AvidDisReader

DIS Veteran

- Joined

- Mar 24, 2019

- Messages

- 1,073

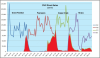

The total sales of 139K was verify solid. Yet, again Riviera was uninspiring with 91.8K or 66% of total. I pondered that a way to help with the possible stigma of the resale restrictions would be with Fixed Weeks contract since the resale buyer would be guaranteed a reservation every year. On that note in July a record 8 Fixed Week contracts were sold and the record was broken in August with 9 contracts.