You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Most Economical Resort - Beyond Year 1

- Thread starter ehh

- Start date

ehh

the sound a shrug makes

- Joined

- Aug 3, 2019

- Messages

- 1,517

Experiment #2 - How much extra should you pay for OKW 2057 over OKW 2042?

To start, I'm not going to get into hypothetical situations owners might have in 2042. For this experiment, OKW 2042 ends in 2042 while OKW 2057 will continue on for 15 more years and end in 2057. No will they/won't they.

tl;dr: You should pay 38.56% more for 2025-2041 points to be valued identically with a 5% discount rate. If you're more aggressive with your time value of money and prefer a 6.5% discount rate, you should pay 32.87% more for 2025-2041 points be valued identically.

If you're buying OKW57 contracts for less than this premium over an equivalent OKW42 contract, you're getting a deal! Sorry about the dues, though.

Also of note, you should factor in all upfront non-dues costs, including closing costs, into the ~38%.

How to get there

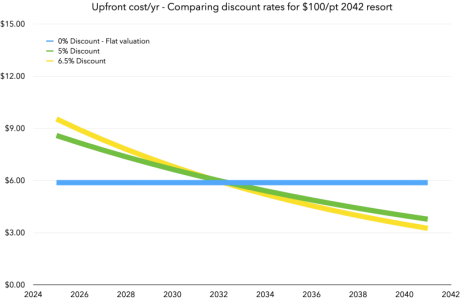

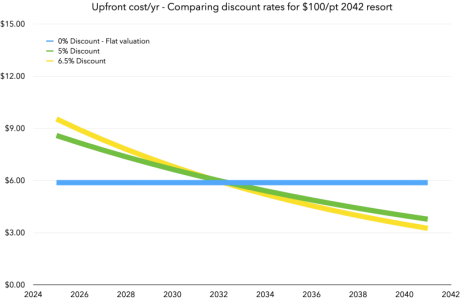

Let's start with the easiest math for valuing points over the years: flat valuation.

Value the points in 2040 the same as the points in 2025 and you can simply divide the cost by the number of years. In this example, let's say the 2042 resort goes for $100/pt after closing costs, so each year's worth of points is valued at $5.88/pt.

If you want to take into account time value of money, you can then discount the points each year. For MER methodology in this thread I've used a 5% annual discount (unless otherwise noted).

Doing this values your 2026 points at 5% less than your 2025 points, but also means your 2041 points are worth 5% less than 2040 points. In practice, this means later years diminish in value but never become 'worthless' (or negative value).

This is what the annual value of points looks like when charted out:

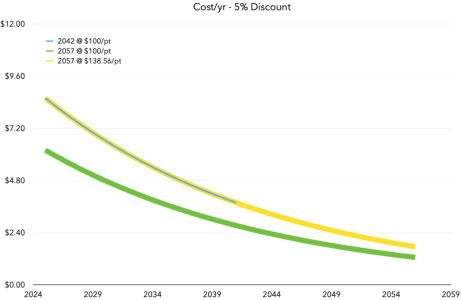

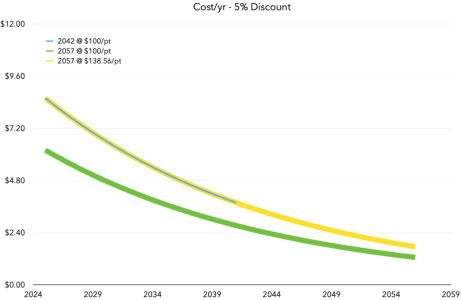

So how do you go from the above to valuing 2042-2056 points?

You need to find a curve that perfectly overlays the 2025-2041 curve and then you chop off the 2042-2056 part and add up the value there to get to 38.56%. But that sounds a lot harder to do than the math actually is!

Easy way: make a 2057 curve for a $100/pt resort and a 2042 curve for a $100/pt resort. Then add up the 2025-2041 value of the 2057 curve and you'll get $72.17 (i.e., if you pay $100/pt for a 2057 contract, 72.17% of the value is used in the first 17 years). Then take the $100 and divide it by 72.17% and you get $138.56/pt.

