You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

DVC Financial Analysis

- Thread starter DKZB

- Start date

Brian Noble

Gratefully in Recovery

- Joined

- Mar 23, 2004

- Messages

- 19,830

You mean beyond the lively debate we’ve been having for the last 20 years? ;-)

I happen to like the MouseSavers take:

https://www.mousesavers.com/other-disney-vacations/disney-vacation-club/#opportunity

I happen to like the MouseSavers take:

https://www.mousesavers.com/other-disney-vacations/disney-vacation-club/#opportunity

You mean beyond the lively debate we’ve been having for the last 20 years? ;-)

I happen to like the MouseSavers take:

https://www.mousesavers.com/other-disney-vacations/disney-vacation-club/#opportunity

Very fair! Just haven't single disboard thread devoted to the topic. I know we talk about it all the time in ROFR thread and on other boards but hoping we can have a single useful thread that will help someone coming here and thinking about this topic.

I have been thinking about selling a few of my DVC contracts and moving into HGVC resale for Ski Season out in CO or UT.

It has sparked a renewed interest in thinking about some of the financial aspects of my contracts. Here is what I have come up with so far:

While the market value at any given time may prove otherwise, the reality is that DVC contracts are a depreciating asset (If you never sell, the value is eventually $0). To me this is the most conservative way to think about them.

Based on this, I think the best way to think about depreciation is to divide the total cost of acquisition by the total lifetime points (Including any banked points). This will give you a cost/lifetime point.

THIS does not reflect my annual cost (including dues) nor does it take into account the time value of my initial purchase, it simply accounts for the depreciation.

To figure out my depreciated "break even" minimum sale price i take my cost/lifetime point x the number of lifetime points remaining.

In theory, if you track the market value of the trip (Best Discounted Rate from Disney) you COULD argue that your real "break even" is the ( total acquisition cost + total dues paid ) - (Total Market Value of Trips taken + Total Proceed From Rentals) but this is MUCH more complicated to track and figure out!

How would you think about your "break even" price when selling?

Last edited:

- Joined

- Nov 15, 2008

- Messages

- 48,499

All we did when we bought was use figures based on current prices and our plans. We compared buying to cash stays at CR, our resort of choice with a 30% discount….and our typical 5 to 6 night trip.

Then calculated how it compared if we had to sell at a 50% loss within a year, 5 years, etc, At 5 years, we could and would break even….if we got to 10 years, we could give away and break even.

For us, that made sense and we went for it. Now, anything we own and get back is a bonus…of course, we have bought and sold a lot, and own 900 points now, so no clue where we are. But we see the value of the trip as the real financial gain.

I just sent my nephew on a 6 night trip to the VGF in a resort studio. I gifted to him. I figure that trip was worth over $3K in savings for him…good enough of a financial plus for us!

Then calculated how it compared if we had to sell at a 50% loss within a year, 5 years, etc, At 5 years, we could and would break even….if we got to 10 years, we could give away and break even.

For us, that made sense and we went for it. Now, anything we own and get back is a bonus…of course, we have bought and sold a lot, and own 900 points now, so no clue where we are. But we see the value of the trip as the real financial gain.

I just sent my nephew on a 6 night trip to the VGF in a resort studio. I gifted to him. I figure that trip was worth over $3K in savings for him…good enough of a financial plus for us!

of course, we have bought and sold a lot, and own 900 points now, so no clue where we are.

This is sort of where I am at. I have clearly made money on all of the contracts I have sold so far. I bought for X and sold for X+$$ after all costs so it was easy to see that I made money.

The contracts I have now are less clear:

I have one contact I MIGHT break even on a purchase price basis but I will certainly make money on a depreciated asset basis. It is a 2042 contract so it is depreciating quickly.

I made a mistake several years ago in a foreclosure sale where I miscalculated the back-dues I would owe. I have no shot at breaking even any time soon on a purchase price basis but when I factor in depreciation, I will probably only take a small loss based on the current market price of similar contracts.

All we did when we bought was use figures based on current prices and our plans. We compared buying to cash stays at CR, our resort of choice with a 30% discount….and our typical 5 to 6 night trip.

