808blessing

DIS Veteran

- Joined

- Dec 5, 2020

- Messages

- 1,153

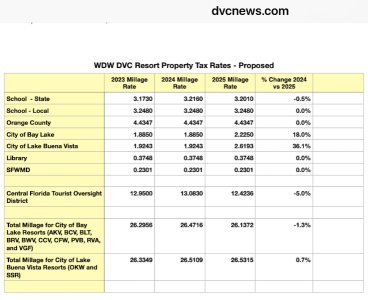

Where are people seeing the break down of the library fee in the taxes though?

I think the library millage rate works out to around 6 cents in our dues per point.

Example: The tax bill was roughly $22,586,000 for Saratoga Springs. The library millage is .03748, which equals $846,636, then divided by the estimated 14 million points owned at SSR comes out to $.0605 per point.

…unless I’m not doing this correctly?

https://dvcnews.com/dvc-program-men...l-tax-rates-for-walt-disney-world-dvc-resorts

What I find amazing is that the Orange County Library is an independent special district. The state codified it chapter 80-555 and they are authorized to levy ad valorem taxes for operating expenses and debt service.If somebody more familiar with DVC taxes and math can confirm the millage calculation?

Thanks!

The info I was using for Saratoga came from:

https://dvcnews.com/dvc-program-men...l-tax-rates-for-walt-disney-world-dvc-resorts

View attachment 1027354

Orange County, Florida

millage rates are set annually by each taxing authority, including the county, cities, school board, and special districts. A millage rate is the amount of tax charged per $1,000 of a property's taxable value, with one mill equaling $1. The calculation for an individual's property tax is based on their property's assessed value, any applicable exemptions, and the total combined millage rate.

HOLD THE PRESSES! The decimal point needs to move.

I cant confirm but I want to express my annoyance with it. Timeshares can certainly be excluded from paying for this. Ridiculous that it wasn't negotiated. Frankly I had no idea we also pay for schools, since schools are a separate line item I would've figured its easy to exclude that from timeshare ownership taxes. I now pay for schools in 4 states I dont use them in. (we homeschool so I I dont use them in my home state either) Guess its time to watch the video Brian linked.So if SSR has $22,586,000 ad valorem tax, and the millage is per $1000…

Then $22,586 x the library millage .3748 = $8,465

and That gets divided by 14 million dues points = $.000604

A 200 point SSR contract would pay about $0.12 in total toward the library for 2025.

Can anybody confirm this?

Honestly didn’t see my comment as controversial or political in any way shape or form.

I don’t know how to calculate it without starting at the assessed value. I pulled the property tax card up and it shows the Saratoga market value at $1,006,581,030.00. And the assessed value at $878,697,485.00. The library is only taxed on $878,697,485 (the assessed value) which left a bill of $329,335.80. Schools however are taxed at market value which left a bill of $6,491,441.20.So if SSR has $22,586,000 ad valorem tax, and the millage is per $1000…

Then $22,586 x the library millage .3748 = $8,465

and That gets divided by 14 million dues points = $.000604

A 200 point SSR contract would pay about $0.12 in total toward the library for 2025.

Can anybody confirm this?

Property taxes (in Florida and elsewhere) usually include the costs of libraries and public schools. The property taxes as they relate to the Orange County Library in Florida cover the costs of 17 different branches. The taxes are charged to property owners in Orange County. However, as to the free library card, only actual residents of the county can get it. Non-residents can purchase a library card for $75 for three months or $125 per year.I can see paying taxes for roads, traffic lights, police, emergency services but not for libraries and schools. Would be interesting to see exactly what is in the taxes.

You don’t have to be an Orange County resident to qualify for the property owner card. However, you do need to produce a tax bill with your name on it. Which we don’t have. The tax bills are issued to: Walt Disney Parks and Resorts US Inc.The property taxes as they relate to the Orange County Library cover the costs of 17 different branches. The taxes are charged to property owners in Orange County. However, as to the free library card, only actual residents of the county can get it. Non-residents can purchase a library card for $75 for three months or $125 per year.

A cardholder (including non-residents who have purchased a card) and often also such cardholders family members entering with a cardholder, can get free admission for a number of things such as the zoo and various botanical gardens that otherwise have entry fees in the Library's Local Wanderer Collection (for which the usual ticket cost for adults range from $15 to $25). The cost of providing that Local Wanderer Collection is included in the property taxes charged for the library.

Not sure if this was discusssed. I had assumed mousekeeping went up because of statewide minimum wage increases?

I’m would think that when minimum wage increases so do other wages. But I could be wrong.Pretty sure Housekeeping is paid above those rates in accordance with their contract.

I don’t know how to calculate it without starting at the assessed value. I pulled the property tax card up and it shows the Saratoga market value at $1,006,581,030.00. And the assessed value at $878,697,485.00. The library is only taxed on $878,697,485 (the assessed value) which left a bill of $329,335.80. Schools however are taxed at market value which left a bill of $6,491,441.20.total tax out the door for 2025 was $24,137,883.31 which is a mill rate of 26.5315 (If anyone wants to look at it Saratoga’s account # is 28-24-28-2085-99-999)

I’m would think that when minimum wage increases so do other wages. But I could be wrong.

I’m would think that when minimum wage increases so do other wages. But I could be wrong.

Yes, they are part of Local 737 Hotel & Restaurant workers union. Their raise went into effect September 28thSomeone that pays more attention may have a better grip on this then I. When I retired there's no doubt in my mind I left my work brain back there at the job.

It's my understanding that Housekeeping works under a negotiated contract with rates that are quite a bit above minimum wage. That would mean that their contract has a time period before the next negotiation process.

I may be mistaken but I don't think so.

I wonder why Cook 2 makes less than Cook 1Yes, they are part of Local 737 Hotel & Restaurant workers union. Their raise went into effect September 28th

For housekeeping, this would explain an increase of about 4.55%, wouldn't it?Yes, they are part of Local 737 Hotel & Restaurant workers union. Their raise went into effect September 28th