While we're on the subject, checking account fees are as follows:

$12 monthly service fee OR $0 with one of the following each monthly statement period:

- Electronic deposits made into this account totaling $500 or more, such as payments from payroll providers or government benefit providers, by using (i) the ACH network, (ii) the Real Time Payment network, or (iii) third party services that facilitate payments to your debit card using the Visa® or Mastercard® network

- OR a balance at the beginning of each day of $1,500 or more in this account

- OR an average beginning day balance of $5,000 or more in any combination of this account and linked qualifying deposits Footnote4(Opens Overlay)/investments Footnote5

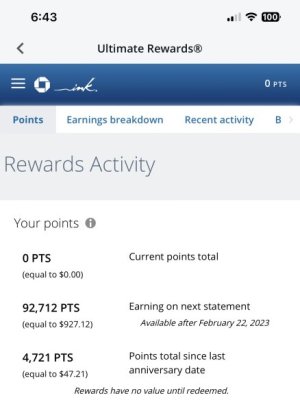

We're all in agreement that the savings that opened with this account counts as a "linked qualifying deposit", right? So, as long as we have to keep the 15k, no fees on either account. Then, I can put $1500 in the checking, leave $300 in the savings for the next 90 days until I close? ($300 is the savings minimum to avoid that fee.)

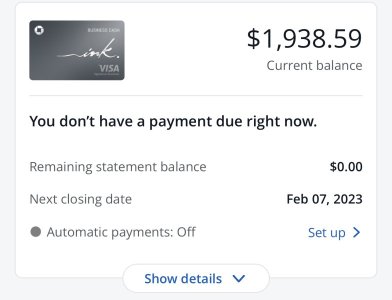

I don't have over $500 in DD or over $1,500 in the checking right now because I believe the current savings float should be sufficient.

Boooo!

Boooo!