Then calculated how it compared if we had to sell at a 50% loss within a year, 5 years, etc, At 5 years, we could and would break even….if we got to 10 years, we could give away and break even.

Problem with looking at it this way is that (it seems) you are not accounting for the opportunity cost of your up-front payment. Also, you are not accounting for your annual dues.

It is a simple way to look at it but I am not sure it is the way to accurately calculate your break even.

That said I'm sure you have saved/made PLENTY over the years!

CastAStone

Business nerd. Good at math. Bad at spelling.

- Joined

- Jun 25, 2019

- Messages

- 5,989

I look at it as what’s the worst case scenario for a breakeven, because the reality is I don’t know how I’m going to use my points, so I want to expect the worst.

I start here: How much am I saving in my home resorts room rate for my preferred room type, (after whatever’s discounts you’d have received) minus dues?

I can assume I’ll save a similar amount in future years, room rate increases generally track dues increases on a % basis.

Then I discount each future years savings to account for the money I’d have made by just chucking your buy in into a savings account (there’s a variety of reasons this is less necessary in a breakeven analysis than in our typical value calculation, but let’s stick with it, worst case scenario and all).

So for example I bought 250 SSR points last year for roughly $22K including closing costs. It also had a year of banked points I rented out so let’s say $18000 all in.

We stay exclusively in 1 bedrooms, and a point at SSR generally buys about $25 in 1 bedroom rack rate, or about $16 after the typical 35% off sale.

So 250 points buys me $4000 worth of SSR 1 bedroom.

For that I pay ~$2000 in dues. So I would save $2000 in year 1. And after assuming a 5% discount rate, I’d break even in 12 years.

That’s worst case scenario for me. (Technically worst case scenario would be to stay in SSR one bedrooms in the summer when they buy as little as $20 in value per point before discounts, but we would never be caught dead in Florida in July or August, so I didn’t factor that in).

The real world is that we should beat that by a lot; we used points at VGC and got at least $25 per point in value out of them, we’re using points at Aulani next year and getting $29 per point in value there. If we ever move up to 2 bedrooms (or, less likely, down to studios) those room types have better paybacks as well.

So I think of it as a floor. My personal break even is 12 years, or better. But someone else who buys SSR for the same price and stays in std studios the second week of December ($50 in value per point before discounts) would crush my payback time.

I start here: How much am I saving in my home resorts room rate for my preferred room type, (after whatever’s discounts you’d have received) minus dues?

I can assume I’ll save a similar amount in future years, room rate increases generally track dues increases on a % basis.

Then I discount each future years savings to account for the money I’d have made by just chucking your buy in into a savings account (there’s a variety of reasons this is less necessary in a breakeven analysis than in our typical value calculation, but let’s stick with it, worst case scenario and all).

So for example I bought 250 SSR points last year for roughly $22K including closing costs. It also had a year of banked points I rented out so let’s say $18000 all in.

We stay exclusively in 1 bedrooms, and a point at SSR generally buys about $25 in 1 bedroom rack rate, or about $16 after the typical 35% off sale.

So 250 points buys me $4000 worth of SSR 1 bedroom.

For that I pay ~$2000 in dues. So I would save $2000 in year 1. And after assuming a 5% discount rate, I’d break even in 12 years.

That’s worst case scenario for me. (Technically worst case scenario would be to stay in SSR one bedrooms in the summer when they buy as little as $20 in value per point before discounts, but we would never be caught dead in Florida in July or August, so I didn’t factor that in).

The real world is that we should beat that by a lot; we used points at VGC and got at least $25 per point in value out of them, we’re using points at Aulani next year and getting $29 per point in value there. If we ever move up to 2 bedrooms (or, less likely, down to studios) those room types have better paybacks as well.

So I think of it as a floor. My personal break even is 12 years, or better. But someone else who buys SSR for the same price and stays in std studios the second week of December ($50 in value per point before discounts) would crush my payback time.

How do you figure?If your looking to break even on a timeshare, maybe it's not the best use of your money.

