There’s actually a decent amount. Even just one resort for example - Poly. Mid Sept to year’s end is $800 to $1500 a night, while member dues for those same rooms from under $200/nt to a maximum of around $400/nt. Here the MF are closer 25%. There’s many other examples in between.

$243 for 20pt/nt is great. Adding buy-in cost then comparing to rack rate discounts starts closing the gap. Buying CFW can still win economically, plus the added value for Fort Lovers to own, and the value of home priority. But what happens with an occasional trade-out. That math gets tougher. I’ll use our next booking, mid-Nov VGF. We booked 2 studios at 23pts/nt avg each (1BR is similar total point cost). MF on these 268pts cost me $2,029. If I used my BWV contract, dues would be $2,324. CFW would cost me $3,256. That $1,000 quickly eats into the small gap of savings on the CFW trips. Take any reservation, run CFW and any other resort owner’s MF. The vast majority of trade calculations have a 30 to 40% MF surcharge, no matter the WDW resort being booked or the points owned.

To stay cost effective most or all trips need to be those cabins. We also see how commonly members change travel patterns after experiencing more of

DVC. There is little flexibility to pivot like that for CFW. The added value of DVC’s flexibility is kind of missing here. Buyer’s need to be very confident about one specific room/resort for decades. Very narrow buyer pool.

If CFW goes and builds up that resort? That has the potential to change all this. What if they add something like Reflections, more amenities like unique restaurants and innovative pool, add a Trust option going forward, etc… The buy-in and MF could start making sense to a much larger buyer pool. More room to pivot and more magic.

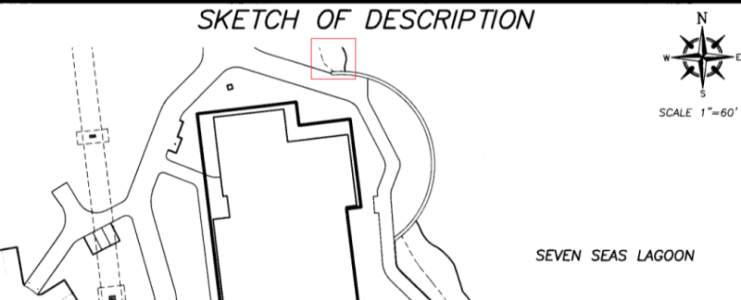

seems like there’s so much space around it, they really could have made it a bit bigger