palhockeymomof2

DIS Veteran

- Joined

- Nov 14, 2001

- Messages

- 7,079

CongratsDd was instant approved for an CIU. Will they expedite a first business card if someone calls? And will they answer on a weekend?

…can’t hurt to try to have it expedited

…can’t hurt to try to have it expeditedCongratsDd was instant approved for an CIU. Will they expedite a first business card if someone calls? And will they answer on a weekend?

…can’t hurt to try to have it expedited

…can’t hurt to try to have it expeditedNo. So many were dead I nixed it all, gotta pull them fresh.Thanks for all you do…is there any way to copy and paste our old support links

I SMd Chase about matching the 90k on my Ink, that I got in January. The public offer was still there at the time, but I used the support link with the 75k. In January they said to message back when I met the spend for the match. I have done that now, and they said they had to send it to another department and could take 6-8 weeks. Never had that response before.

That is strange. I did the exact same thing and got the message asking me to message back after hitting the spend (although it was worded kind of oddly, I thought). I did that right after the 75,000 hit and they credited me within a few days. Hope it ends well for you too!

I received a similar message when I SM'd for the match after meeting the MSR. It said it would take up to 5 biz days for the other dept to respond, which I think it took 4-5 days. After that dept responded, I received the points match shortly after, maybe even instantly. I think the 6-8 weeks might just be a standard language they use.

This sounds do-able. I'll order on Monday and hope the charge and credit both post quickly! Thanks.Just got a credit in March. I ordered and the charge (51.95) posted March 6. The credit posted March 12, leaving $1.95 balance.

Depending on timing, you should be able to close within the 30 days and have the AF refunded.

Thank you!Amex will fully refund the annual fee if canceled within 30 days. The credit should post well before that deadline, but you can receive statement credits on closed cards if the credit is delayed (the terms and conditions say 10-12 weeks, but it's usually much faster than that)

Welcome! With that amt of monthly spend, you should be able to accumulate pts at a good pace depending on how you want to do this hobby. There is no wrong way to do it and those of here have a wide variety of strategies and priorities. Personally, I'm in the group that focuses on Sign Up Bonuses (SUBs) and then maximizing my Chase UR pts when I don't have a SUB. I try to go for a card when it is at its highest SUB (or at least a very good SUB). Chase and AmEx are my preferred pts systems and I haven't branched into the other brands yet (I started in 2020). If Delta is your preferred carrier, you might want to start with AmEx since the MRs transfer directly to Delta.No cards applied for in the past 2 years. Mine are very old, mostly with Citi, one unused CapOne Silver

Monthly: $3-4000 that could be paid on a card instead of debit

Paid off monthly

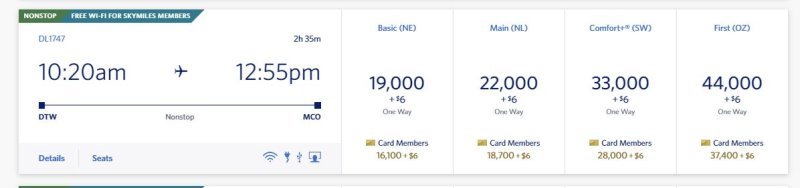

Airport: DTW

Preferred Airline: Delta

Southwest services DTW but not a lot of non-stop routes we would take so it is not preferred.

No preference on hotels other than Disney

We have some Delta direct miles

Goal: Discounted flights to Disney/Orlando and savings on Disney vacations, preferably as DVC members soon

Trips: At least annually

Travel only with spouse usually.

You have gotten some good tips already. I just want to add my personal experience with getting a co-branded card (specific to one airline or hotel). I was always loyal to SW for many reasons, even before I began this credit card game. So naturally when I started using credit cards for the purpose of travel, the Chase SW card(s) were part of my portfolio and I accumulated a lot of SW points. Well, things have changed for various reasons. While SW is still my preferred airlines, I cannot always use them. So I have learned it is better to have non-cobranded cards where the points can transfer to a variety of travel partners.I'm looking for a way to generate rewards toward Delta flights. We spend a few thousand a month with our bank debit cards. It seems like that could add up to help on the one or two flights we take a year if we just used a different card and paid it off each month. We are actually ready to book a flight and the Delta AmEx Gold offer popped up which got me thinking about this. I do not know if that is still a good program for rewards from spending rather than flying.

My only current rewards card that sees any use is Costco.