You can then chart it back out to verify everything checks out:

The original analysis in this thread used the June 2024 dvcresalemarket.com sales data and, coincidentally (or not?), the market had pretty closely figured this out organically! OKW42 averaged $82/pt and OKW57 averaged $110/pt, a 34.1% premium before closing costs.

More recent months of sales data has not quite reflected as much optimization, with OKW42 going for $91/pt while OKW57 has held steady at $110/pt, just a 21% premium.

To start, I'm not going to get into hypothetical situations owners might have in 2042. For this experiment, OKW 2042 ends in 2042 while OKW 2057 will continue on for 15 more years and end in 2057. No will they/won't they.

tl;dr: You should pay 38.56% more for 2025-2041 points to be valued identically with a 5% discount rate. If you're more aggressive with your time value of money and prefer a 6.5% discount rate, you should pay 32.87% more for 2025-2041 points be valued identically.

If you're buying OKW57 contracts for less than this premium over an equivalent OKW42 contract, you're getting a deal! Sorry about the dues, though.

Also of note, you should factor in all upfront non-dues costs, including closing costs, into the ~38%.

How to get there

Let's start with the easiest math for valuing points over the years: flat valuation.

Value the points in 2040 the same as the points in 2025 and you can simply divide the cost by the number of years. In this example, let's say the 2042 resort goes for $100/pt after closing costs, so each year's worth of points is valued at $5.88/pt.

If you want to take into account time value of money, you can then discount the points each year. For MER methodology in this thread I've used a 5% annual discount (unless otherwise noted).

Doing this values your 2026 points at 5% less than your 2025 points, but also means your 2041 points are worth 5% less than 2040 points. In practice, this means later years diminish in value but never become 'worthless' (or negative value).

This is what the annual value of points looks like when charted out:

So how do you go from the above to valuing 2042-2056 points?

You need to find a curve that perfectly overlays the 2025-2041 curve and then you chop off the 2042-2056 part and add up the value there to get to 38.56%. But that sounds a lot harder to do than the math actually is!

Easy way: make a 2057 curve for a $100/pt resort and a 2042 curve for a $100/pt resort. Then add up the 2025-2041 value of the 2057 curve and you'll get $72.17 (i.e., if you pay $100/pt for a 2057 contract, 72.17% of the value is used in the first 17 years). Then take the $100 and divide it by 72.17% and you get $138.56/pt.

You can then chart it back out to verify everything checks out:

The original analysis in this thread used the June 2024 dvcresalemarket.com sales data and, coincidentally (or not?), the market had pretty closely figured this out organically! OKW42 averaged $82/pt and OKW57 averaged $110/pt, a 34.1% premium before closing costs.

More recent months of sales data has not quite reflected as much optimization, with OKW42 going for $91/pt while OKW57 has held steady at $110/pt, just a 21% premium.

ehh

the sound a shrug makes

- Joined

- Aug 3, 2019

- Messages

- 1,517

Experiment #3 - What upfront price per point would make Vero Beach good for SAP?

This isn't going to go into SAP+, as how much people value the + varies from situation to situation. Just looking to answer plain ol' SAP to be used anywhere else.

The first thing we need to do is define "good". I'll go with this:

I'm also going to ignore the existence of subsidized Vero Beach contracts. Yes they exist, but good luck finding one and then also passing ROFR.

tl;dr: if you plan to hold onto the contract until expiration as SAP, there isn't a price where Vero Beach becomes good for SAP, not even free makes them good SAP.

But if you're able to get rid of the contract in a few years, then maybe there's some hope! Free is good for about 7 years, then you should get out (for SAP uses).

If you can get out after 5 years, then you can pay about $3.50/pt and still be at the edge of 'good'.

VB ain't SAP.

How to get there

This one is pretty easy in terms of the math. I just plug in $0 for the upfront price and re-sort all the tables and such.

