WDWfantasy

WDW Fanatic

- Joined

- May 1, 2000

- Messages

- 471

I’m pretty sure tickets purchased through Undercover Tourist code as travel with Chase. Does anyone know how tickets purchased through Unlocked Magic code?

Has anyone ever successfully redeemed Alaska Mileageplan for American flights? I've been trying for a week and every day it kicks back as "unable to confirm availability."

I booked a one-way on AA via Alaska about a month ago.

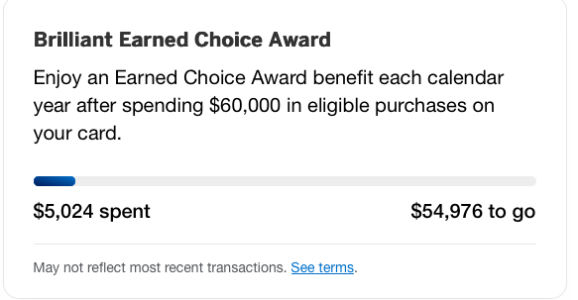

Thanks I found the benefit in my account but not able to locate the tracker.The Brilliant has the Earned Choice Award tracker. You can use that as a double check assuming your MSR doesn't span calendar years.

Thanks I found the benefit in my account but not able to locate the tracker.

Thanks I found it!I don't see it in app, only on browser. Under Rewards & Benefits, about half way down, next to the dining credit tracker.

Ok points transfer experts...it's been quite a few years since I've needed to do this- good reading to help me understand best way to use points on ,say British airways but on AA metal? I'm trying to figure out how to even use the BA website and it's not great for me so far....

Hi there,

I am a returnee, but I have not been on here in a while. I’m back on as DH and I were both just denied Chase Business Cards and I realized I’m rusty and clearly could use some input on our strategy. We have had great success with this group in the past and have been able to use what we have learned to earn UR rewards and go on trips. We fall under moderate in terms of card applications. I have an idea why we were both recently denied, but need advice on how to rectify it. We currently have 190k chase points on my Sapphire Reserve, but would like to open another no fee Chase Ink to add to it. Anyway, here’s our stats:

Me/P1:

Cards In Last 24 Months:

04/23 Chase Ink Visa

10/23 Chase Ink Visa

12/24 Synchrony Verizon Visa

Total cards 12–8 regular & 4 business. Total CL is 74,700. Income 140k no debt except for a mortgage that will be paid off this year. Reserve opened in 4/2020.

DH/P2:

04/23 Chase Ink

08/23 Chase Ink

10/23 Capital One Bass Pro

05/24 Synchrony American Eagle

07/24 Synchrony Lowes

P2 Cl is $63,200, Some of which is authorize user on P1 cards. Total cards for P2 is 11. 6 Personal & 5 business.

I believe P2 was denied because we hadn’t realized he had taken out 4 cards in 24 months.

I applied after his denial because I had gotten a “you are preapproved email”.

I suspect now that we were both tonight, because we are either too many cards or too much debt in relation to our income. I also suspect P2 was denied because he applied within the 24 month window.

My question is, How do we rectify this? We’d ideally like to add some more points, maybe one card each in a year— not looking to do anything excessive. It should be noted that the reserve credit line was increased to 20,000 by Chase as well as my freedom was increased to over 15,000. Do I reduce those now because they’re preventing me from being approved. Close cards or reduce? Is it personal cards hurting us or both? We do not ever pay interest and are able to pay our payments in full every month. Our credit utilization is below 3%.

Thanks for everyone’s feedback.

Thanks so much! I have four and Dh has 5. Will closing 3 and reapplying in 30 days hurt us?How many Chase business cards do you have open? Many people won't be approved with more than 2 open now. Only the total Chase CL matters. It should be less than 50% of income or around 70k, whichever is less.

You can close any Chase business cards older than a year and try again in 30 days.

Hi there,

I am a returnee, but I have not been on here in a while. I’m back on as DH and I were both just denied Chase Business Cards and I realized I’m rusty and clearly could use some input on our strategy. We have had great success with this group in the past and have been able to use what we have learned to earn UR rewards and go on trips. We fall under moderate in terms of card applications. I have an idea why we were both recently denied, but need advice on how to rectify it. We currently have 190k chase points on my Sapphire Reserve, but would like to open another no fee Chase Ink to add to it. Anyway, here’s our stats:

Me/P1:

Cards In Last 24 Months:

04/23 Chase Ink Visa

10/23 Chase Ink Visa

12/24 Synchrony Verizon Visa

Total cards 12–8 regular & 4 business. Total CL is 74,700. Income 140k no debt except for a mortgage that will be paid off this year. Reserve opened in 4/2020.

DH/P2:

04/23 Chase Ink

08/23 Chase Ink

10/23 Capital One Bass Pro

05/24 Synchrony American Eagle

07/24 Synchrony Lowes

P2 Cl is $63,200, Some of which is authorize user on P1 cards. Total cards for P2 is 11. 6 Personal & 5 business.

I believe P2 was denied because we hadn’t realized he had taken out 4 cards in 24 months.

I applied after his denial because I had gotten a “you are preapproved email”.

I suspect now that we were both tonight, because we are either too many cards or too much debt in relation to our income. I also suspect P2 was denied because he applied within the 24 month window.