I would venture a guess that most people buy DVC to save money (which said another way is making money vs. what you would have spent).

You can look at calculations the way I do or you can look at it as a savings vs. they vacations you would take the way @Sandisw does but either way is the same. You spend more $$ > have a break even point > Then save/make money.

For MANY timeshare they are essentially worthless when you buy them. The nice part of DVC is there has historically been a strong resale market that allows you to get out if circumstances change.

eticketplease

DIS Veteran

- Joined

- Aug 24, 2021

- Messages

- 7,025

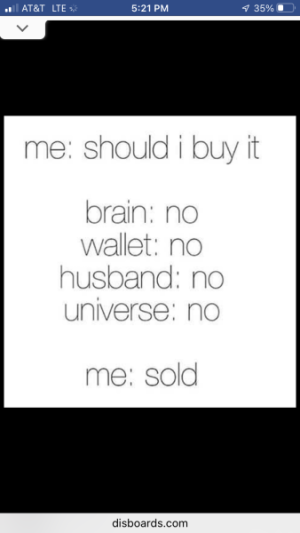

Lots of numbers crunching on thisThis is the calculation I used

lilsonicfan

DIS Veteran

- Joined

- Jan 20, 2003

- Messages

- 3,476

I wish I could say that I did a thorough financial analysis before buying into DVC. I think I still did pretty well at around $100 per point with lots of points to use, but quite honestly, it was a matter of having extra cash and wanting to buy into DVC. In our previous visits to WDW and DL we stayed offsite, not even at Disney properties, so really hard to say I would have spent this money anyway!

Instagramhusband

Mouseketeer

- Joined

- Mar 21, 2024

- Messages

- 190

If you are a long term planner I just think DVC makes too much sense. You can save money, though I know its negligible based on how/when/what you paid or prioritize.

We don't prioritize what direct provides us so we went with resales. Even knowing that, I can admit that in our case buying Direct 7 years ago would have saved me money given how much we go and the places we like to stay.

I do feel comfort in knowing that there is a market for resales though out intent is to enjoy.

We don't prioritize what direct provides us so we went with resales. Even knowing that, I can admit that in our case buying Direct 7 years ago would have saved me money given how much we go and the places we like to stay.

I do feel comfort in knowing that there is a market for resales though out intent is to enjoy.

I've done all those financial analyses - net present value, profitability index, cut the numbers anyway I know how. At the end of the day, it's about getting quality vacations at a good price, and I think DVC is tough to beat in that regard. But also, I'm kind of bougie... I need 1) a wall between me and my kids, 2) a king-sized bed, and 3) a soaker tub. Also, just Florida (and Cali) are so accessible/affordable to get to.

I also feel like excluding some of the higher-end, more costly timeshare brands (Ritz, Phoenecian/St. Regis, Four Seasons), the other major brands (MVC, HGVC, etc) are going to be downgrades based on online reviews or limitations (like no soaker tubs ). DVC just hits that sweet-spot for me.

). DVC just hits that sweet-spot for me.

I also feel like excluding some of the higher-end, more costly timeshare brands (Ritz, Phoenecian/St. Regis, Four Seasons), the other major brands (MVC, HGVC, etc) are going to be downgrades based on online reviews or limitations (like no soaker tubs

intamin

Ready to go.

- Joined

- Nov 25, 2022

- Messages

- 3,712

My little breakeven spreadsheet compares to DVC to rack rate of the deluxes and 25% off rack rate of deluxe resorts. Something else I've considered doing is the cost of a moderate like CBR like we used to stay at and add on an "upgrade fee" like 100-200 dollars which would be how much more I would've been willing to pay to stay deluxe.

All this to say the actual value is likely somewhere in between what we were paying for moderates and deluxes and I don't know what that exact number is. How do I quantify the value of being able to walk back to my hotel when I'm not feeling well? How do I quantify being able to put my family and ourselves up in 2BRs and Grand Villas at Riviera for our wedding? You don't. We wanted to stay in these deluxe resorts regardless and DVC gives us the opportunity to do so for the foreseeable future.