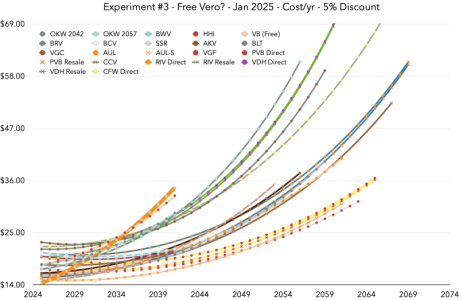

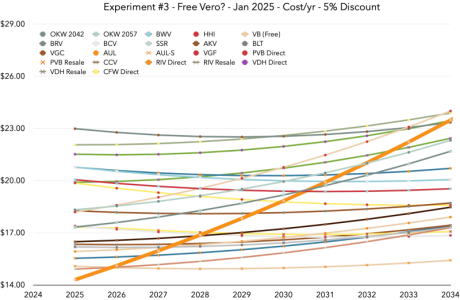

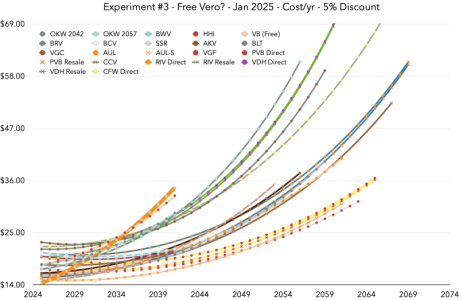

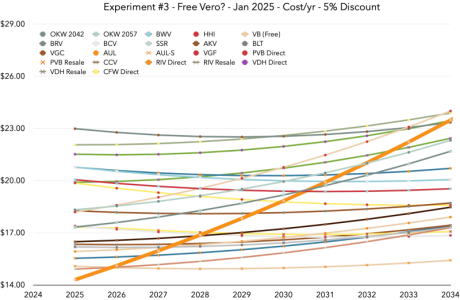

First, let's show what it looks like:

In these charts, Vero @ $0/pt is the thicker orange line. By 2034 it's still one of the highest cost/pt for that given year due to just its dues and forecasted dues growth. Though it does have some cheap years early on!

Year 1 it's actually the least expensive! Yay for free.

Let's look at the 'cumulative cost' tables...

For years 1-5, FREE VERO is:

For years 1-10, FREE VERO is:

Let's look at years 1-17 for the fun of it:

For years 1-17, FREE VERO is:

But there were some good looking early years! Let's look back at that.

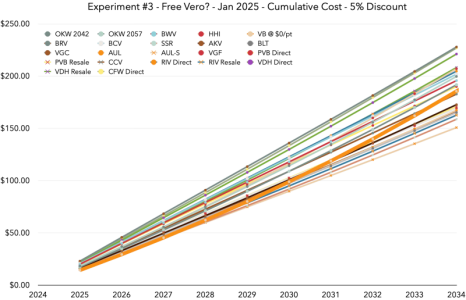

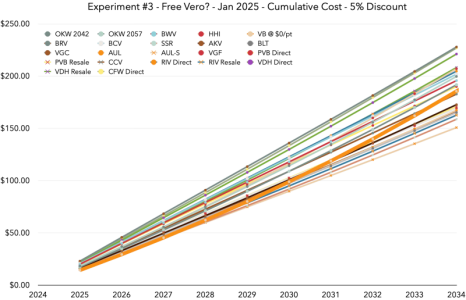

Here's cumulative costs charted out:

(there's a reason I don't normally chart this--it's chaotic to read due to the condensed nature)

Okay, so it looks like 2031-2032ish is when the thicker orange line (FREE VERO) breaks from the 'good' pack, or years 7-8.

Let's make one final table for Years 1-7:

Here you can see it's right at the threshold of "good" and won't make it to year 8. It's #7 of 20 and 13% above the best.

So, yeah, there is no price that Vero becomes good SAP unless you can get out in a few years (or dues growth slows down a lot).

This isn't going to go into SAP+, as how much people value the + varies from situation to situation. Just looking to answer plain ol' SAP to be used anywhere else.

The first thing we need to do is define "good". I'll go with this:

- In the top third of the rankings

- General idea being to break the resorts into three groups: "good", "mid", and "bad".

- Within 20% of the best

- General idea being is if you can save more than 20% then is it really all that good?

I'm also going to ignore the existence of subsidized Vero Beach contracts. Yes they exist, but good luck finding one and then also passing ROFR.

tl;dr: if you plan to hold onto the contract until expiration as SAP, there isn't a price where Vero Beach becomes good for SAP, not even free makes them good SAP.