I'm looking for a way to generate rewards toward Delta flights. We spend a few thousand a month with our bank debit cards. It seems like that could add up to help on the one or two flights we take a year if we just used a different card and paid it off each month. We are actually ready to book a flight and the Delta AmEx Gold offer popped up which got me thinking about this. I do not know if that is still a good program for rewards from spending rather than flying.

My only current rewards card that sees any use is Costco.

How long ago was that?Similar situation with a slight difference.

When I replied to the original SM that stated they would be happy to credit the additional 15k bonus points once I met the MSR, the Chase rep that answered stated that I should now see the 15k additional bonus on chase.com or on my next statement along with the original 75k bonus.

However, when I logged in online, I only saw the 75k and no 15k and there was no points pending either. I wait a few days and then replied back on the same SM that stated I would be getting the 15k credit that I didn't see the additional 15k as promised and nothing was pending either.

Chase responded that they have sent the matter to the department that will be investigating the matter and that I should hear back in a few days... Still waiting.

So after looking at the benefits she's decided that it's not worth it.My dd is 24, has one credit card that she keeps paid off and is thinking about doing the disney Visa mainly to have the benefits for our trip. She isn't sure if she will want to keep it more than a year or not. She is concerned about the affect on her credit score if she cancels after a year. I'm also curious if it will help her credit score having another card. She really does not have any bills in her name besides her current card.

Called as her this morning. Very happy to expedite it for herCongrats…can’t hurt to try to have it expedited

Dd was instant approved for an CIU. Will they expedite a first business card if someone calls? And will they answer on a weeken

So glad to hear DPs of Chase biz approvals. I was denied last week and so need to do some cleaning up of current biz cards.New CIC approved today! I recently cleaned up my business cards and have 2 CICs, 1 CIU and 1 IHG biz card. I did have a green star pre-approved for CIP in my account. Not sure if that helped or not. Last chase app was in Nov.

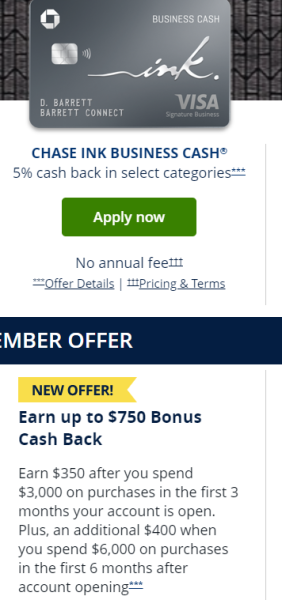

Went through P2 referral and got the normal 75K URs for 6K spend. The new public offer is bad. 9K spend (split over 6 months) for 75K.

View attachment 846566

No cards applied for in the past 2 years. Mine are very old, mostly with Citi, one unused CapOne Silver

Monthly: $3-4000 that could be paid on a card instead of debit

Paid off monthly

Airport: DTW

Preferred Airline: Delta

Southwest services DTW but not a lot of non-stop routes we would take so it is not preferred.

No preference on hotels other than Disney

We have some Delta direct miles

Goal: Discounted flights to Disney/Orlando and savings on Disney vacations, preferably as DVC members soon

Trips: At least annually

Travel only with spouse usually.

You have gotten some good advice and I'm going to throw some more food for thought your way. Keep in mind as you enter this hobby, your goals can change. When I started this hobby back in 2012 I was only planning to do this for one trip to Scotland. That was it. This hobby literally changed my life and my perspective and here I am doing things and going places that I never thought were possible.

You have gotten some good advice and I'm going to throw some more food for thought your way. Keep in mind as you enter this hobby, your goals can change. When I started this hobby back in 2012 I was only planning to do this for one trip to Scotland. That was it. This hobby literally changed my life and my perspective and here I am doing things and going places that I never thought were possible.

Hopefully that is the way it is. I have property tax coming up so 6K in one spend is easy..

FWIW, I read the public offer as a total of $6,000 spend for 75k URs. It’s just that it’s split and more accessible for those who don’t have high spend.

Out of curiosity, what do your recents chaseNew CIC approved today! I recently cleaned up my business cards and have 2 CICs, 1 CIU and 1 IHG biz card. I did have a green star pre-approved for CIP in my account. Not sure if that helped or not. Last chase app was in Nov.

Went through P2 referral and got the normal 75K URs for 6K spend. The new public offer is bad. 9K spend (split over 6 months) for 75K.

View attachment 846566

i read it same as you.So glad to hear DPs of Chase biz approvals. I was denied last week and so need to do some cleaning up of current biz cards.

FWIW, I read the public offer as a total of $6,000 spend for 75k URs. It’s just that it’s split and more accessible for those who don’t have high spend.