming will continue to not be profitable for many years, the stock probably has some more downside to go between that and fears of a recession.

In some good news, Disney continues to lower their debt even with the sink that is streaming. It will still take some time to get back to manageable levels but I'm hopeful that once this is achieved, we will see more investments in the parks.

Which is why I think Parks and Experiences is where the future lies and where the money is to be made. When they're hitting on all cylinders, no one can duplicate what they do - a unique product. Why? Because it's a lot of hard work, discipline, planning and execution. It's the way of the world.

wabbott

DIS Veteran

- Joined

- Aug 4, 2021

- Messages

- 6,944

wabbott

DIS Veteran

- Joined

- Aug 4, 2021

- Messages

- 6,944

Wish I had the audio, but Jim Cramer just called for Bob Chapek’s firing….

He said if this were the NFL, Chapek would have been fired immediately.

https://www.cnbc.com/video/2022/11/09/theres-no-doubt-disney-ceo-bob-chapek-has-to-go-says-jim-cramer.html

There’s ‘no doubt’ Disney CEO Bob Chapek has to go, says Jim Cramer

This is my opinion only - Cramer is a buffoon. A front runner. How he's never been prosecuted for trading stocks in his account and at the same time dispensing advice, I'll never know. Pay him no attention, except that he is often a contrary indicator.

The parks can only go so far and provide so much money to the company. If linear tv was in a better position it makes sense to focus solely on the parks to drive growth as they did in the past with linear being the cash cow and parks used as growth but linear tv is not in a good position.Sound analysis. You asked is there a PROFITABLE future in steaming? A very good question. I mean, it ain't like DIS has the patent on it. Anyone can do it, so it's basically a commodity now. If I recall my economics 101, it's called 'ease of entry.' Remember when My Space was the go to of social media? And then Facebook came along and took them out. Meta/Facebook now looks like it may go the way of the dinosaurs.

Which is why I think Parks and Experiences is where the future lies and where the money is to be made. When they're hitting on all cylinders, no one can duplicate what they do - a unique product. Why? Because it's a lot of hard work, discipline, planning and execution. It's the way of the world.

I believe there is profitability in streaming and Netflix has proven this to be true. Obviously the ARPU of Netflix is substantially higher than Disney's streaming services but the price increases should bump that up a bit and i think Disney has a bit more pricing power to increase that further. DTC should pass linear tv sometime in FY 2024 and become Disney's second largest revenue segment.

I think Disney was hit with a bunch of things (some self inflicted) that on their own may not have been bad but altogether has made it a headache for everyone involved. The, IMO, overpaying of fox left them with a huge debt load that would have been fine and manageable but the pandemic and subsequent additional debt load left Disney in a terrible position. Growing a streaming service from scratch that would take billions to roll out only adds to the cash flow problem. Not to mention a mostly beloved CEO departing, as well as a future Disney obligation of $9B to buy out the rest of Hulu (also IMO overpriced and they should sell their current Hulu share but doubtful anyone would buy).

At some point money needs to go to the parks for expansion but seems doubtful for the next 12 months. 2020-2023 feel like lost years for the parks in terms of any money they make go to a segment in the company losing money and parks are just left to hold on long enough until cash can return. I am hopeful that come 2024 when DTC starts to generate profit, Disney will run that an auto pilot and parks can get some love. Be it better upkeep, new lands or a new park, I just want something.

P.S. I agree with you on Cramer. I don't know many people who take him seriously. He is a very good entertainer and as such does a great job in front of the camera but I have found his investment advice to be worse than most average analysts.

wabbott

DIS Veteran

- Joined

- Aug 4, 2021

- Messages

- 6,944

I hope you're correct about streaming being a money maker. Otherwise, a very, very big gamble on the company's future will be a bust, and a lot of time wasted.The parks can only go so far and provide so much money to the company. If linear tv was in a better position it makes sense to focus solely on the parks to drive growth as they did in the past with linear being the cash cow and parks used as growth but linear tv is not in a good position.

I believe there is profitability in streaming and Netflix has proven this to be true. Obviously the ARPU of Netflix is substantially higher than Disney's streaming services but the price increases should bump that up a bit and i think Disney has a bit more pricing power to increase that further. DTC should pass linear tv sometime in FY 2024 and become Disney's second largest revenue segment.

I think Disney was hit with a bunch of things (some self inflicted) that on their own may not have been bad but altogether has made it a headache for everyone involved. The, IMO, overpaying of fox left them with a huge debt load that would have been fine and manageable but the pandemic and subsequent additional debt load left Disney in a terrible position. Growing a streaming service from scratch that would take billions to roll out only adds to the cash flow problem. Not to mention a mostly beloved CEO departing, as well as a future Disney obligation of $9B to buy out the rest of Hulu (also IMO overpriced and they should sell their current Hulu share but doubtful anyone would buy).