But if you're able to get rid of the contract in a few years, then maybe there's some hope! Free is good for about 7 years, then you should get out (for SAP uses).

If you can get out after 5 years, then you can pay about $3.50/pt and still be at the edge of 'good'.

VB ain't SAP.

How to get there

This one is pretty easy in terms of the math. I just plug in $0 for the upfront price and re-sort all the tables and such.

First, let's show what it looks like:

In these charts, Vero @ $0/pt is the thicker orange line. By 2034 it's still one of the highest cost/pt for that given year due to just its dues and forecasted dues growth. Though it does have some cheap years early on!

Year 1 it's actually the least expensive! Yay for free.

Let's look at the 'cumulative cost' tables...

For years 1-5, FREE VERO is:

- #3 rank (of SAP-eligible) out of 20 SAP-eligible resort-contract types

- 6.9% more than best (AUL-S)

- One of the most typed calculator numbers

For years 1-10, FREE VERO is:

- #10 rank (of SAP-eligible) out of 20 SAP-eligible resort-contract types

- 23% more than best SAP (AUL-S)

Let's look at years 1-17 for the fun of it:

For years 1-17, FREE VERO is:

- #16 rank (of SAP-eligible) out of 20 SAP-eligible resort-contract types

- By my prior definition, this is officially "bad"

- 47.7% more than best SAP (AUL-S)

But there were some good looking early years! Let's look back at that.

Here's cumulative costs charted out:

(there's a reason I don't normally chart this--it's chaotic to read due to the condensed nature)

Okay, so it looks like 2031-2032ish is when the thicker orange line (FREE VERO) breaks from the 'good' pack, or years 7-8.

Let's make one final table for Years 1-7:

Here you can see it's right at the threshold of "good" and won't make it to year 8. It's #7 of 20 and 13% above the best.

So, yeah, there is no price that Vero becomes good SAP unless you can get out in a few years (or dues growth slows down a lot).

Brian Noble

Gratefully in Recovery

- Joined

- Mar 23, 2004

- Messages

- 19,654

I'm a little surprised by that---if you offered 35% as the over/under, I'd've taken the under and not thought twice. I think I have not viscerally internalized "2042 is SOON."tl;dr: You should pay 38.56% more for 2025-2041 points to be valued identically with a 5% discount rate.

eticketplease

DIS Veteran

- Joined

- Aug 24, 2021

- Messages

- 6,574

Well are these just for SAP or to actually stay at the resort?My question is, CCV vs BLT, which is the better buy, longer contract or less dues?

If you have a family of 5 you need a lot more points to stay at CCV than at BLT for a week

Chili327

On the Boardwalk…

- Joined

- Feb 18, 2023

- Messages

- 5,130

I would never have more than 2, so even duos can work for me.Well are these just for SAP or to actually stay at the resort?

If you have a family of 5 you need a lot more points to stay at CCV than at BLT for a week

Boosterman

Mouseketeer

- Joined

- Sep 30, 2024

- Messages

- 81

This shows that VB is overvalued by a lot even at current selling prices. I wonder if we will ever see a 'negative' VB resales where sellers pay buyers just to take over the contract.Experiment #3 - What upfront price per point would make Vero Beach good for SAP?

This isn't going to go into SAP+, as how much people value the + varies from situation to situation. Just looking to answer plain ol' SAP to be used anywhere else.

The first thing we need to do is define "good". I'll go with this:

I'm going to say that "good SAP" has to meet both definitions. If there's a long list of better options or the best is that much better, then it's not "good".

- In the top third of the rankings

- General idea being to break the resorts into three groups: "good", "mid", and "bad".

- Within 20% of the best

- General idea being is if you can save more than 20% then is it really all that good?

I'm also going to ignore the existence of subsidized Vero Beach contracts. Yes they exist, but good luck finding one and then also passing ROFR.

tl;dr: if you plan to hold onto the contract until expiration as SAP, there isn't a price where Vero Beach becomes good for SAP, not even free makes them good SAP.

But if you're able to get rid of the contract in a few years, then maybe there's some hope! Free is good for about 7 years, then you should get out (for SAP uses).

If you can get out after 5 years, then you can pay about $3.50/pt and still be at the edge of 'good'.

