On my Amex Plat, I have a $25 off $50+ and $20 off $40+ x 3. I wonder if they stack. Along with the Kroger offer of $15 off first 3 purchases, it would be really nice to stock up on some pantry staples for cheap. Best case scenario would be $95-25-20-20-15 = $15. Will report back.Just picked up groceries at Kroger. Original total was $118. With coupons and sales prices it was $63. Will get $20 back from Amex. Plus I got 1,070 fuel points (worth about $20). Nice to get a deal on groceries once in a while.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

I love credit cards so much! v5.0 - 2022 (see first page for add'l details)

- Thread starter SouthFayetteFan

- Start date

- Status

- Not open for further replies.

CyndiLouWho

DIS Veteran

- Joined

- Feb 7, 2013

- Messages

- 7,031

IFlossU

DIS Veteran

- Joined

- Sep 3, 2003

- Messages

- 1,532

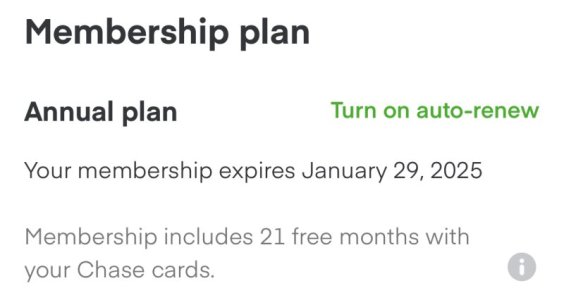

I too have been asleep on this benefit. I understand how the Instacart + and the quarterly credit stack, but I don’t see how I can combine all my credits to make a larger purchase. It appears I have to select 1 card as the payment method and I’ll get say $10 for using my Freedom card. Am I missing something? Is there a way to use multiple card credits for 1 large purchase? Or is the most I will save $15 with my preferred card?Here’s my account. It expired in 2024 but just added DH CSR.View attachment 725850

ETA: I did some playing around with Instacart and answered my question. With the CSP I can get $15 off 1x/quarter. $10 with my Freedom cards. Seems like the CSR at $15/month is a worthwhile value.

Last edited:

CaptainAmerica

DIS Veteran

- Joined

- Oct 12, 2018

- Messages

- 5,083

I'm getting super annoyed with Amex when it comes to Blue Cash Everyday. I keep it around exclusively for online shopping 3%, but the coding is super inconsistent. Loads of things that are online shopping don't code that way, and other things code correctly as online shopping but don't get the 3% for some reason. They never have a satisfactory answer when I challenge them on the big ones.

Judique

Dis Veteran, Beach Lover at BWV, BCV, HHI, VB

- Joined

- Aug 1, 2003

- Messages

- 13,660

Have an offer on my Amex Bonvoy Biz card - spend $2000, get 7500 bonus. So with the spend it would be 11,500 points. Not feeling like it's worth it, I am feeling burnout from all the other offers on my cards!

I don't think it's worth it either. Valuing Marriott points at .009cents/per point it's $103.50 in value.

I had a similar offer on a card that used to be a BOA AAA card before they changed to Commenity Bank. They sent me the new card and I haven't activated it. So they are bribing me with a spend $2000 get $100 offer. I just don't feel like messing with another card issuer/bank.

CyndiLouWho

DIS Veteran

- Joined

- Feb 7, 2013

- Messages

- 7,031

Yeah I don't think you can combine in 1 purchase. I have a spreadsheet to make sure to use the Freedoms once a quarter and CSR once a month. I just switch cards when I purchase as they are all already loaded in my account.I too have been asleep on this benefit. I understand how the Instacart + and the quarterly credit stack, but I don’t see how I can combine all my credits to make a larger purchase. It appears I have to select 1 card as the payment method and I’ll get say $10 for using my Freedom card. Am I missing something? Is there a way to use multiple card credits for 1 large purchase? Or is the most I will save $15 with my preferred card?

ETA: I did some playing around with Instacart and answered my question. With the CSP I can get $15 off 1x/quarter. $10 with my Freedom cards. Seems like the CSR at $15/month is a worthwhile value.

havaneselover

Dreaming about a Disney cruise

- Joined

- Nov 9, 2009

- Messages

- 11,892

I need to remember when I do FAFSA, I get a letter from the IRS saying the data retrieval tool was used. DD and I both had letters in Informed Delivery and I was super anxious waiting for the mail.

