airjay75

DIS Veteran

- Joined

- Apr 21, 2025

- Messages

- 1,324

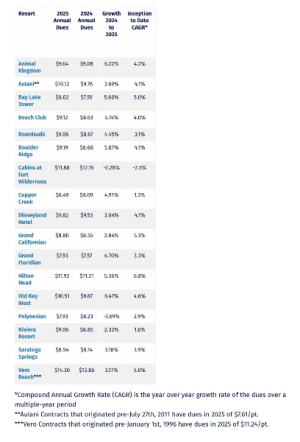

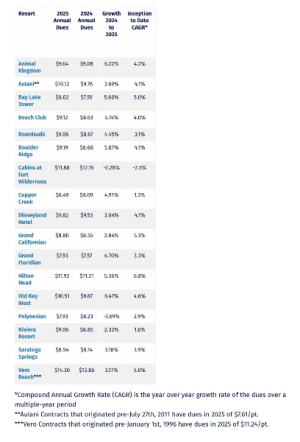

https://www.dvcresalemarket.com/buying/annual-dues/

Credit to @Genie+ for asking this in a different thread - I thought it was deserving of its own thread, so figured I would start one.

Basically, post any predictions, thoughts, or questions you might have. Which resorts do you think will see the highest percentage increases? Lowest increases? Think any resort will actually have their dues go down?

I know one question that I've thought about - how have refurbishments affected dues in the past? I presume each resort tries to budget for them the operating reserves, but also imagine some refurbs come in over or under budget? Thinking about how that might affect CCV, BLT, and AKV this year.

Share anything you'd like!

Credit to @Genie+ for asking this in a different thread - I thought it was deserving of its own thread, so figured I would start one.

Basically, post any predictions, thoughts, or questions you might have. Which resorts do you think will see the highest percentage increases? Lowest increases? Think any resort will actually have their dues go down?

I know one question that I've thought about - how have refurbishments affected dues in the past? I presume each resort tries to budget for them the operating reserves, but also imagine some refurbs come in over or under budget? Thinking about how that might affect CCV, BLT, and AKV this year.

Share anything you'd like!