You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Has anyone projected future dues for each resort thru the end of each contract?

- Thread starter EvaRose

- Start date

-

- Tags

- annual dues dvc spreadsheet

CastAStone

Business nerd. Good at math. Bad at spelling.

- Joined

- Jun 25, 2019

- Messages

- 5,988

I had the same thought!"I am worried that my future wages won't increase proportionate to dues increases, which are due in large part to CM wages increasing."

At the same time it’s not a totally invalid concern.

The price of things has basically dropped continuously for decades. By things, think TVs, appliances, computers, groceries, dishes, trash cans; if it’s an object, theres a very good chance that it costs a lot less now than it did in the 50s or 80s or the 2000s after adjusting for inflation or for wage growth.

The price of services, meanwhile, has increased significantly vs inflation. College, childcare, hospital care, even things like spa treatments and auto service. It’s why restaurant food has become more expensive despite groceries becoming cheaper.

Hotels are somewhere in between, but more service than object. You’re paying for sheets and pillows and a TV, but the marginal cost of you coming is mostly in cleaning after you leave. So it’s not totally unreasonable to expect hotel / timeshare costs to continue to outpace inflation, and potentially wage growth, because of wage growth, as ridiculous as that sounds, as over time a higher percentage of the cost of a stay will be labor vs everything else.

Basically, yes, but in percentages. Looks like I or someone else will have to do some more math lol

There is a site with the info, but I am unsure if I can share it. Maybe through DM?

DonMacGregor

Sub Leader

- Joined

- May 13, 2021

- Messages

- 6,578

I just find it immensely entertaining that people are worried their income won't match the dues increases, when the lion's share of those dues increases go to wages going up for people who largely can't afford DVC (with obvious lesser contributions from taxes, insurance, etc.).I had the same thought!

At the same time it’s not a totally invalid concern.

I suppose service worker's wages could increase at a greater rate than some DVC owners, but that's sort of a "you" problem.

GogoDenali

Earning My Ears

- Joined

- Mar 7, 2024

- Messages

- 14

I think this is already happening to vero beach already. The dues are so high that its making the contract becoming worthless on the secondary market......

EvaRose

If the apocalypse comes, beep me.

- Joined

- Apr 5, 2024

- Messages

- 12

This site has the historical dues per resort by year as well as the % increase by year! https://www.dvchelp.com/page/maintenance-fees-current-and-historicalBasically, yes, but in percentages. Looks like I or someone else will have to do some more math lol

intamin

Ready to go.

- Joined

- Nov 25, 2022

- Messages

- 3,410

I had seen this one but I actually like @Massachusetts spreadsheet because it gives a more recent representation of the dues. A lot of resorts when they first opened had extremely low dues and then saw more dramatic percentage increases later on so I'd say his is a more accurate current snapshot and this one is good to see their CAGR since the inception of each resort.This site has the historical dues per resort by year as well as the % increase by year! https://www.dvchelp.com/page/maintenance-fees-current-and-historical

Cabius

More Disney-obsessed than is healthy.

- Joined

- Nov 22, 2017

- Messages

- 1,574

I've been fiddling around with a dues model this evening. Feel free to check it out and make a copy!

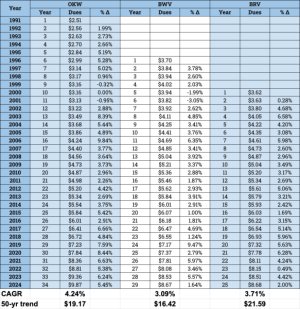

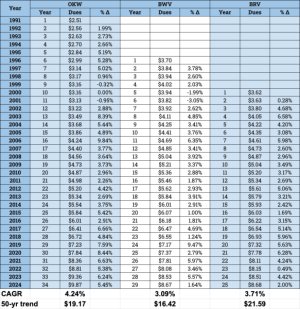

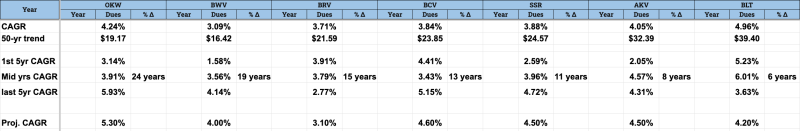

To start with, just the raw dues data, with the year-over-year % changes, for each resort. From here I calculated the Compound Annual Growth Rate (CAGR) for each resort since its inception, and what the year-50 dues would be if future dues matched the historic average for each resort.

