https://www.wsj.com/lifestyle/travel/universal-disney-theme-park-dominance-a71ba4c6

The Threat in Disney World’s Backyard

Smaller rival Universal is expanding its parks, mobilizing Harry Potter, Super Mario and an army of Minions to steal away Disney visitors.

By Jacob Passy and Robbie Whelan

Updated April 13, 2024 12:08 am EDT

When the Universal

Epic Universe theme park opens next year, it will add 750 acres populated by Harry Potter, Donkey Kong and dragons to the company’s Central Florida resort.

It will also be an epic shot across Walt Disney’s bow.

Just 10 miles down Interstate 4 is Walt Disney World, the biggest part of Disney’s most important profit engine, and the stuff of dreams for tens of millions of visitors a year.

To understand the stakes for both companies, consider this: A common vacation itinerary includes three or four days at Disney World and one or two days at Universal. If Universal can now persuade families to spend one more day at its parks instead of at Disney, it could nab hundreds of millions of dollars in annual revenue.

Universal’s timing couldn’t be better. It’s been five years since Disney opened a major expansion—or new land, in the company’s parlance—in Florida. Those years have coincided with multiple rounds of ticket-price increases, irking even some die-hard Disney fans.

Over the past decade, Disney’s parks division has become more strategically important to the company, with profits eclipsing those of the TV-networks division, which includes ESPN, ABC and Disney Channel.

Universal’s parent, Comcast, is mining box-office hits like “Despicable Me” and “How to Train Your Dragon” as it invests in its parks. The company set itself up for success with a “foot on the gas” strategy early in the Covid-19 pandemic that has meant it has fresh attractions to offer as demand rebounds, Chief Financial Officer Jason Armstrong said at a March investor conference.

If Universal flips enough families, it could be a big blow to Disney’s most-profitable division at a time when the company is struggling to juggle other priorities, including finding its next chief executive, reinvigorating its movie studios and making money in streaming.

It is a classic case of the smaller rival taking on the industry leader. The Disney division that includes theme parks—plus cruises, videogames and consumer products—posted $32.5 billion in sales for the fiscal year ending Sept. 30. Universal’s parks division brought in $8.95 billion in revenue last year.

“Guests have told us they love our brand of immersive storytelling, and that if we gave them more of that, they’d give us more of their time,” a Universal spokesperson said. “We looked at that strategically” and decided to build another park.

Disney says it has been steadily offering new and refreshed attractions, pointing to a host of well-reviewed thrill rides and renovations that have recently added sheen to aging parks like Epcot.

“Epic is Universal playing catch-up on a decade of nonstop development at Walt Disney World,” a Disney spokesperson said.

When Walt Disney World opened in 1971, almost five years after the death of the company’s namesake founder, admission cost $3.50 for an adult. Visitors could roam Magic Kingdom—the only theme park on the property at the time—and take in dozens of free attractions and performances, but had to purchase separate ticket books to get on rides like Jungle Cruise and Haunted Mansion.

As the resort expanded over the decades, filling more and more of the roughly 40 square miles of land Disney owns near Orlando with hotels and new parks, visits began to require more time and more planning. Families began mapping out longer visits so that they could explore other parts of the Walt Disney World Resort.

Disney’s last major addition in Florida arrived in 2019, when it opened a new land at its Hollywood Studios theme park called Star Wars: Galaxy’s Edge, based on the popular science fiction franchise. Elsewhere in the U.S., Disney has made significant expansions, such as its Avengers Campus, added to the California Adventure park in Anaheim, Calif., in 2021.

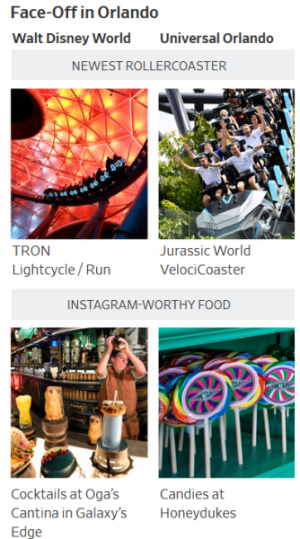

Guardians of the Galaxy: Cosmic Rewind, a hit roller coaster that opened in 2022, simulates time travel by launching riders backward through a darkened solar system while music from pop artists like Blondie and Tears For Fears blares. Tron Lightcycle / Run, a nearly 60-m.p.h. screamer of a coaster that evokes the retro-futurism of the 1980s with neon lights and a synthesizer soundtrack, opened last year and is consistently mobbed by eager fans. A daily app-based waiting list for the coaster often maxes out.

“By staggering these major launches, we have been able to commercially and operationally optimize our new offerings over time, rather than having to do it all at once,” Disney CEO Bob Iger said in April. The company plans to announce a raft of new attractions at its

D23 fan event this summer.

