WinterSolider

DIS Veteran

- Joined

- Feb 21, 2024

- Messages

- 1,118

@Brian Noble @pkrieger2287 help me wrap my head around this because I think I'm onto something but I can't quite get there...

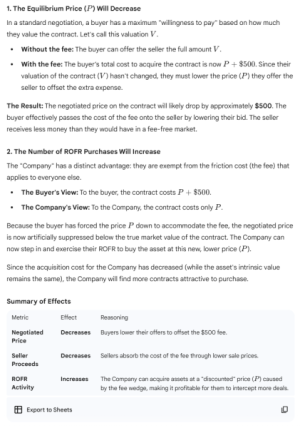

Doesn't this new fee essentially create ROFR arbitrage to Disney's benefit? It seems like the fee only applies to sales with a third party but does not apply to ROFR sales, ensuring that Disney can purchase contracts through ROFR at a $500 discount to the current fair market price.

Doesn't this new fee essentially create ROFR arbitrage to Disney's benefit? It seems like the fee only applies to sales with a third party but does not apply to ROFR sales, ensuring that Disney can purchase contracts through ROFR at a $500 discount to the current fair market price.