There's quite a bit of variance, from a high of 4.96% (BLT) to a low of 3.09% (BWV).

In addition to the overall CAGR, I calculated the CAGR for just the first 5 years, the most recent 5 years, and the intervening years (the duration of which varies from resort to resort). This is interesting, as you can see many resorts follow the OKW/BWV pattern of dues growth accelerating over time, while BRV and BLT had higher increases earlier on, and smaller recent climbs.

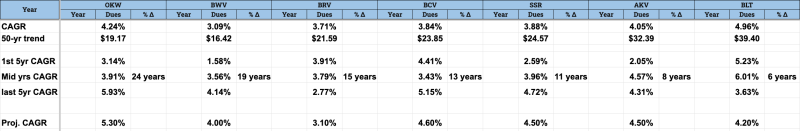

Finally, I added a "Proj. CAGR" field which is just my estimate for average future growth rates, an admittedly subjective blend based on historical trends.

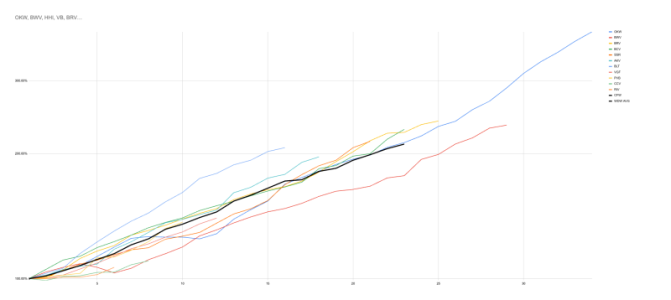

The chart below shows the percentage changes (log scale) for each resort from its inception to present day. The thick black line is the average. (I know it's hard to read here, but you should be able to open the Google Sheet and play around with it in greater detail.)

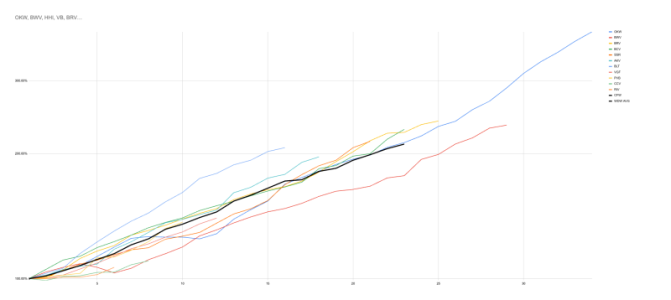

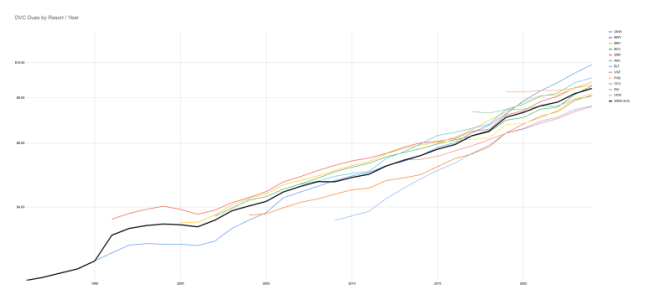

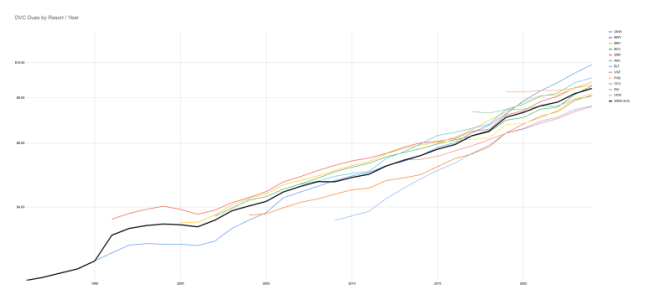

This chart shows dues in dollar terms rather than % change.