VB ain't SAP.

How to get there

This one is pretty easy in terms of the math. I just plug in $0 for the upfront price and re-sort all the tables and such.

First, let's show what it looks like:

View attachment 932790

View attachment 932791

In these charts, Vero @ $0/pt is the thicker orange line. By 2034 it's still one of the highest cost/pt for that given year due to just its dues and forecasted dues growth. Though it does have some cheap years early on!

Year 1 it's actually the least expensive! Yay for free.

Let's look at the 'cumulative cost' tables...

For years 1-5, FREE VERO is:

So FREE VERO is good for the first 5 years! Let's move on to years 1-10:

- #3 rank (of SAP-eligible) out of 20 SAP-eligible resort-contract types

- 6.9% more than best (AUL-S)

- One of the most typed calculator numbers

For years 1-10, FREE VERO is:

Okay, so it's no longer "good SAP" by the definition I set above.

- #10 rank (of SAP-eligible) out of 20 SAP-eligible resort-contract types

- 23% more than best SAP (AUL-S)

Let's look at years 1-17 for the fun of it:

For years 1-17, FREE VERO is:

So, yeah, FREE VERO is bad SAP over the life of the contract.

- #16 rank (of SAP-eligible) out of 20 SAP-eligible resort-contract types

- By my prior definition, this is officially "bad"

- 47.7% more than best SAP (AUL-S)

But there were some good looking early years! Let's look back at that.

Here's cumulative costs charted out:

View attachment 932794

(there's a reason I don't normally chart this--it's chaotic to read due to the condensed nature)

Okay, so it looks like 2031-2032ish is when the thicker orange line (FREE VERO) breaks from the 'good' pack, or years 7-8.

Let's make one final table for Years 1-7:

Here you can see it's right at the threshold of "good" and won't make it to year 8. It's #7 of 20 and 13% above the best.

So, yeah, there is no price that Vero becomes good SAP unless you can get out in a few years (or dues growth slows down a lot).

JackosinDIS

DIS Veteran

- Joined

- Jun 15, 2023

- Messages

- 1,699

One of the most typed calculator numbers

Brian Noble

Gratefully in Recovery

- Joined

- Mar 23, 2004

- Messages

- 19,654

I think the only way this happens is if dues exceed the "generic" rental rate for non-Home points. Until that happens, owning the points still has some residual value. That's not a reason to buy them, but it is a reason to hold them rather than give them away.I wonder if we will ever see a 'negative' VB resales where sellers pay buyers just to take over the contract.

If that does happen, I think you'd more likely see owners default rather than pay to give them away. That's what typically happens with most other timeshares that do not have a viable market for resale. This might (or might not) involve a small credit rating ding, but someone in e.g. retirement couldn't give two ***** about their credit rating, because they are done borrowing money.

Guess who has owned Vero for a really long time?

Mouseforward

DIS Veteran

- Joined

- Sep 6, 2024

- Messages

- 1,337

I think you would also want to look at the oceanfront hotel cost in Vero it looks like $400 - 800 / night in season . I don’t know the area enough to know if the oceanfront hotels are <> the disney resort. But I could see some hanging on until the end if they really want a yearly beach vacation.think the only way this happens is if dues exceed the "generic" rental rate for non-Home points. Until that happens, owning the points still has some residual value. That's not a reason to buy them, but it is a reason to hold them rather than give them away.

If you're comparing a studio at Disney's Vero Beach to the Vero Beach Hotel & Spa and Costa D'Este (which are the two nicest hotels on the beach), VB's rooms are less nice... the on site restaurants are at least as good as Wind & Waves, however the location at VB Disney is much more isolated, meaning the actually sitting by the beach is much more relaxing... All depends on what you are looking for...I think you would also want to look at the oceanfront hotel cost in Vero it looks like $400 - 800 / night in season . I don’t know the area enough to know if the oceanfront hotels are <> the disney resort. But I could see some hanging on until the end if they really want a yearly beach vacation.

TheDailyMoo

DIS Veteran

- Joined

- Jun 9, 2021

- Messages

- 2,435

The proposition changes greatly if you could somehow snag the unicorn VB-S though correct?Experiment #3 - What upfront price per point would make Vero Beach good for SAP?

