tink89

DIS Veteran

- Joined

- Nov 13, 2017

- Messages

- 1,690

Hi everyone. Been on this board a few times here and there but have not applied for a credit card in 2 years. We do have a few trips coming up where we will need to fly, but we dont usually fly a lot or with one specific airline. Would it be better to apply for another hotel card or airline card?

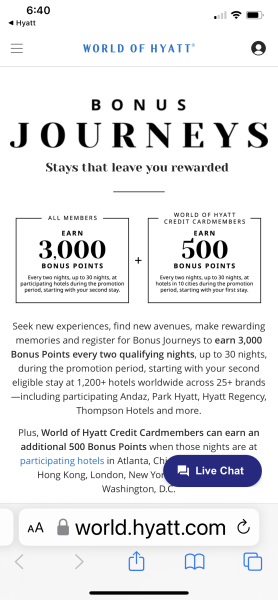

Already have CSP and do not want any biz cards. We stay at Hyatt, Marriott and Hilton hotels mostly. Already have a few amex hilton cards and the Hyatt card. Should we go for the Marriiott bonvoy card with the 100k points or the american airlines card with the $200 off and 40k miles. Or should we look else where? Amex?

Thanks

Already have CSP and do not want any biz cards. We stay at Hyatt, Marriott and Hilton hotels mostly. Already have a few amex hilton cards and the Hyatt card. Should we go for the Marriiott bonvoy card with the 100k points or the american airlines card with the $200 off and 40k miles. Or should we look else where? Amex?

Thanks