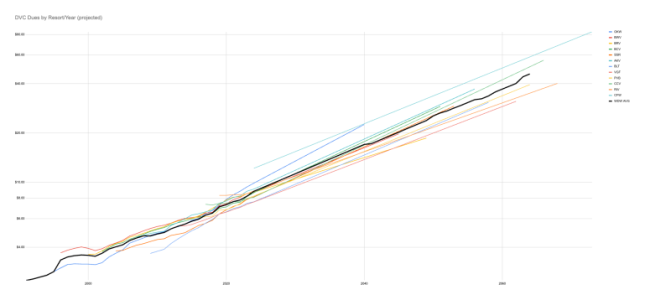

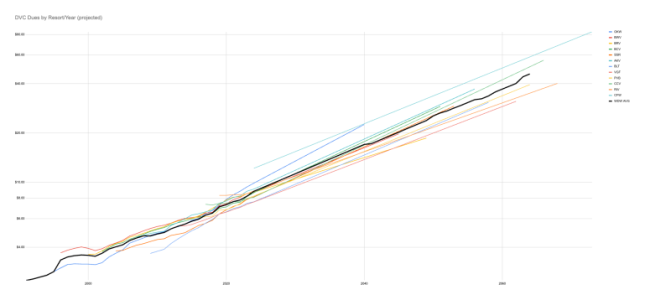

Finally, I made a chart projecting dues for each resort out to the 50-year mark, based on my data-informed guesses for future CAGR.

NOTE: If dues decrease as end-of-life approaches and we no longer need to save up for the next refurb, that will curve these lines down over the last 7 to 15 years, but I didn't really take that into account. The only thing I know for sure is that the future won't actually look like this... but it might look something like this?

Anyway, that's my data nerd project for tonight. I hope it piques some others' interest as well. Feel free to copy off that Google sheet and poke around!

To start with, just the raw dues data, with the year-over-year % changes, for each resort. From here I calculated the Compound Annual Growth Rate (CAGR) for each resort since its inception, and what the year-50 dues would be if future dues matched the historic average for each resort.

There's quite a bit of variance, from a high of 4.96% (BLT) to a low of 3.09% (BWV).

In addition to the overall CAGR, I calculated the CAGR for just the first 5 years, the most recent 5 years, and the intervening years (the duration of which varies from resort to resort). This is interesting, as you can see many resorts follow the OKW/BWV pattern of dues growth accelerating over time, while BRV and BLT had higher increases earlier on, and smaller recent climbs.

Finally, I added a "Proj. CAGR" field which is just my estimate for average future growth rates, an admittedly subjective blend based on historical trends.

The chart below shows the percentage changes (log scale) for each resort from its inception to present day. The thick black line is the average. (I know it's hard to read here, but you should be able to open the Google Sheet and play around with it in greater detail.)

- On a percentage basis, BLT is an outlier in terms of its growth from its starting dues. But, most of that was fairly early on, and it's leveled off in the past few years.

- BWV has been an outlier on the low end for a long time.

- SSR used to be below-average, and has since moved to above-average!

- RIV and CCV are still bumping along the very bottom of the pack, along the lines of BCV. RIV is just getting to the point where it's starting to see material dues increases; we'll see what that looks like long-term!

This chart shows dues in dollar terms rather than % change.

- In some ways, this reads like an inverse of the chart above, as resorts with the highest starting dues have seen the lowest increases, and vice versus.

- For example, while BWV has seen the lowest increases, it started very high, and still has above-average due costs

- Conversely, while BLT has seen the biggest % increases, its starting dues were so low that it is still one of the cheapest options

Finally, I made a chart projecting dues for each resort out to the 50-year mark, based on my data-informed guesses for future CAGR.

NOTE: If dues decrease as end-of-life approaches and we no longer need to save up for the next refurb, that will curve these lines down over the last 7 to 15 years, but I didn't really take that into account. The only thing I know for sure is that the future won't actually look like this... but it might look something like this?

Anyway, that's my data nerd project for tonight. I hope it piques some others' interest as well. Feel free to copy off that Google sheet and poke around!

cdirazonian

Mouseketeer

- Joined

- May 21, 2008

- Messages

- 189

WOW! It did & thank you for sharing all that!Anyway, that's my data nerd project for tonight. I hope it piques some others' interest as well. Feel free to copy off that Google sheet and poke around!

Sprinkles&Sprints

DIS Veteran

- Joined

- Jan 30, 2024

- Messages

- 1,448

This is amazing!! Thank you for pulling this all together!!I've been fiddling around with a dues model this evening. Feel free to check it out and make a copy!

