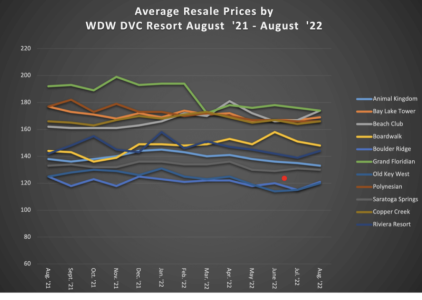

There was a bubble - just like in homes

Do a 5 and 10 year trend not 12/months

So taking your point, I looked at 4 years.

August 2018 to August 2022: (Inflation has been 18% over the last 4 years combined).

| Aug 2018 prices | With 18% inflation | Actual Aug 2022 | actual change | |

| AKL | 112 | 132.16 | 133 | 0.60% |

| BLT | 141 | 166.38 | 169 | 1.50% |

| BCV | 138 | 162.84 | 174 | 6.80% |

| BWV | 129 | 152.22 | 148 | -2.80% |

| BRV | 106 | 125.08 | 121 | -3.30% |

| CCV | 155 | 182.9 | 166 | -9.30% |

| VGF | 166 | 195.88 | 174 | -11.10% |

| OKW | 103 | 121.54 | 120 | -1.30% |

| POLY | 161 | 189.98 | 166 | -12.70% |

| SSR | 101 | 119.18 | 130 | 9.10% |

So BCV has appreciated almost 7% in the last 4 years.. SSR has appreciated 9% over the last 4 years.

Every other resort is flat or down.

CCV, POLY and VGF are down significantly.

BWV and BRV are both modestly down. While BLT, AKL and OKW are about flat. (less than a 2% change over 4 years). AKL has almost perfectly tracked inflation, price staying entirely flat.

So as we go back even 4 years, we really aren't seeing much DVC appreciation.