The Fed has to raise interest to match inflation in order to get inflation under control. The problem is were a debt-based economy and everyone(people, government, businesses, corporations) are up to their eyeballs in debt. I see lots of pain ahead, but hopefully, we'll come out on the other side in a better place. It's been obvious for years this was not sustainable.

Yes, I understand how it goes....and agree we're in for pain. And we have reached record levels of debt once again after a bit of a lull during the pandemic when Americans piled up cash. Perhaps there's still some cash on the sidelines, but our level of consumer debt is at an all time high....as a total, and across all categories....mortgage/auto/credit card debt/student loans. And it will go up from here without question. This thread references airfares, which those of us who have enough disposable income to travel...are noticing. But we're going to see consumer debt really rise now for Americans on the lower end of the income spectrum simply to afford things like groceries, gas and utility bills.

DH and I are roughly 4-5 years out from retirement and so we're watching this period very closely....and thinking about how we'd handle spending if we were newly retired. For now, we're sticking with our 75/25 stock/bond allocation for existing holdings, but moving forward we're buying VTSAX (total stock market index)....with our tax advantaged retirement accounts, because the market is going to be "on sale" over the next couple of years. That's a change for us...as we typically continue to buy with the same asset allocation strategy. That's about 73% of our yearly savings, the other 27% is going into cash...well, not cash, but things like I-Bonds...laddered CDs, where we can get some return (albeit not beating current inflation levels). We want to accumulate 4-5 years of spending to get us started in retirement....because we don't know how the markets will be affecting our next egg in the coming few years for sure....and how that may affect our projections. We'd like to not touch the nest egg for as long as possible. Even though our projections are conservative....this is a bit of a wake-up call for sure in how our retirement years/spending can be affected.

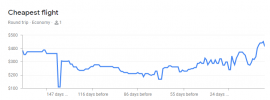

One thing I'll enjoy in retirement is having the flexibility to really pick any day to depart/return. We can depart on a Friday for a trip, but usually we need to return on a weekend day, and so we typically pay more for flights. And we can never grab last minute sales...etc. We're still locked in with schedules...etc. Hoping that flexibility will stretch our travel dollars in retirement.