To start with, just the raw dues data, with the year-over-year % changes, for each resort. From here I calculated the Compound Annual Growth Rate (CAGR) for each resort since its inception, and what the year-50 dues would be if future dues matched the historic average for each resort.

There's quite a bit of variance, from a high of 4.96% (BLT) to a low of 3.09% (BWV).

View attachment 850063

In addition to the overall CAGR, I calculated the CAGR for just the first 5 years, the most recent 5 years, and the intervening years (the duration of which varies from resort to resort). This is interesting, as you can see many resorts follow the OKW/BWV pattern of dues growth accelerating over time, while BRV and BLT had higher increases earlier on, and smaller recent climbs.

View attachment 850065

Finally, I added a "Proj. CAGR" field which is just my estimate for average future growth rates, an admittedly subjective blend based on historical trends.

The chart below shows the percentage changes (log scale) for each resort from its inception to present day. The thick black line is the average. (I know it's hard to read here, but you should be able to open the Google Sheet and play around with it in greater detail.)

View attachment 850066

- On a percentage basis, BLT is an outlier in terms of its growth from its starting dues. But, most of that was fairly early on, and it's leveled off in the past few years.

- BWV has been an outlier on the low end for a long time.

- SSR used to be below-average, and has since moved to above-average!

- RIV and CCV are still bumping along the very bottom of the pack, along the lines of BCV. RIV is just getting to the point where it's starting to see material dues increases; we'll see what that looks like long-term!

This chart shows dues in dollar terms rather than % change.

View attachment 850067

- In some ways, this reads like an inverse of the chart above, as resorts with the highest starting dues have seen the lowest increases, and vice versus.

- For example, while BWV has seen the lowest increases, it started very high, and still has above-average due costs

- Conversely, while BLT has seen the biggest % increases, its starting dues were so low that it is still one of the cheapest options

Finally, I made a chart projecting dues for each resort out to the 50-year mark, based on my data-informed guesses for future CAGR.

View attachment 850068

NOTE: If dues decrease as end-of-life approaches and we no longer need to save up for the next refurb, that will curve these lines down over the last 7 to 15 years, but I didn't really take that into account. The only thing I know for sure is that the future won't actually look like this... but it might look something like this?

Anyway, that's my data nerd project for tonight. I hope it piques some others' interest as well. Feel free to copy off that Google sheet and poke around!

Massachusetts

Mouseketeer

- Joined

- May 22, 2018

- Messages

- 219

TheDailyMoo

DIS Veteran

- Joined

- Jun 9, 2021

- Messages

- 2,412

Well with CPI coming in hot today not sure we see any rate cuts rest of year. Our dues will definitely pop a higher than average percentage across the board next year.

CastAStone

Business nerd. Good at math. Bad at spelling.

- Joined

- Jun 25, 2019

- Messages

- 5,988

TheDailyMoo

DIS Veteran

- Joined

- Jun 9, 2021

- Messages

- 2,412

Very true however just in my opinion I think rates need to stay where they are if not go up to really right the ship but I know that's not a popular stance nor am I an economist so your guess is as good as mine. But even if the fed lowered it a quarter here and a quarter there by December I don't think it moves the needle for our dues. I think unfortunately we get hit with a higher level percentage raise in dues for 2025. Then hopefully the feds actions will bring us back down to a respectable CPI. Don't forget today's numbers were the Core CPI excluding food and energy and as we know those are on the rise and will be into the summer and rising energy costs impact everything including our dues. VB $15?last month came in cold. I don’t think the fed is making full year decisions on one negative datapoint.

View attachment 850219

Tatebeck

I Can G🤣 The DIS-tance

- Joined

- Dec 3, 2023

- Messages

- 2,454

Amazing work! I was going to ask for higher resolution graphs until I saw the link!I've been fiddling around with a dues model this evening. Feel free to check it out and make a copy!

Sort of. But on the other hand, I think if you went back to 1994 or 2004 and showed them 2024 rack rates, they would think you were absolutely insane.

Disney also wants to keep recycling and reselling DVC resorts as a permanent source of income, which means that long-term they will continue to try and make it an attractive value proposition. The day that DVC costs as-much-or-more as a cash stay is the day that that entire business unit becomes ~worthless.