When Disney has swung for the fences recently, it hasn’t always connected. Star Wars: Galactic Starcruiser, an ambitious interactive hotel experience that cost more than $350 million to build, closed less than two years after opening in 2022. Disney said it would use what it learned to guide decisions about future experiences.

Disney last year announced that it would spend $60 billion over a decade to “turbocharge” growth at the division that includes theme parks and cruises, but did not say how much would be spent on domestic parks.

Earlier this month, the company previewed a planned expansion of the Magic Kingdom park that’s about the size of Galaxy’s Edge. It has also begun work on a new section of Animal Kingdom in Orlando called Tropical Americas, based on themes from the movie “Encanto” and the Indiana Jones franchise. The company has not said when those areas will open. Most large expansions take years to complete.

“Give us something more exciting—something brand new that can keep bringing people back,” said Jenean Criscitiello, a 32-year-old Disney fan from the Chicago suburbs. She and her husband don’t have a trip planned to Disney this year in part because they weren’t eager to experience rides and attractions they’d already done dozens of times.

A Disney spokeswoman said fans have high expectations and the company is “always striving to deliver on those expectations and in fact exceed them.”

Political and legal skirmishes with Florida Gov. Ron DeSantis over the last two years complicated announcing any big expansions at Disney’s Florida parks.

Now, a legal truce reached last month between Disney and the state “will actually enable us to pursue the kinds of significant investment in our Florida parks” that fans want to see, Iger said at the company’s April shareholder meeting.

Universal finds ‘Jaws’

Universal’s theme-park roots stretch back to the 1960s, when it was a movie studio owned by MCA. Universal Pictures offered tours of its studio lot in Hollywood in red-and-white trams in an effort to increase profits. Originally, the tour drove through back lot areas, giving visitors a glimpse of movie stars and live film sets.

Over time, the tour grew more ambitious. Massive permanent sets were built to showcase special effects. Audio-animatronic versions of the shark from Steven Spielberg’s “Jaws” and King Kong were installed to thrill guests.

By the 1970s, MCA saw the success Disney had in exporting the

Disneyland concept to Florida and began planning a movie studio-themed park in the Sunshine State. Universal Studios Florida opened in 1990, a year after Disney opened a new park of its own, now known as Hollywood Studios.

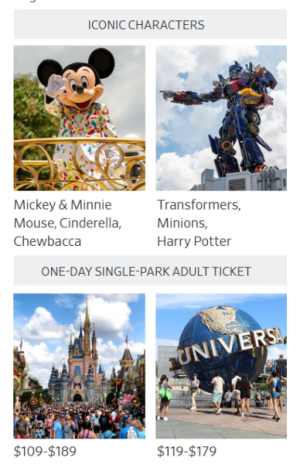

In 2007, Universal announced plans for the Wizarding World of Harry Potter at its Universal Islands of Adventure theme park in Orlando. Attendance surged after the Harry Potter-themed area opened in 2010.

“Everybody saw the potential of doing that level, that kind of project, and what it could do for the company and for the parks and the resorts,” said Mike West, who has previously worked at both Disney and Universal designing theme-park attractions.

Quickly, Universal planned an expansion of the Harry Potter attractions at neighboring Universal Studios. The two areas are connected by a ride, inspired by the magical Hogwarts Express train, that shuttles between the parks. To experience that ride and both Harry Potter areas in the same day, visitors must purchase multipark tickets, which cost anywhere from $174 to $234 for a one-day adult ticket.

Other Potter attractions include a ride through Hogwarts called Harry Potter and the Forbidden Journey, plus several roller coasters, including Hagrid’s Magical Creatures Motorbike Adventure. The theme park opening next year is set to include a third Wizarding World, a land called Super Nintendo World and roller coasters like Starfall Racers and the Donkey Kong-themed Mine Cart Madness.

“Disney doesn’t have the shovels in the ground at this point to open anything that might directly compete with Epic,” said Robert Niles, a former Disney employee who once piloted rafts at the Tom Sawyer Island attraction at Walt Disney World and now runs the website Theme Park Insider.

Adding Up

If Orlando visitors spend one additional day and switch their lodging to Universal instead of Disney, it would have an impact.

Note: Budgets are for a family of four, with two kids over the age of 10, visiting Orlando the week of July 15 and staying at a mid-tier resort for five nights. Theme-park admission costs cover tickets that permit park hopping. Food costs cover two meals in the park per day—one counter-service, the other table-service—plus two snacks and bottles of water per person. Costs based on pricing information found on the companies' websites and include estimates for some items. Taxes not included.

Source: WSJ analysis of the companies’ publicly available information

David Holechek, a 42-year-old father of four in the Denver suburbs, owns a Disney timeshare and spends thousands of dollars each year to take his family to Walt Disney World. The Holecheks usually tack on a brief stop at the nearby Universal Orlando Resort.

