Yes, apologies Q1….Q4? Which ended 9/30/22. Or Q1?

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

DIS Shareholders and Stock Info ONLY

- Thread starter hhisc16

- Start date

wabbott

DIS Veteran

- Joined

- Aug 4, 2021

- Messages

- 6,977

https://www.zacks.com/stock/quote/DIS/detailed-earning-estimates

Sales Estimates

Sales Estimates

| Current Qtr (12/2022) | Next Qtr (3/2023) | Current Year (9/2023) | Next Year (9/2024) | |

|---|---|---|---|---|

| Zacks Consensus Estimate | 23.33B | 22.06B | 90.80B | 97.62B |

| # of Estimates | 4 | 4 | 5 | 5 |

| High Estimate | 23.68B | 22.28B | 94.11B | 101.09B |

| Low Estimate | 23.15B | 21.74B | 89.21B | 94.87B |

| Year ago Sales | 21.82B | 19.25B | 82.72B | 90.80B |

| Year over Year Growth Est. | 6.93% | 14.61% | 9.76% | 7.51% |

Earnings Estimates

| Current Qtr (12/2022) | Next Qtr (3/2023) | Current Year (9/2023) | Next Year (9/2024) | |

|---|---|---|---|---|

| Zacks Consensus Estimate | 0.69 | 1.06 | 3.97 | 5.32 |

| # of Estimates | 6 | 4 | 8 | 8 |

| Most Recent Consensus | 0.53 | 0.83 | 2.84 | 4.87 |

| High Estimate | 0.78 | 1.28 | 4.77 | 6.38 |

| Low Estimate | 0.53 | 0.83 | 2.84 | 4.87 |

| Year ago EPS | 1.06 | 1.08 | 3.53 | 3.97 |

| Year over Year Growth Est. | -34.91% | -1.85% | 12.46% | 33.97% |

wabbott

DIS Veteran

- Joined

- Aug 4, 2021

- Messages

- 6,977

https://deadline.com/2023/01/avatar...r-global-international-box-office-1235236387/

‘Avatar: The Way Of Water’ Swims Past $2B Worldwide – International Box Office

By Nancy Tartaglione

International Box Office Editor/Senior Contributor

January 22, 2023 8:13am PST

Refresh for latest…: It’s now official, James Cameron’s Avatar: The Way of Water has become the sixth movie ever to cross the $2B mark worldwide. It is also the filmmaker’s third to hit the milestone, alongside Titanic and the original Avatar.

The mega-achievement was presaged ahead of the weekend with the global gross on the 20th Century Studios/Disney sequel now $2.024B through Sunday. That includes $1.426B from overseas turnstiles. This means that offshore, Way of Water has become the No. 4 title of all time, jumping past Avengers: Infinity War and behind only Avatar, Avengers: Endgame and Titanic. This gives Cameron bragging rights to three of the top four movies ever at the international box office.

On a worldwide basis, Way of Water remains the No. 6 film ever, with the Na’vi next set on leap-frogging Infinity War and Star Wars: The Force Awakens. When that happens later this week, the epic sci-fi adventure will become the No. 4 movie of all time globally – and give Cameron three of the top four.

Also globally, Avatar: The Way of Water has grossed $227M from IMAX, overtaking Star Wars: The Force Awakens to become the 2nd highest grossing movie in the format’s history.

This sixth weekend overall saw a 38% drop overseas, bringing in a further $53.6M. Owing to the opening of several titles for Lunar New Year (more to come below), Avatar 2 had a 56% drop in China, however it has reached $229.7M there and stands as the highest grossing studio film of the pandemic era in the market, also having passed the original release of the first Avatar.

The Top 10 overseas markets to date are: China ($229.7M), France ($129.8M), Germany ($117M), Korea ($96.9M), the UK ($81.9M), India ($57.9M), Australia ($55.1M), Mexico ($51.4M), Spain ($47M) and Italy ($45.3M).

‘Avatar: The Way Of Water’ Swims Past $2B Worldwide – International Box Office

By Nancy Tartaglione

International Box Office Editor/Senior Contributor

January 22, 2023 8:13am PST

Refresh for latest…: It’s now official, James Cameron’s Avatar: The Way of Water has become the sixth movie ever to cross the $2B mark worldwide. It is also the filmmaker’s third to hit the milestone, alongside Titanic and the original Avatar.

The mega-achievement was presaged ahead of the weekend with the global gross on the 20th Century Studios/Disney sequel now $2.024B through Sunday. That includes $1.426B from overseas turnstiles. This means that offshore, Way of Water has become the No. 4 title of all time, jumping past Avengers: Infinity War and behind only Avatar, Avengers: Endgame and Titanic. This gives Cameron bragging rights to three of the top four movies ever at the international box office.

