amalone1013

DIS Veteran

- Joined

- Jan 15, 2016

- Messages

- 8,392

I've got a 25% offer! I'm so excited to use it this time, after the whole debacle with the last sale...Do you have the FedEx offer on any Amex cards to get a little extra back?!

I've got a 25% offer! I'm so excited to use it this time, after the whole debacle with the last sale...Do you have the FedEx offer on any Amex cards to get a little extra back?!

Just applied for global entry for myself using DH’s new Amex Plat. He applied a few weeks ago using his CSR.

For anyone that has experience with Global Entry, I know it also provides TSA Pre Check, will we be able to use the pre check line with our 7 yo daughter who does not have Global Entry? We don’t have any upcoming international flights so would only be using pre check. If I decide to apply for the Biz Plat then I’d use that credit to purchase Global Entry for her.

One other question, how long from application to interview on average?

Well my first try at Plastiq failed. They denied my CIP payment stating they can’t do mortgages with Visa. What do I do now. Do I edit my payment somehow or start over. Will they know I was already declined. Payment was for J.G. Wentworth Home Lending. I put in JG Wentworth. With P.O. Box and then Payment Processing and then city state and zip. What do you all do? I put it under Business payment.

yesAnd a Hilton question. Are the points earned with the rewards program (not the credit card points) earned on the base rate, before taxes?

Which card would you use for gas? After the Freedom Quarter is over... And for now ignoring AMEX Exxon offer.

- BoA 3% cashback

- SPG Biz 4pts/$

- Hilton Biz 6pts/$

Sept would give you over 90 days btwn all 3 biz cards. It is too close for comfort for me, but others would prob say go for it.DH is 3/24. Last app CIP 5/18. If I want SW Biz 12/18, can I squeeze in CIC in September or October?

This alone justifies it all lol. Tuition is such a big expense that with a fee, it can require some mathing to see if it's worth it. NO FEE??

As for Amex, I doubt they will blink an eye esp. if the Green is a charge card, so it doesn't count towards your 5 card limit. Your explanation sounds perfectly logical IMO. Risk reduction and just cancel them one at a time when you cross that bridge

You can cancel Amex cards via chat.

I think self referral for the Biz Green is a no brainer.

The BGR requires a little more math. The offer via referral is 50k MR/$5k/3 months, but you’ll get an additional 20k MR for the referral. You can call into the number listed on DoC and ask for the 75k MR/$10k/4 months offer if you have the spend, which will put you 5k MR ahead of the self referral offer.

Well my first try at Plastiq failed. They denied my CIP payment stating they can’t do mortgages with Visa. What do I do now. Do I edit my payment somehow or start over. Will they know I was already declined. Payment was for J.G. Wentworth Home Lending. I put in JG Wentworth. With P.O. Box and then Payment Processing and then city state and zip. What do you all do? I put it under Business payment.

Change the category

ETA: if you are ok with them possibly figuring it out and shutting down your account. You have to weigh the URs you could potentially get in the short run with having your account shut down in the long run.

When they stopped my payment in the rent/mtg category, I sent a check myself that month and the next month set it up to go via a new category.So soon after a denial, I would not try again by simply changing the category. That’s just asking to be shut down. Unfortunately, Plastiq caught on. I don’t know if you used the Real Estate category, which raises some flags, or the “Wentworth” is as much a giveaway as “Chase” or “Wells Fargo.”

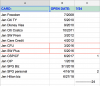

OK, so how does this plan look? The things in yellow were part of my plan and are completed.

View attachment 340153

If I close the SW premier (this is painful b/c it is one of my older accounts) how long do I need to wait for my total chase CL to update so I can app for the SW Biz? And then how long until I app for a personal SW card?

Here is my full snapshot:View attachment 340154

I think I am going to prioritize the SW CP over the CIC at this time b/c DH's runs out in Dec and we can use it March and April next year for sure. Unless ya'll think CIC is more important...I'm all ears.

ETA: I could go CIC for DH. Or SW biz. He isn't eligible for any personal SW cards til 10/2019.

Actually he is eligible for a sapphire double dip too.

Why is this so hard? I can look at other people's situations and know exactly what I'd app for. Mine gets me all confused. FOMO

OK for DH...I think I should downgrade his CSR to a CF after I book our DCL tomorrow. (Is that going to mess me up for the CSR trip insurance though?)

Then I can double dip him a CSR/CSP. I just closed his SW plus last week so that freed up some credit line.View attachment 340166

Anyone see something else I should consider? Maybe then do a CIC in the spring?