Anything can happen, but I expect both cash costs and DVC dues to increase at greater than the rate of inflation short of some major economic realignment (e.g. anything from seismic increases in tax rates on the upper-middle class to violent socialist revolution).

I actually think we’ve hit the concrete ceiling on Disney vacation pricing and everything else is rising to those “Disney prices.” Ultimately, $8-10k is the topped-out level for vacations for families. We had movement from 1990s to today because there was plenty of room to climb to that. I don’t think it’s even plausible to argue Disney vacations will double/triple 20 years from now because that room doesn’t exist in budgets like it used to.

Disney food prices aren’t bad now relative to what you get elsewhere. I went to an arena a month ago and the concessions were “reasonable” given what fast food prices are now.

So what we’re seeing is the concessions/theme park prices are stagnating while the lower regular options have gotten more expensive.

hockeydad21

DIS Veteran

- Joined

- Sep 28, 2022

- Messages

- 508

I hate to break it to ya, but it gets pretty ugly pretty quick. Assuming inflation holds steady with its historical rate, you're looking at over $30 per point in dues at the Poly towards the tail end. The 2042 resorts will be far less in dues per point given the shorter term.Making a best guess based on past due increases and inflation, has anyone ever created spreadsheets with estimated future years dues for each resort?

I made one for Boardwalk with 3.1% increase each year based on the data I found that said the average increase was 3.1, but not sure if that's exactly the best way to predict through end of contract. Would also be curious to look at other resorts through the end of their contracts, like Polynesian and Copper Creek.

Massachusetts

Mouseketeer

- Joined

- May 22, 2018

- Messages

- 219

I hate to break it to ya, but it gets pretty ugly pretty quick. Assuming inflation holds steady with its historical rate, you're looking at over $30 per point in dues at the Poly towards the tail end. The 2042 resorts will be far less in dues per point given the shorter term.

For the most part I tend to agree that based on the information that we have dues will outpace inflation by 1-2%. However we may be discounting the role technology may have in reducing costs for Disney operations. Would anyone be shocked if Disney buses were autonomous vehicles by 2035? How much of housekeeping could be automated? The staffing costs make up the majority of dues. If technology can replace 25-30% of staff over the next 15-20 years maybe the dues fall in line with inflation rather than above inflation.

Cabius

More Disney-obsessed than is healthy.

- Joined

- Nov 22, 2017

- Messages

- 1,574

It would also be interesting to project our dues for the last 7-15 years of resort operation, assuming that capital reserves will wind down toward zero. Even if routine maintenance costs accelerate, that could put a lot of downward pressure on end-of-life due costs. We'll see....For the most part I tend to agree that based on the information that we have dues will outpace inflation by 1-2%. However we may be discounting the role technology may have in reducing costs for Disney operations. Would anyone be shocked if Disney buses were autonomous vehicles by 2035? How much of housekeeping could be automated? The staffing costs make up the majority of dues. If technology can replace 25-30% of staff over the next 15-20 years maybe the dues fall in line with inflation rather than above inflation.

Massachusetts

Mouseketeer

- Joined

- May 22, 2018

- Messages

- 219

It would also be interesting to project our dues for the last 7-15 years of resort operation, assuming that capital reserves will wind down toward zero. Even if routine maintenance costs accelerate, that could put a lot of downward pressure on end-of-life due costs. We'll see....

That we shall! My bet is that Disney is still going to fund capital reserves through the life of the contract. It may not be fair but I don't see them cutting owners a break as 2042 approaches.

-

Disney Doesnt Care About Figment, Only Your Money

-

Limited Time: New Cream Cheese Stuffed Gingerbread Cookie

-

Disney World's Best Christmas Lights are at EPCOT

-

What Your Favorite Magic Kingdom Ride Says About You

-

New Disney Merch: T-Shirts, Ears, Towels&More!

-

Cinderella Castle's Repainting Project Starts in January at Magic Kingdom

-

New 'Disney Unscripted' on Disney Destiny Ship

New Threads

- Replies

- 0

- Views

- 55

- Replies

- 13

- Views

- 347

- Replies

- 4

- Views

- 122

- Replies

- 3

- Views

- 198

New Posts

- Replies

- 22

- Views

- 2K

- Replies

- 13

- Views

- 347

- Replies

- 4

- Views

- 192

- Replies

- 206

- Views

- 27K

- Poll

- Replies

- 35

- Views

- 1K