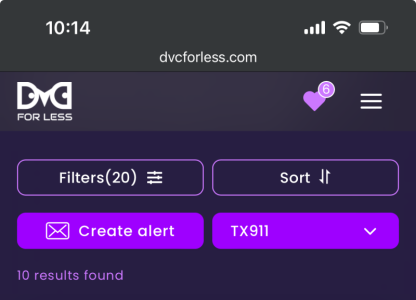

tx911

Hate the politics, love the voter

- Joined

- Jul 28, 2023

- Messages

- 3,350

Anything in particular that makes you feel that way? Just upcoming dues?I truly do think this fall into winter is going to bring extraordinary deals...like can't resist prices

I am on board the resale train now, although the very long wait between the purchase decision and points in account is off-putting. I wish there were a way to make it quicker, like inside of one month