You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tax on onboard purchases on transatlantic cruises

- Thread starter iona

- Start date

happycamper47

DIS Veteran

- Joined

- Nov 10, 2012

- Messages

- 1,930

Either way taxes (if any) should only be charged until you reach International water (12 miles out). It's not based on the Port of origin.

I’m shocked at how many people think this. We just got off the WBTA. The evening before we reached our first port in Portugal, there was a frenzy of passengers buying in the shops because they heard hefty European taxes were about to be added to purchases.

As the previous poster pointed out, taxes are charged only when the ship is in or near the port. This is why shops are closed… typically, only food, beverage and services are available for purchase and these are often exempt from local taxes. We bought a cupcake and some drinks while the shop was in Spain and no taxes were added.

I’ve been to a lot of ports and most don’t levy tax on food/ beverage/ services. The only one I can think of is Miami.

As the previous poster pointed out, taxes are charged only when the ship is in or near the port. This is why shops are closed… typically, only food, beverage and services are available for purchase and these are often exempt from local taxes. We bought a cupcake and some drinks while the shop was in Spain and no taxes were added.

I’ve been to a lot of ports and most don’t levy tax on food/ beverage/ services. The only one I can think of is Miami.

I took a cruise out of NYC last month and coffee cost me more in port than at sea. So, NYC seems to charge tax on drinks, too.I’ve been to a lot of ports and most don’t levy tax on food/ beverage/ services. The only one I can think of is Miami.

This is my understanding as well. Mediterranean cruises to Spain, France, Italy, and Greece would have the European VAT. Cruises from or stopping in Southampton do not, because the United Kingdom is no longer in the EU. Transatlantic cruises similarly do not charge VAT.I believe the VAT is added for cruises entirely in the EU, rate based on departure port. I know people have had it added to Mediterranean cruises. We did not have VAT on our Baltic Sea and Norway cruises.

I believe the VAT is added for cruises entirely in the EU, rate based on departure port. I know people have had it added to Mediterranean cruises. We did not have VAT on our Baltic Sea and Norway cruises.

This is my understanding as well. Mediterranean cruises to Spain, France, Italy, and Greece would have the European VAT. Cruises from or stopping in Southampton do not, because the United Kingdom is no longer in the EU. Transatlantic cruises similarly do not charge VAT.

Your cruise fare includes all applicable taxes. But anything you purchase while onboard the ship that was not prepaid is subject to taxation. Most purchases are done in international waters, so they’re duty (tax) free. However, purchases at port/ within its legal jurisdiction are subject to tax. As I mentioned earlier, this is why shops don’t open until the ship is in international waters. But drinks, food and spa services are sold in ports and tax is added to these purchases if lawfully required. As I mentioned earlier, most ports don’t tax these items but some - MIA, NYC, etc. - do (at least food and beverage).

For reference, there was no tax on this year's EBTA.

It looks like Florida requires sales tax on alcohol purchases, so if you purchased drinks while the ship was at or near Port Everglades, you would’ve paid the tax. If you weren’t charged, Disney paid it for you.

Spain didn’t charge but Portugal may have.

cwis

DIS Veteran

- Joined

- Feb 3, 2016

- Messages

- 1,709

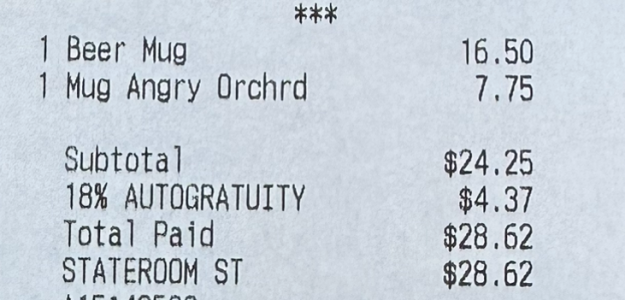

Interesting. My first bar check was on embarkation day at 4.43pm. We were still in port, and it shows no taxes.It looks like Florida requires sales tax on alcohol purchases, so if you purchased drinks while the ship was at or near Port Everglades, you would’ve paid the tax. If you weren’t charged, Disney paid it for you.

It might just be included in the price. That's what happened with my coffee in NYC.Interesting. My first bar check was on embarkation day at 4.43pm. We were still in port, and it shows no taxes.

View attachment 863075

European

Mouseketeer

- Joined

- Mar 12, 2003

- Messages

- 464

If you just got off, wasn’t it the EBTA?I’m shocked at how many people think this. We just got off the WBTA. The evening before we reached our first port in Portugal, there was a frenzy of passengers buying in the shops because they heard hefty European taxes were about to be added to purchases.

As the previous poster pointed out, taxes are charged only when the ship is in or near the port. This is why shops are closed… typically, only food, beverage and services are available for purchase and these are often exempt from local taxes. We bought a cupcake and some drinks while the shop was in Spain and no taxes were added.

I’ve been to a lot of ports and most don’t levy tax on food/ beverage/ services. The only one I can think of is Miami.

cwis

DIS Veteran

- Joined

- Feb 3, 2016

- Messages

- 1,709

That's not what Disney Cruise Line is usually doing.It might just be included in the price. That's what happened with my coffee in NYC.