This isn't going to go into SAP+, as how much people value the + varies from situation to situation. Just looking to answer plain ol' SAP to be used anywhere else.

The first thing we need to do is define "good". I'll go with this:

I'm going to say that "good SAP" has to meet both definitions. If there's a long list of better options or the best is that much better, then it's not "good".

- In the top third of the rankings

- General idea being to break the resorts into three groups: "good", "mid", and "bad".

- Within 20% of the best

- General idea being is if you can save more than 20% then is it really all that good?

I'm also going to ignore the existence of subsidized Vero Beach contracts. Yes they exist, but good luck finding one and then also passing ROFR.

tl;dr: if you plan to hold onto the contract until expiration as SAP, there isn't a price where Vero Beach becomes good for SAP, not even free makes them good SAP.

But if you're able to get rid of the contract in a few years, then maybe there's some hope! Free is good for about 7 years, then you should get out (for SAP uses).

If you can get out after 5 years, then you can pay about $3.50/pt and still be at the edge of 'good'.

VB ain't SAP.

How to get there

This one is pretty easy in terms of the math. I just plug in $0 for the upfront price and re-sort all the tables and such.

First, let's show what it looks like:

View attachment 932790

View attachment 932791

In these charts, Vero @ $0/pt is the thicker orange line. By 2034 it's still one of the highest cost/pt for that given year due to just its dues and forecasted dues growth. Though it does have some cheap years early on!

Year 1 it's actually the least expensive! Yay for free.

Let's look at the 'cumulative cost' tables...

For years 1-5, FREE VERO is:

So FREE VERO is good for the first 5 years! Let's move on to years 1-10:

- #3 rank (of SAP-eligible) out of 20 SAP-eligible resort-contract types

- 6.9% more than best (AUL-S)

- One of the most typed calculator numbers

For years 1-10, FREE VERO is:

Okay, so it's no longer "good SAP" by the definition I set above.

- #10 rank (of SAP-eligible) out of 20 SAP-eligible resort-contract types

- 23% more than best SAP (AUL-S)

Let's look at years 1-17 for the fun of it:

For years 1-17, FREE VERO is:

So, yeah, FREE VERO is bad SAP over the life of the contract.

- #16 rank (of SAP-eligible) out of 20 SAP-eligible resort-contract types

- By my prior definition, this is officially "bad"

- 47.7% more than best SAP (AUL-S)

But there were some good looking early years! Let's look back at that.

Here's cumulative costs charted out:

View attachment 932794

(there's a reason I don't normally chart this--it's chaotic to read due to the condensed nature)

Okay, so it looks like 2031-2032ish is when the thicker orange line (FREE VERO) breaks from the 'good' pack, or years 7-8.

Let's make one final table for Years 1-7:

Here you can see it's right at the threshold of "good" and won't make it to year 8. It's #7 of 20 and 13% above the best.

So, yeah, there is no price that Vero becomes good SAP unless you can get out in a few years (or dues growth slows down a lot).

dvc lover 1970

DIS Veteran

- Joined

- May 29, 2013

- Messages

- 1,238

CCV is great because you are in the legacy resorts, it has a late expiration 2068 and the point chart is the old charts before the ridiculous sky high charts

Those seem to emerge about once or twice a year, as I recall those price out more or less not too dissimilar to OKW for dues...The proposition changes greatly if you could somehow snag the unicorn VB-S though correct?

ehh

the sound a shrug makes

- Joined

- Aug 3, 2019

- Messages

- 1,517

Subsidized dues flatten its longterm trajectory, but it's still not "good SAP", even at typical non-subsidized prices.The proposition changes greatly if you could somehow snag the unicorn VB-S though correct?

