Traveling on cc points

DIS Veteran

- Joined

- Apr 27, 2016

- Messages

- 1,212

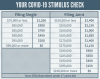

Judgmental much? Depending on where you live in the country, 75k/150k a year is not a great living. Here in Connecticut with our taxes and very high cost of living,150k for a couple is in the mid middle class range. We are fortunate that we haven’t lost our jobs during this whole mess and don’t need the $1200 but it doesn’t make us gross that we are concerned about our taxes going up because thousand upon thousands of people will be getting another check without any loss of income.Maybe this isn't the place for this pity party. You make enough money that you don't even qualify for the stimulus checks meanwhile millions are literally waiting in food lines and will get $600 that will cover half of a month of rent if they are lucky. And your concern is that your taxes might slightly go up, pretty gross, but I guess not surprising.

I haven’t read 1 comment that said that people who lost their jobs and are in real need of the money shouldn’t get it but the 75k/150k is an arbitrary number that doesn’t take variables like where you live or if you lost your job. Why should a couple who hasn’t lost their jobs making 149k get a $1200 check?

)

)