Today I used my third Chase offer for $20 off at Kohl's (bought another $100 Amex gift card). Also hit up Staples for the 4th time this week. And I'm really enjoying my new CRV. The only weird thing I've noticed is it doesn't have the button to program my garage door.

Really enjoying having dd home. We're making frosted sugar cookies tonight

Today I used my third Chase offer for $20 off at Kohl's (bought another $100 Amex gift card). Also hit up Staples for the 4th time this week. And I'm really enjoying my new CRV. The only weird thing I've noticed is it doesn't have the button to program my garage door.

Really enjoying having dd home. We're making frosted sugar cookies tonight

I'm quoting myself in case anyone else is interested. I just did this and it went very smoothly. I had them look for availability first. (Which I had already checked out using the British airways website) and once they found it, they told me how many points I needed and I transferred in the MR from Amex, which posted instantly. So looks like my whole family is going to Italy in October!Has anyone transferred amex points to Etihad and booked an AA flight through them? How did it go? I hate calling.

CyndiLouWho

DIS Veteran

- Joined

- Feb 7, 2013

- Messages

- 7,031

I had a letter from IRS in Informed Delivery too. Freaked me out but it was just a letter telling me I might be eligible for health insurance because they noticed someone in family was not covered. No idea how they got that since we all have coverage thru DHs work.I need to remember when I do FAFSA, I get a letter from the IRS saying the data retrieval tool was used. DD and I both had letters in Informed Delivery and I was super anxious waiting for the mail.

TheOneWithTheTriplets

DIS Veteran

- Joined

- Mar 27, 2018

- Messages

- 3,940

I'm getting super annoyed with Amex when it comes to Blue Cash Everyday. I keep it around exclusively for online shopping 3%, but the coding is super inconsistent. Loads of things that are online shopping don't code that way, and other things code correctly as online shopping but don't get the 3% for some reason. They never have a satisfactory answer when I challenge them on the big ones.

That's obnoxious! I haven't had that problem, but we've mostly used it at Amazon, which codes consistently.

Only one that didn't work for me was AliExpress, but that's because it's only for US retailers, which I didn't realize at the time.

Psychodisney

DIS Veteran

- Joined

- Feb 22, 2005

- Messages

- 3,857

I got the same letter! And we are covered too. I panicked slightly but have become numb to my IRS love letters. My 2019 taxes were finally resolved a couple of weeks ago.I had a letter from IRS in Informed Delivery too. Freaked me out but it was just a letter telling me I might be eligible for health insurance because they noticed someone in family was not covered. No idea how they got that since we all have coverage thru DHs work.

FreeDiningFanatic

DIS Veteran

- Joined

- Aug 18, 2015

- Messages

- 2,302

I haven't gotten the credit on my Freedom that is associated with the same account as my CSP. Now makes me wonder if I enrolled it, lol. I am working with four cards here and two accounts peeps!Instacart+ question: If I add two CFs to my account, does that mean I have $20 to spend now?

ETA: I don't think I enrolled this card. So, I'll try it again this quarter. I also have to keep a spreadsheet tab on this to keep track, but hey, free money is free money!

Last edited:

Exactly, and only three days after we completed the necessary spend. Any other time I've earned points it took 2-3 weeks.Like they posted too fast and ended up in December?

palhockeymomof2

DIS Veteran

- Joined

- Nov 14, 2001

- Messages

- 7,095

Mine RR points always post when the monthly statement closes…usually the same or next dayExactly, and only three days after we completed the necessary spend. Any other time I've earned points it took 2-3 weeks.

Did they post when your statement closed ?

Judique

Dis Veteran, Beach Lover at BWV, BCV, HHI, VB

- Joined

- Aug 1, 2003

- Messages

- 13,660

My Kohl's didn't have visa or mc or amex. I looked for Visa this last time around to give as a gift.I need to remember when I do FAFSA, I get a letter from the IRS saying the data retrieval tool was used. DD and I both had letters in Informed Delivery and I was super anxious waiting for the mail.

Today I used my third Chase offer for $20 off at Kohl's (bought another $100 Amex gift card). Also hit up Staples for the 4th time this week. And I'm really enjoying my new CRV. The only weird thing I've noticed is it doesn't have the button to program my garage door.

