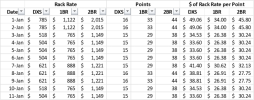

Turns out I may have exaggerated (it's no secret that I'm a Beach Club hater). It appears to be roughly break-even.

This assumes that you're going to use every single Beach Club point you buy at Beach Club, and that if you hadn't bought DVC you would have stayed at Beach Club as a cash guest exactly the same amount.

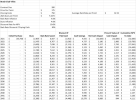

Most of the work here goes into figuring out that initial "Average Rack Rate per Point." If you're staying in 1BR every time, this gets significantly worse. If Studios every time, a bit better. The 2BR average is very close to the resort overall average.

View attachment 665888

View attachment 665889