My question is, How do we rectify this? We’d ideally like to add some more points, maybe one card each in a year— not looking to do anything excessive. It should be noted that the reserve credit line was increased to 20,000 by Chase as well as my freedom was increased to over 15,000. Do I reduce those now because they’re preventing me from being approved. Close cards or reduce? Is it personal cards hurting us or both? We do not ever pay interest and are able to pay our payments in full every month. Our credit utilization is below 3%.

Thanks for everyone’s feedback.

Back

BackHi there,

I am a returnee, but I have not been on here in a while. I’m back on as DH and I were both just denied Chase Business Cards and I realized I’m rusty and clearly could use some input on our strategy. We have had great success with this group in the past and have been able to use what we have learned to earn UR rewards and go on trips. We fall under moderate in terms of card applications. I have an idea why we were both recently denied, but need advice on how to rectify it. We currently have 190k chase points on my Sapphire Reserve, but would like to open another no fee Chase Ink to add to it. Anyway, here’s our stats:

Me/P1:

Cards In Last 24 Months:

04/23 Chase Ink Visa

10/23 Chase Ink Visa

12/24 Synchrony Verizon Visa

Total cards 12–8 regular & 4 business. Total CL is 74,700. Income 140k no debt except for a mortgage that will be paid off this year. Reserve opened in 4/2020.

DH/P2:

04/23 Chase Ink

08/23 Chase Ink

10/23 Capital One Bass Pro

05/24 Synchrony American Eagle

07/24 Synchrony Lowes

P2 Cl is $63,200, Some of which is authorize user on P1 cards. Total cards for P2 is 11. 6 Personal & 5 business.

I believe P2 was denied because we hadn’t realized he had taken out 4 cards in 24 months.

I applied after his denial because I had gotten a “you are preapproved email”.

I suspect now that we were both tonight, because we are either too many cards or too much debt in relation to our income. I also suspect P2 was denied because he applied within the 24 month window.

My question is, How do we rectify this? We’d ideally like to add some more points, maybe one card each in a year— not looking to do anything excessive. It should be noted that the reserve credit line was increased to 20,000 by Chase as well as my freedom was increased to over 15,000. Do I reduce those now because they’re preventing me from being approved. Close cards or reduce? Is it personal cards hurting us or both? We do not ever pay interest and are able to pay our payments in full every month. Our credit utilization is below 3%.

Thanks for everyone’s feedback.

Thanks so much! I have four and Dh has 5. Will closing 3 and reapplying in 30 days hurt us?

Thank you! This is all very helpful! We definitely have some business cards we do not use frequently enough and can be closed.I see @palhockeymomof2 has replied saying much of what I was going to post.... but I would certainly emphasize lowering credit limits if you do not need high limits. I typically reduce my Freedom and Ink CLs to $5,000 or less. My Sapphire around $12k. Definitely close some cards. It is better to have fewer business cards with some regular use.

Is DH an authorized user on any of the cards you have opened in the last 2 years? That would push him to 5/24 and almost certainly result in denial. It is for this reason you need to think carefully about adding each other as authorized users.

Also, I note you opened several store cards - these generally offer a poor return compared to other cards and use up valuable 5/24 slots. I generally won't consider opening a new card unless I am getting at least $500 of value from it.

Back

What were the reasons Chase said when they denied you ?

2 things I would do before reapplying are reduce your total CLs with Chase and close any cards that are over a year old you aren’t using, especially the business cards..if you aren’t maxing out the CICs 5x catagories.

Since last fall Chase has tightened up business card approvals and it seems best chance is having less than 2. That said if you consistently use the business cards you can get approved with more than that open.

My example is on Monday I noticed green star pre approval offers in DHs account even though he has 5 business cards open, which we use and pay off monthly. I applied for one right through that link rather than go through my support link and he was instantly approved. In my experience using your Chase business cards and having a balance on them at the time of application helps.

DD25 was just approved for the Schwab Platinum 125,000 MR deal. I'll help her out with the spend requirement

DD25 was just approved for the Schwab Platinum 125,000 MR deal. I'll help her out with the spend requirement

Look in your business cards log in under statements and documents…then notices and letters you should see something thereWe are still waiting for the denial letters. Once they come, I will update everyone. At this point, I’m just guessing. Thanks for the tips on having less than two. We had no idea that had changed.

Thank you! This is all very helpful! We definitely have some business cards we do not use frequently enough and can be closed.

Is there any danger in closing too many cards too soon? Thanks for all your help and feedback!

Is this just for the ink line or does it apply to cobranded like SW & United as well?Since last fall Chase has tightened up business card approvals and it seems best chance is having less than 2. That said if you consistently use the business cards you can get approved with more than that open.

My husband and I were and to app a 3rd Chase bus with a SW card at the end of '24. We both had two inks open.Is this just for the ink line or does it apply to cobranded like SW & United as well?

Ok thanks- that makes sense why I'm getting nowhere on the BA website,I assume just nothing available for what I'm checking.BA is much like AS with partner availability IIRC...if there is sAAver award space American might make it available to BA.

On the home page, under "book," going to "book flights with Avios" is where I begin but again, if there aren't seats given to BA by AA then BA will error out. I've also found their system prefers nonstop flights MUCH more than connecting ones, but that could just be due to a dearth of lack of sAAver flights from my small airport, not sure.

Much like AS miles...when they're helpful, they're great, when they're not, it's very frustrating to attempt to use.