At some point money needs to go to the parks for expansion but seems doubtful for the next 12 months. 2020-2023 feel like lost years for the parks in terms of any money they make go to a segment in the company losing money and parks are just left to hold on long enough until cash can return. I am hopeful that come 2024 when DTC starts to generate profit, Disney will run that an auto pilot and parks can get some love. Be it better upkeep, new lands or a new park, I just want something.

P.S. I agree with you on Cramer. I don't know many people who take him seriously. He is a very good entertainer and as such does a great job in front of the camera but I have found his investment advice to be worse than most average analysts.

I would caution about "auto pilot." Anytime business managers think that their operation can run itself, and that they can put their feet up, deposit the profits in the bank, and play golf every afternoon - that is a disaster about to happen. Fiscal discipline goes away, creativity stops, you lose touch with your customers (guests), etc.

I just finished a couple of weeks ago Eisner's autobiography Work in Progress. There wasn't anything new in the book, but I wanted to be fair and get his side of the story. With all his faults, Eisner wasn't afraid of hard work, and he had the creative chops, at least for the first 10 or 15 years. If I were the major stockholder of DIS, and I could find a clone that were his 1984 duplicate, I would hire him in a heartbeat.

AvidDisReader

DIS Veteran

- Joined

- Mar 24, 2019

- Messages

- 1,073

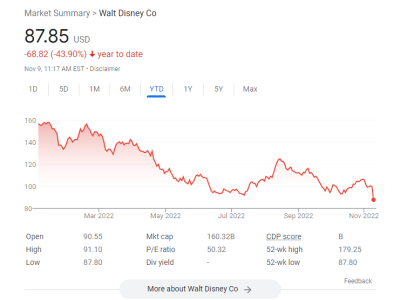

Yes this is a big ouch. However, it is also an oppurtunity. If I was a young investor, this is just the kind of risk I would take as long term I believe Disney will prosper. I am very close to retirement (actually past what I intended as I put if off when inflation destroyed the value of my retirement funds). So for me, with no dividend, this is not a risk I currently am willing to take.

AvidDisReader

DIS Veteran

- Joined

- Mar 24, 2019

- Messages

- 1,073

One of the polarizing figures in Disney history. The first decade with so much promise, the last decade that was quite frankly depressing. Personally, I will forever remember the renaissance of the animation department: Little Mermaid, Beauty and the Beast, Aladdin, Lion King, etc. The down side was the horrible state he let the parks deteriorate to. That and his incredible nastiness where he refused to bring anyone in to help run the company--go google the Michael Ovitz fiasco.I hope you're correct about streaming being a money maker. Otherwise, a very, very big gamble on the company's future will be a bust, and a lot of time wasted.

I would caution about "auto pilot." Anytime business managers think that their operation can run itself, and that they can put their feet up, deposit the profits in the bank, and play golf every afternoon - that is a disaster about to happen. Fiscal discipline goes away, creativity stops, you lose touch with your customers (guests), etc.

I just finished a couple of weeks ago Eisner's autobiography Work in Progress. There wasn't anything new in the book, but I wanted to be fair and get his side of the story. With all his faults, Eisner wasn't afraid of hard work, and he had the creative chops, at least for the first 10 or 15 years. If I were the major stockholder of DIS, and I could find a clone that were his 1984 duplicate, I would hire him in a heartbeat.

Last edited:

wabbott

DIS Veteran

- Joined

- Aug 4, 2021

- Messages

- 6,944

Michael Ovitz. The go-to book on that chapter of the Eisner reign - and the Jeffrey Katzenberg circus - is Kim Masters' The Keys to the Kingdom: The Rise of Michael Eisner and the Fall of Everybody Else.One of the polarizing figures in Disney history. The first decade with so much promise, the last decade that was quite frankly depressing. Personally, I will forever remember the renaissance of the animation department: Little Mermaid, Beauty and the Beast, Aladdin, Lion King, etc. The down side was the horrible state he let the parks deteriorate to. That and his incredible nastiness where he refused to bring anyone in to help run the company--go google the David Ortiz fiasco.

wabbott

DIS Veteran

- Joined

- Aug 4, 2021

- Messages

- 6,944

Michael Ovitz. The go-to book on that chapter of the Eisner reign - and the Jeffrey Katzenberg circus - is Kim Masters' The Keys to the Kingdom: The Rise of Michael Eisner and the Fall of Everybody Else.One of the polarizing figures in Disney history. The first decade with so much promise, the last decade that was quite frankly depressing. Personally, I will forever remember the renaissance of the animation department: Little Mermaid, Beauty and the Beast, Aladdin, Lion King, etc. The down side was the horrible state he let the parks deteriorate to. That and his incredible nastiness where he refused to bring anyone in to help run the company--go google the David Ortiz fiasco.