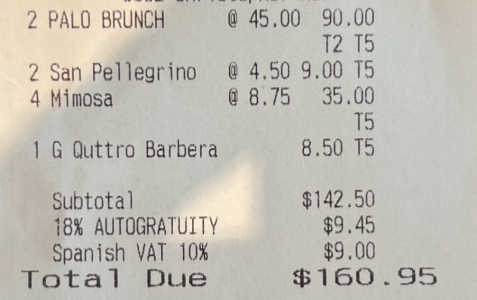

See for example a Palo Brunch during a Mediterranean cruise last year, where VAT was applied during the voyage. It makes sense for accounting purposes I guess.

Fair enough. My experience last month was with a different cruise line, unfortunately.That's not what Disney Cruise Line is usually doing.

See for example a Palo Brunch during a Mediterranean cruise last year, where VAT was applied during the voyage. It makes sense for accounting purposes I guess.

View attachment 863093

In

Tons of postings on CC indicate that other cruise lines have levied tax on drink purchases made while ships were in port. On Royal Caribbean blog, somebody asked why they were charged sales tax on a drink in Port Everglades given they had the drink package, and the response was that the State of Florida levies tax on all drink purchases; prepaid drink packages are assessed tax based upon the value of the drink.

I didn’t buy alcohol in Port Everglades on my cruise but if you did and weren’t charged sales tax then. DCL covered the charge for you.

Is there any instance of DCL charging sales tax on drink purchases while in port? Disney may just eat the cost since it’s so trivial.

Interesting. My first bar check was on embarkation day at 4.43pm. We were still in port, and it shows no taxes.

View attachment 863075

Tons of postings on CC indicate that other cruise lines have levied tax on drink purchases made while ships were in port. On Royal Caribbean blog, somebody asked why they were charged sales tax on a drink in Port Everglades given they had the drink package, and the response was that the State of Florida levies tax on all drink purchases; prepaid drink packages are assessed tax based upon the value of the drink.

I didn’t buy alcohol in Port Everglades on my cruise but if you did and weren’t charged sales tax then. DCL covered the charge for you.

Is there any instance of DCL charging sales tax on drink purchases while in port? Disney may just eat the cost since it’s so trivial.

I’m shocked at how many people think this. We just got off the WBTA. The evening before we reached our first port in Portugal, there was a frenzy of passengers buying in the shops because they heard hefty European taxes were about to be added to purchases.

As the previous poster pointed out, taxes are charged only when the ship is in or near the port. This is why shops are closed… typically, only food, beverage and services are available for purchase and these are often exempt from local taxes. We bought a cupcake and some drinks while the shop was in Spain and no taxes were added.

I’ve been to a lot of ports and most don’t levy tax on food/ beverage/ services. The only one I can think of is Miami.

This is not completely accurate. Ships that depart and return from and travel only in EU ports will have a VAT charge added to every sale and service sold during the cruise. The Med cruises that depart roundtrip from Barcelona and go to Italy are the most common example for DCL. The VAT applies for the duration of the cruise and does not matter if you are in international water or not. You can claim a VAT waiver if you meet all requirements when departing Europe at the end of your trip. Here’s a common letter DCL hands out on those cruises:

https://disneycruiselineblog.com/wp...6/European-Union-VAT-Information-May-2018.pdf

As your transatlantic cruise departs or arrives in the US it is not subject to VAT. A lot of cruises that do a EBTA back to back with the first Med cruise (when offered) will purchase souvenirs the first leg to avoid the VAT on their second wholly Med cruise.

-

Make Candy Apple Olafs for your 'Frozen the Musical' Showing

-

All The New INSIDE OUT Merch For 10th Anniversary

-

El Artista: A Spanish Haunting Coming to Halloween Horror Nights

-

Is Walt Disney World Focusing Too Heavily on the Magic Kingdom?

-

New Disney Springs Shaken & Stirred Cocktail Class Dates

-

Looking for Ways to Experience 'Elio' at Disney Parks? We've Got Some + NEW Merch!

-

Why is There a Giant Dinosaur at Disney's Hollywood Studios?

New Threads

- Replies

- 0

- Views

- 44

- Replies

- 0

- Views

- 65

- Replies

- 0

- Views

- 100

- Walt Disney World News

- Walt Disney World Articles

- Disney Cruise Line News

- Disneyland News

- General Disney News

- Universal Orlando News

GET UP TO A $1000 SHIPBOARD CREDIT AND AN EXCLUSIVE GIFT!

If you make your Disney Cruise Line reservation with Dreams Unlimited Travel you’ll receive these incredible shipboard credits to spend on your cruise!

New Posts

- Replies

- 14K

- Views

- 292K

- Replies

- 30

- Views

- 1K

- Replies

- 38

- Views

- 2K

- Replies

- 114

- Views

- 8K

- Replies

- 16

- Views

- 2K

- Replies

- 3K

- Views

- 385K

- Poll

- Replies

- 3K

- Views

- 312K