Unlike the previous poster, I disagree with a couple of other things...

It's not like Riviera was at full price at the time. During that same period, buying 150 points at RIV was $168/pt using MB, or

an extra $1000 for 150 points. Sure $1000 is $1000, but on a ~$25K purchase it's in the ballpark of the closing costs. Not something that would matter to most if they really preferred one resort over the other.

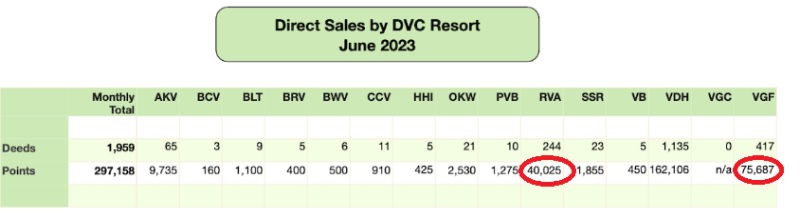

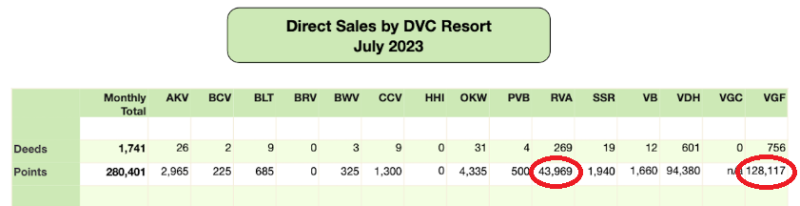

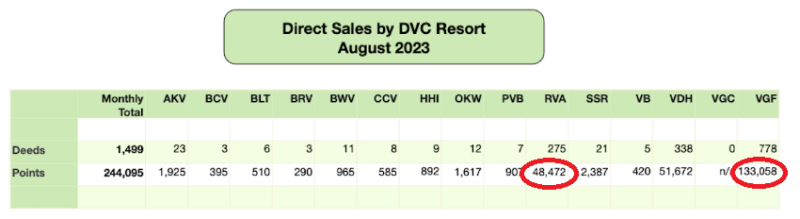

Do you believe that an extra ~4% in cost accounted for the disparity of 155% in sales over that summer (337K points vs 132K points)? VGF sold 2.5x more than Riviera just because it cost 4% less and there was no other "elephant in the room"???

Another way to look at it - if the situation was reversed and VGF was at $168/pt and RIV at $161/pt so you really think RIV would have outsold VGF? I think the sales volume outcome would have been about the same as it was because that 4% price difference, or $1000, is neither here nor there in the grand scheme of things...

View attachment 862295

View attachment 862293

View attachment 862294

Source: dncnews.com

https://dvcnews.com/dvc-program-men...in-strong-grand-floridian-surges-in-june-2023

https://dvcnews.com/dvc-program-men...r-off-as-walt-disney-world-rises-in-july-2023

https://dvcnews.com/dvc-program-men...ngthen-disneyland-sales-weaken-in-august-2023

We're 12 months later and PVB tower is still prices for sale. Is it possible they severely underestimated the demand for a resort without resale restrictions priced at or near resale value?

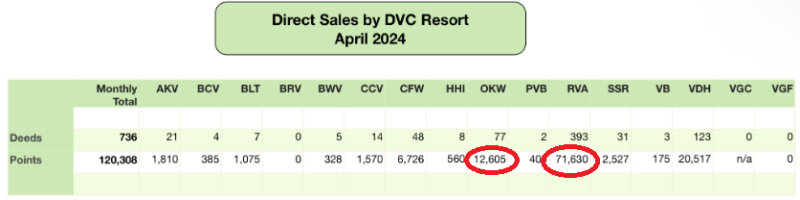

If price were the "overall deciding factor", shouldn't OKW sell at least 2.5x as much as Riviera? It has a much larger price discount vs. Riviera compared with the 4% price advantage VGF had over Riviera last summer. Yet OKW sold ~12.6K points in April vs 71K+ points for RIV (less than 20% of RIV sales).

There are many other factors besides the purchase price which affect demand...

View attachment 862297

https://dvcnews.com/dvc-program-men...elps-direct-sales-rise-slightly-in-april-2024