All this to say the actual value is likely somewhere in between what we were paying for moderates and deluxes and I don't know what that exact number is. How do I quantify the value of being able to walk back to my hotel when I'm not feeling well? How do I quantify being able to put my family and ourselves up in 2BRs and Grand Villas at Riviera for our wedding? You don't. We wanted to stay in these deluxe resorts regardless and DVC gives us the opportunity to do so for the foreseeable future.

I've done all those financial analyses - net present value, profitability index, cut the numbers anyway I know how. At the end of the day, it's about getting quality vacations at a good price, and I think DVC is tough to beat in that regard. But also, I'm kind of bougie... I need 1) a wall between me and my kids, 2) a king-sized bed, and 3) a soaker tub. Also, just Florida (and Cali) are so accessible/affordable to get to.

I also feel like excluding some of the higher-end, more costly timeshare brands (Ritz, Phoenecian/St. Regis, Four Seasons), the other major brands (MVC, HGVC, etc) are going to be downgrades based on online reviews or limitations (like no soaker tubs). DVC just hits that sweet-spot for me.

Wow, that absolutely nails it from our perspective, too. We like the separation from the kids, and we like 1- and 2-bedroom villas like at Riviera and Grand Flo that have 2 great pulldown beds in the living room. Great innovation and works perfectly for us while our kids are little.

But why oh why does Disney not offer more king bed options? I can rent a house at Evermore just up the road that has 5 king beds, so that if I'm hosting my extended family, I can at least offer them a comfy bed. No such option with DVC. Best I can do is book a 2nd 1-bedroom unit so they get a king bed, but then they might be on the other end of the resort. Just terrible.

One tip I would add for folks buying DVC is work closely with your guide if you already have a cash stay booked. We had a longer cash stay booked at the Riviera in a 2-bedroom preferred, and it was obviously quite expensive. Our guide, about 2 months before our trip, placed a hold on a 2-bedroom preferred room on the DVC side, for the same dates we were traveling. We basically "converted" our cash stay to DVC, and we paid almost the same amount for our entire DVC contract as we would have for the cash stay. I think DVC guides have some tools like this (i.e. they get first access to free'd up rooms even before waitlisters), so don't be afraid to tell your guide exactly what you're looking for.

kilik64

Champions of the World!

- Joined

- May 21, 2021

- Messages

- 1,565

The over analyzing financials of what is supposed to be a fun to use purchase was a bit much for me.

I looked and saw that I could basically spend on DVC what I was paying to stay in a moderate (or heck less than one of those AOA family suites, and that was before they went up even more post skyliner!) and bump up to nice deluxe resorts. There is no "saving" with DVC really for us, we will end up spending more most likely vs not having it. The room is only a minor part of a WDW vacation when you are going to spend a lot on park tickets, food, merch, travel, etc as a part of it.

I looked and saw that I could basically spend on DVC what I was paying to stay in a moderate (or heck less than one of those AOA family suites, and that was before they went up even more post skyliner!) and bump up to nice deluxe resorts. There is no "saving" with DVC really for us, we will end up spending more most likely vs not having it. The room is only a minor part of a WDW vacation when you are going to spend a lot on park tickets, food, merch, travel, etc as a part of it.

-

Disney's Famous Evil Queen Fired for Breaking the Rules?

-

Disney Magic Merch Finds: Celebrating the Original Disney Cruise Line Ship

-

Anxious About Disney? Here Are 5 Myths Busted Before You Go

-

How Disney Pricing Changed in 2003 and Never Looked Back

-

Two Pieces of Disneyland History Now Rotate Daily on Main Street

-

New 'Tangled' Look at Disney Springs PhotoPass Studio

-

Disney Character Meals Are Not Automatically Worth the Price

New Threads

- Replies

- 0

- Views

- 79

- Replies

- 3

- Views

- 198

- Replies

- 0

- Views

- 269

- Replies

- 13

- Views

- 970

- Replies

- 1

- Views

- 708

New Posts

- Replies

- 343

- Views

- 198K

- Replies

- 13

- Views

- 970

- Replies

- 8K

- Views

- 867K

- Replies

- 16K

- Views

- 899K