Genie+

You can never spend enough

- Joined

- May 12, 2022

- Messages

- 6,183

As a pretty average US family, we would spend much less on Disney if we no longer had a deep connection to the parks. Park spending alone is huge, but we probably spend at least 10 times more on non-park purchases than if we didn’t visit parks.

We can tolerate park prices as they sit now, but if those increased or experience decreased drastically then our average yearly Disney spending would go from >$7k to <$500 (maybe even <$300). WDW is key to our spending. It’s like a gateway drug.

We can tolerate park prices as they sit now, but if those increased or experience decreased drastically then our average yearly Disney spending would go from >$7k to <$500 (maybe even <$300). WDW is key to our spending. It’s like a gateway drug.

clarker99

DIS Veteran

- Joined

- May 15, 2019

- Messages

- 1,179

I bought at open this morning. If it hits $85, I am buying again. lolI think some of you posters were on CNBC this morning LOL.

Jim Cramer - Bob Chapek needs to be FIRED right now!!!!!!!!!!!!

Media Analyst Jeff Greenfeild - get rid of ABC and ESPN NOW!!!!! Apparently @wabbott got in his ear!

At least we can try and laugh on this depressing day...

BostonEd

I'd rather be skiing.

- Joined

- Sep 3, 2015

- Messages

- 776

Are you from Boston?go google the David Ortiz fiasco.

Ovitz, correct. Although Ovitz also got a little too big for his britches. A super-powerful agent who suddenly thought he could run a company. Nope.Michael Ovitz.

Jwaire

DIS Veteran

- Joined

- Sep 17, 2020

- Messages

- 1,285

I think some of you posters were on CNBC this morning LOL.

Jim Cramer - Bob Chapek needs to be FIRED right now!!!!!!!!!!!!

Media Analyst Jeff Greenfeild - get rid of ABC and ESPN NOW!!!!! Apparently @wabbott got in his ear!

At least we can try and laugh on this depressing day...

Look I don't like Chapek, but Cramer is a clown and Greenfield probably owns stock in a company that is interested in acquiring ABC and ESPN.

The down side was the horrible state he let the parks deteriorate to. That and his incredible nastiness where he refused to bring anyone in to help run the company.

Much of that was Paul Pressler. We were in a recession after 9/11 & Iraq. It's not like it was the best time to invest in theme parks especially with the losses from Euro Disneyland and the failure of Animal Kingdom.

Eisner's problem was he was in poor health (likely from all the stress) and he didn't trust anybody. This caused the board to demand a succession plan. He also lost his biggest supporter oil tycoon Sid Bass. His massive ego (some of it deserved, look how much Disney grew under him) got in the way of his creativeness and business sense. But he wasn't a bad CEO.

If Eisner would have purchased Pixar, he would have kept the job and got to retire on his own terms. But look at Pixar now without John Lasseter, it no longer brings in the coin either. So maybe he was right about Pixar after all.

Anyway. He was at least creative and willing to take risks. Chapek is just a suit.

-

New Menu for Annual Flavors of Carnival at Jazz Kitchen

-

Why Disney Parks Shifted Away from Focusing Solely on Families

-

Should EPCOT's France Pavilion Showcase a Marie Store?

-

Our Go-To Disney Snacks & Meals: Magic Kingdom

-

Pegasus Was the Star of 'Disney Hercules' and My Stateroom on the Disney Destiny

-

Race Weekend Discount + New Menu Items in Disney Springs

-

New Valentines Merch Spotted at Walt Disney World

New Threads

- Replies

- 0

- Views

- 59

- Replies

- 0

- Views

- 56

- Replies

- 0

- Views

- 65

- Replies

- 2

- Views

- 79

- Replies

- 0

- Views

- 125

Disney Vacation Planning. Free. Done for You.

Our Authorized Disney Vacation Planners are here to provide personalized, expert advice, answer every question, and uncover the best discounts.

Let Dreams Unlimited Travel take care of all the details, so you can sit back, relax, and enjoy a stress-free vacation.

Start Your Disney Vacation

New Posts

- Replies

- 22

- Views

- 2K

- Replies

- 12K

- Views

- 677K

- Replies

- 120

- Views

- 8K

- Replies

- 10K

- Views

- 1M

- Replies

- 20

- Views

- 2K

- Replies

- 61K

- Views

- 2M