A $50/pt VB-S contract is:

- #6 ranked SAP contract for years 1-5. right between CCV and AKV

- This meets the definition of "good" I set above

- #8 ranked SAP contract for years 1-7, right between VGF and PVB-R

- This meets the definition of "mid" I set above

- #9 ranked SAP contract for years 1-10, between AKV and BRV

- Still mid

- Also right at the threshold of 20% worse than the best

- #13 ranked SAP contract for years 1-17, roughly equal to RIV-D

- Right at the threshold between mid and bad for rankings

- 35% worse than the best, AUL-S

- Over 20% worse than VGF, PVB-R, or SSR

TheDailyMoo

DIS Veteran

- Joined

- Jun 9, 2021

- Messages

- 2,435

And the crazy part is even when I offer $15pp I know that it's not a great deal for me and I also know that it is probably borderline offensive to the owner. Very little about VB resale makes sense on either side. Like has been said by others many VB owners will just either ride it out and deal with the more expensive vacations towards the end or they'll just default and say here Disney...you deal with it now.Subsidized dues flatten its longterm trajectory, but it's still not "good SAP", even at typical non-subsidized prices.

A $50/pt VB-S contract is:

- #6 ranked SAP contract for years 1-5. right between CCV and AKV

- This meets the definition of "good" I set above

- #8 ranked SAP contract for years 1-7, right between VGF and PVB-R

- This meets the definition of "mid" I set above

- #9 ranked SAP contract for years 1-10, between AKV and BRV

- Still mid

- Also right at the threshold of 20% worse than the best

- #13 ranked SAP contract for years 1-17, roughly equal to RIV-D

- Right at the threshold between mid and bad for rankings

- 35% worse than the best, AUL-S

- Over 20% worse than VGF, PVB-R, or SSR

Mirabell Rose

Mouseketeer

- Joined

- Jul 27, 2023

- Messages

- 422

I see you have both direct and resale for resorts like Poly. At the 17 year mark, clock strikes midnight for the 2042 resorts. So then the resale contract isn’t good for any of those resorts if they reissue for new sales with restrictions (as a guide put out there today in a Poly tour - although to me no one knows for sure what happens in 17 years). I realize the projections are up to 17 years, but I wonder what the value then of the direct versus resale will be on the value of the contract, particularly in the resale market, particularly with the depressed value of RIV resales in a limit of where the resales can be used.(Yes, I realize restricted to one resort is different some versus being restricted to just the resort that have expiration dates before RIV.

Mirabell Rose

Mouseketeer

- Joined

- Jul 27, 2023

- Messages

- 422

Poly resale seemed like the way to go on your charts versus direct, but now I’m not as sure.

Tatebeck

I Can G🤣 The DIS-tance

- Joined

- Dec 3, 2023

- Messages

- 2,501

After 2042 (and really now too) the value in resale vs direct only matters to you the original buyer. Anything you sell later will be the same to the buyers (restricted to the remaining resorts out of the original set). It will just be less resorts to choose from at that point so the resale value on the original resorts may drop a bit lower (or restricted resorts may rise) to be closer to each otherPoly resale seemed like the way to go on your charts versus direct, but now I’m not as sure.

So really you are just deciding if you would like to stay at Poly plus some possible stays at a few of the other remaining resorts for the lower resale price or be able to use points at the newer future resorts for the higher price.

MarkNC2Disney

DIS Veteran

- Joined

- Apr 15, 2021

- Messages

- 881

I like CCV. But I bet the point per square foot is proportional to the higher charts at VGF/RR.CCV is great because you are in the legacy resorts, it has a late expiration 2068 and the point chart is the old charts before the ridiculous sky high charts

Ahem, @ehh, new experiment please

-

One Disney Ride I Can't Stand, But Also Can't Stop

-

New Loungefly Bags Celebrate 100 Years of Winnie the Pooh

-

Disney Days Are Long. You Don't Have to Walk All of Them

-

How Kindergarten Changes the Way Families Do Disney

-

If You Only See One Disney Parade, This Is the One

-

Trailer Revealed for 'The Muppet Show' Special Event Debuting Feb. 4

-

FIRST LOOK: 2026 runDisney Princess Half Marathon Weekend Merch

New Threads

- Replies

- 0

- Views

- 37

- Replies

- 1

- Views

- 45

- Sticky

- Replies

- 0

- Views

- 505

New Posts

- Replies

- 61K

- Views

- 3M

- Replies

- 17

- Views

- 3K

- Replies

- 320

- Views

- 37K

- Replies

- 7K

- Views

- 221K

- Replies

- 10

- Views

- 4K

- Replies

- 86

- Views

- 11K

- Replies

- 1

- Views

- 45