The family is forgoing this year’s trip to Disney World. When they travel to Orlando next year, they expect to spend more days at Universal than at Disney for the first time.

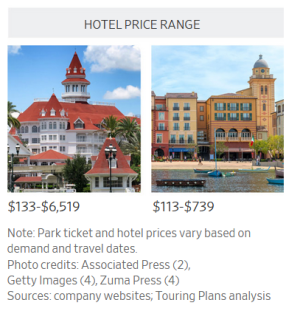

A family of four visiting Disney World for a five-day, four-night stay in mid-July with Park Hopper tickets, a quick-service dining plan and a room in a moderate-tier hotel would spend upward of $5,000, not counting the cost of souvenirs or add-ons such as the

Genie+ line-skipping service. Shortening the Disney leg by even a day would trim hundreds of dollars from their spending at the company’s parks and resorts.

The Imagineers

Iger and Josh D’Amaro, who oversees the Disney division that includes theme parks, have told employees that the parks business is at a transition point.

It is coming out of a few years focused on maximizing how much visitors spend each visit, or what it calls yield per visitor, by increasing ticket pricing and selling add-ons like line-skipping features. Now, the company is ready to return to steady rollouts of ambitious expansions, according to a manager in Disney’s parks division.

Devising new theme-park attractions has historically been a multiyear process, says Eddie Sotto, a former Imagineer, a member of the company’s elite team of theme-park designers, who now consults with theme parks through his own design firm.

“It’s very difficult to take an intellectual property or movie and say, ‘Well, this movie just suddenly became a surprise hit and now this ride needs to be there tomorrow,’ ” Sotto said.

Note: Disney figures for the segment including theme parks include operating income from theme parks, cruise lines, consumer product sales and merchandise licensing. The corresponding Comcast figures are Ebitda for theme parks and consumer products. Disney fiscal year ends Sept. 30. Comcast figures are for calendar years.

Sources: the companies

Revenue from the division has represented 30% to 40% of Disney’s overall revenue for most of the past decade, but the division’s share of operating income has grown steadily, to 69% in fiscal 2023 from 39% in 2018, making the business the darling of Disney and its most reliable driver of profit growth.

Iger holds a meeting every month or two to review major initiatives with Imagineers. He and D’Amaro, one of the executives on the shortlist of Iger’s potential successors as CEO, have delivered a clear message at recent meetings that one person in attendance described as: “Open the doors and show me your new visions.”

Fight for visitors

Over the past decade, Universal Orlando Resort has added multiple hotels that range from budget to luxury. This summer it will open a new section of the Universal Studios Florida park based on DreamWorks Animation’s films such as “Shrek” and “Trolls.” In recent years, Universal has also added rides to its Florida theme parks based on the Despicable Me, Fast & Furious and Jurassic World film franchises.

“We’ve seen Universal become more of a destination itself,” says Kari Dillon, owner of two travel agencies based in Huntersville, N.C.: Marvelous Memories Travels and Marvelous Mouse Travels. “We do a ton of split stays as it is right now, where people are going down and spending half their week at Disney and then taking the other half and going down to Universal.”

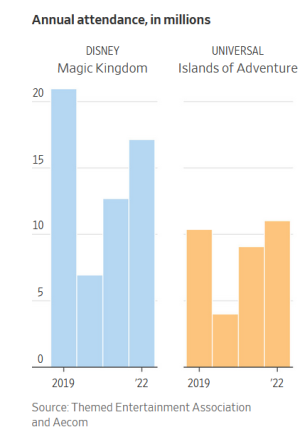

Attendance at Universal’s Florida theme parks has snowballed in the years since they first opened in 1990. Islands of Adventure attracted more than 11 million visitors in 2022, while Universal Studios had almost 10.8 million guests, according to data from the Themed Entertainment Association and consulting firm Aecom.

Disney’s Magic Kingdom, which had more than 17 million visitors in 2022, has long been the world’s most-visited theme park. But since the start of the Covid-19 pandemic, attendance at Universal’s Islands of Adventure park has surpassed that of Disney World’s other three Orlando-area theme parks.

The new Universal park could lead Walt Disney World attendance to decline by about one million visitors in the two years spanning 2025 and 2026, according to a new analysis from MoffettNathanson, and boost overall attendance at Universal’s three parks in the area by more than eight million.

Craig Longhurst, who works in real-estate development and management in Winston-Salem, N.C., once a year typically takes his two sons, 15 and 10, each to Walt Disney World individually. Lately, he’s grown irritated at the rising cost of visiting the theme parks. The latest “Moana” themed walk-through attraction isn’t interesting enough to warrant a trip, he said.

“If they’re going to continue to charge these prices,” Longhurst said, “they’re going to have to invest in the parks and develop some new attractions that get me to part with my money.”

Write to Jacob Passy at

jacob.passy@wsj.com and Robbie Whelan at

robbie.whelan@wsj.com