For the most part that is correct.

The 100,000 points will hit on the statement you finish the required spend so if you meet the spend for XMAS Gifts and your statement hits in December then the bonus points would hit for 2025 year but if the statement date is in January the points would be posted for your 2026 year.

If you open the card today 8/22/2025 that would give you until 1/22/2026 to meet the spend.

You want to try and delay as much spend as you can until January which would give you 22 days to spend the $4,000.

If you spend any amount before January it will not count for the 2026/2027 Companion Pass.

Between 1/1/26 - 1/31/26 you will receive 10,000 Points that are only good for the Companion Pass (CP).

On January 10th you place a $4,000 purchase at the base 1x earning rate brings your total CP Point balance to 14,000.

When your statement hits you will receive the bonus 100,000 points bringing your CP Point balance to 114,000.

Based on this example you would now need 21,000 more points.

You do not have to spend $21,000 on the card to get there although you certainly could.

Flights booked with cash (whether you used the card or not) would give you points.

If you booked the flights with the SW CC you would earn 2x-4x depending on which card you have

You can also earn mile instead of shopping through rakuten or other cashback portals by using the southwest portal at

rapidrewardsshopping.southwest.com

The other approved partners are listed at

https://mobile.southwest.com/rapid-rewards/partners/

By going through those partners and using your SW CC you would be able to double dip and spend less.

Alternatively you could also open a business card as well and meet its spending requirements which would give you 60,000 or 80,000 points depending on the card.

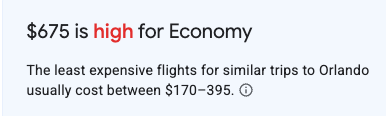

In the below example $6,075 was spent with the Priority Card ($229 Fee) to earn the Companion pass by 4/7/2026 that would be good for the rest of 2026 and 2027.

You would also have 126,946 points to book your flight (Remember the 10K from the CC aren't useable for booking) and then you would just need to pay taxes for you and your companion.

View attachment 995977