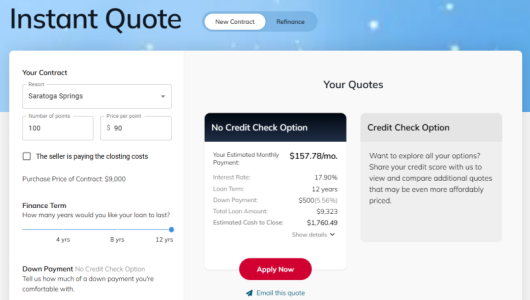

The 12% you previously referenced isn't even the midpoint of the range. Here's the current APR language:

Interest Rate – We offer fixed interest rates as low as 9.99%

(10.0% APR) for a 15-year loan and up to a maximum rate of 18.0%

(18.01% APR). The Sample Financing Terms above assume a 10% down payment and a fixed annual rate of 15.0%

(15.01% APR) which requires, among certain other criteria: (1) minimum credit score of 675 - 724, (2) current on any primary residence mortgage, (3) no foreclosures in the prior 3 years, (4) no open federal tax liens, (5) no open bankruptcy, (6) no foreclosure or deed-in-lieu in last 7 years on any Disney Vacation Club ownership interest. The rate is reduced by .50% if automated electronic monthly payments are selected and maintained. You may still qualify for financing even if your situation doesn’t match our assumptions. Your loan’s interest rate will depend upon the specific characteristics of your loan transaction and your payment history. Other restrictions may apply.

The example

DVC provides under the cost of membership tab lists the payment with a 10% down payment at 15% APR. The 10% APR isn't really out of line with other consumer loans, and I suppose 18% is better than carrying a balance on a credit card.