Really enjoying having dd home. We're making frosted sugar cookies tonight

FreeDiningFanatic

DIS Veteran

- Joined

- Aug 18, 2015

- Messages

- 2,302

The posting of RR cc points earned through spending isn't based on a number of days or weeks. Ever. They post to one's account based on one's statement closing date. Once a $ charge posts to the credit card, it earns a certain number of points. Those points are then paid out and transferred to Chase when the statement closes. A statement closes the same time every month.Exactly, and only three days after we completed the necessary spend. Any other time I've earned points it took 2-3 weeks.

So for example, let's assume someone signed up for a $5,000 MSR, earning 80,000 points. Let's say their statement closes 12/15/22. If on 12/11, they charged $5,001 and the charge posts, they will have earned their SUB of 80,000 points when their statement closes on 12/15. Just a matter of a few days after charging. Those points will count towards that calendar year's companion pass, so 2022/23.

In another scenario, one might charge $5,001 on 12/16/22. Because their statement just closed on 12/15, their next statement won't be until January 15, 2023. In this scenario, it's nearly four weeks between the points charging and being "earned" on the statement. They'll earn their SUB of 80,000 points and it will count towards 2023/24 companion pass.

afan

Honorary Bus Driver

- Joined

- Dec 30, 2014

- Messages

- 9,554

Maryrachel713

Mouseketeer

- Joined

- Jul 26, 2022

- Messages

- 341

My new card is January first. So if I start using it now it will count ? I wasn’t sure when it would start countingThe posting of RR cc points earned through spending isn't based on a number of days or weeks. Ever. They post to one's account based on one's statement closing date. Once a $ charge posts to the credit card, it earns a certain number of points. Those points are then paid out and transferred to Chase when the statement closes. A statement closes the same time every month.

So for example, let's assume someone signed up for a $5,000 MSR, earning 80,000 points. Let's say their statement closes 12/15/22. If on 12/11, they charged $5,001 and the charge posts, they will have earned their SUB of 80,000 points when their statement closes on 12/15. Just a matter of a few days after charging. Those points will count towards that calendar year's companion pass, so 2022/23.

In another scenario, one might charge $5,001 on 12/16/22. Because their statement just closed on 12/15, their next statement won't be until January 15, 2023. In this scenario, it's nearly four weeks between the points charging and being "earned" on the statement. They'll earn their SUB of 80,000 points and it will count towards 2023/24 companion pass.

gottalovepluto

DIS Legend

- Joined

- Jul 14, 2014

- Messages

- 23,617

Welp. Someone else in your fam might be getting a different letter. Eventually.I had a letter from IRS in Informed Delivery too. Freaked me out but it was just a letter telling me I might be eligible for health insurance because they noticed someone in family was not covered. No idea how they got that since we all have coverage thru DHs work.

Only time I ran afoul of them was over their screwup on my health insurance coverage

- Status

- Not open for further replies.

-

What Disney World Rides Are CLOSED In December 2025?

-

2025 Disney Parks Holiday Special Releases Early

-

Set the Holiday Scene with Disney's Grand Californian Magic

-

Disney Gives Back To Local Community on Thanksgiving

-

New Black Friday Sales & Your Favorite Universal Characters

-

Full Menu and Details from Worlds of Marvel Onboard the Disney Destiny

-

My 5 Favorite Things About the Holidays at the Disneyland Resort

New Threads

- Replies

- 6

- Views

- 147

- Replies

- 13

- Views

- 303

- Replies

- 0

- Views

- 181

- Replies

- 0

- Views

- 146

Receive up to $1,000 in Onboard Credit and a Gift Basket!

That’s right — when you book your Disney Cruise with Dreams Unlimited Travel, you’ll receive incredible shipboard credits to spend during your vacation!

CLICK HERE

That’s right — when you book your Disney Cruise with Dreams Unlimited Travel, you’ll receive incredible shipboard credits to spend during your vacation!

CLICK HERE

New Posts

- Replies

- 79

- Views

- 6K

- Replies

- 6K

- Views

- 490K

- Replies

- 20

- Views

- 1K

- Replies

- 3

- Views

- 205

- Replies

- 12

- Views

- 1K

- Replies

- 13

- Views

- 303

- Replies

- 9

- Views

- 385