Payday Friday! Car registration has been paid today - on time and in full. There were years that wasn't happening for me.

Week 13

2024 Financial Goals

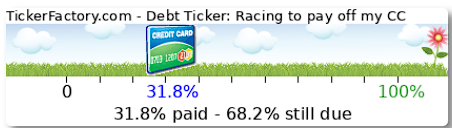

1. Pay off my credit cards and car loan in 2 years by using the debt avalanche.

I paid a total of $380 above my $90 minimum payment on my Q Card account in the month of March. The balance is just about $2000 now. My Sephora card will technically be paid off before the Q Card though because the balance is so low that the minimum payment will pay it off next month.

2. Increase my monthly payments to my husband for household expenses by $800 a month beginning in May and open a joint checking account where we will each contribute monthly. We figured giving me until May to sock some extra cash into my checking would be a good idea since my personal loan is now paid off and that was sucking $1000 off the top of my paycheck once a month.

Snoozed until May. I will pay my husband $300 extra in April and begin paying him the full extra amount beginning in May.

3. Set aside $285 per month from January-June to cover the cost of our hotel for our anniversary trip in July to Monterey.

$285 more into my HYSA (3/6)

4. Begin paying for our 2025 spring break cruise to Mexico in March. Payments will be $450 a month from March-December.

(1/10)

5. Continue using the YNAB app and website to track my money daily. I'm still tracking my money the old fashioned way with a register but I really like the budgeting aspect of YNAB and am getting more and more used to it.

I'm a bit behind on YNAB because my sister and her family are here from Michigan and staying with us so I've only been at the office here and there. That's where I get all my accounting done. Next week I'll catch up. (12/52)

2024 Personal Goals

1. Finish deep cleaning and organizing my kitchen. My husband is basically the Swedish Chef so he makes quite a mess when he cooks. I appreciate the fact that he does all of the cooking but it's a lot to keep on top of TBH. I need to do a better job and put in more effort. I will track this weekly.

With my sister arriving, my husband and I buckled down on getting this done. He mopped and wiped things down and cleaned the refrigerator. I've almost caught up on the rest. I feel like a weight has been lifted off of my psyche. (6/52)

2. Once I feel like my kitchen is back under control I'll transition to organizing my clothes that are in boxes in our bedroom. I will tackle this at least one of the days of my weekend.

Snoozed.

3. Reorganize and deep clean my bathroom. I have too much on the countertop and need to make use of the cabinets in a more organized manner.

Snoozed.

4. By July I'd like to be at the point I can begin to tackle my boxes that are still unpacked in the garage. I had a storage unit for years and now they're just sitting untouched since we moved into the house 3 years ago.

Snoozed.

5. In August I'd like to make my stepson's room into a workout room. He's a senior in high school this year and he'll be starting college next fall. He's only staying over 1 or 2 nights a week at most at this point since he lives with his mom so I don't feel I'll be booting him out or anything. I am at my highest weight ever and I honestly don't even know what that is since I'm scared to get on the scale. I can have all of the DVDs and online workouts in the world but they do no good if you don't use them. I think having a space set aside will really help me out.

My BODi bike arrived yesterday! Everything is put together and ready to go. I have new workout clothes and cycling shoes as well. There's a 20 minute calibration ride I need to do to assess where I'm at before I start any programs. I'm starting this when my sister and her family are on their way back to Michigan.

6. Get my passport at some point this year to be ready for the cruise in 2025.

This probably won't happen for at least a few months.

7. I came up with a new goal. Get back to baking on a weekly basis. This will begin when my kitchen is 'done'. JK, I know a kitchen is never truly caught up on.

Snoozed until I cross #1 off of my list.

Enjoy your weekends everyone!

Great job on so many books and your other goals!

Great job on so many books and your other goals!