On a worldwide basis, Way of Water remains the No. 6 film ever, with the Na’vi next set on leap-frogging Infinity War and Star Wars: The Force Awakens. When that happens later this week, the epic sci-fi adventure will become the No. 4 movie of all time globally – and give Cameron three of the top four.

Also globally, Avatar: The Way of Water has grossed $227M from IMAX, overtaking Star Wars: The Force Awakens to become the 2nd highest grossing movie in the format’s history.

This sixth weekend overall saw a 38% drop overseas, bringing in a further $53.6M. Owing to the opening of several titles for Lunar New Year (more to come below), Avatar 2 had a 56% drop in China, however it has reached $229.7M there and stands as the highest grossing studio film of the pandemic era in the market, also having passed the original release of the first Avatar.

The Top 10 overseas markets to date are: China ($229.7M), France ($129.8M), Germany ($117M), Korea ($96.9M), the UK ($81.9M), India ($57.9M), Australia ($55.1M), Mexico ($51.4M), Spain ($47M) and Italy ($45.3M).

BrianL

Doom Buggy Driver

- Joined

- Jul 24, 2013

- Messages

- 28,011

https://deadline.com/2023/01/avatar...r-global-international-box-office-1235236387/

‘Avatar: The Way Of Water’ Swims Past $2B Worldwide – International Box Office

By Nancy Tartaglione

International Box Office Editor/Senior Contributor

January 22, 2023 8:13am PST

Refresh for latest…: It’s now official, James Cameron’s Avatar: The Way of Water has become the sixth movie ever to cross the $2B mark worldwide. It is also the filmmaker’s third to hit the milestone, alongside Titanic and the original Avatar.

The mega-achievement was presaged ahead of the weekend with the global gross on the 20th Century Studios/Disney sequel now $2.024B through Sunday. That includes $1.426B from overseas turnstiles. This means that offshore, Way of Water has become the No. 4 title of all time, jumping past Avengers: Infinity War and behind only Avatar, Avengers: Endgame and Titanic. This gives Cameron bragging rights to three of the top four movies ever at the international box office.

On a worldwide basis, Way of Water remains the No. 6 film ever, with the Na’vi next set on leap-frogging Infinity War and Star Wars: The Force Awakens. When that happens later this week, the epic sci-fi adventure will become the No. 4 movie of all time globally – and give Cameron three of the top four.

Also globally, Avatar: The Way of Water has grossed $227M from IMAX, overtaking Star Wars: The Force Awakens to become the 2nd highest grossing movie in the format’s history.

This sixth weekend overall saw a 38% drop overseas, bringing in a further $53.6M. Owing to the opening of several titles for Lunar New Year (more to come below), Avatar 2 had a 56% drop in China, however it has reached $229.7M there and stands as the highest grossing studio film of the pandemic era in the market, also having passed the original release of the first Avatar.

The Top 10 overseas markets to date are: China ($229.7M), France ($129.8M), Germany ($117M), Korea ($96.9M), the UK ($81.9M), India ($57.9M), Australia ($55.1M), Mexico ($51.4M), Spain ($47M) and Italy ($45.3M).

To be the director responsible for 3 of the top 6 movies of all time and 3 above $2 Billion is absolutely incredible! James Cameron is just on another level.

wabbott

DIS Veteran

- Joined

- Aug 4, 2021

- Messages

- 6,977

"It ain't bragging if you can do it." Dizzy DeanTo be the director responsible for 3 of the top 6 movies of all time and 3 above $2 Billion is absolutely incredible! James Cameron is just on another level.

wabbott

DIS Veteran

- Joined

- Aug 4, 2021

- Messages

- 6,977

https://www.tmz.com/2023/01/22/james-cameron-2-billion-movies-avatar-box-office/

James Cameron Only Director With Three $2-Billion Movies!!!

1/22/2023 5:35 PM PST

James Cameron joined an exclusive club Sunday -- one that includes only himself ... he's the sole director in history with three movies that have crossed a huge money milestone.

That benchmark is the $2-billion line, which his latest film -- 'Avatar: The Way of Water' -- crossed Sunday ... now marking the third such flick of his to have achieved it at the international box office. His other two crown jewels ... 'Avatar' ($2.9B) and 'Titanic' ($2.1B).

Only three other films have passed $2 bil ... all of 'em Disney-owned. There's 'Avengers: Endgame' (#2, $2.7B), 'Star Wars: Episode VII - The Force Awakens' (#4, $2.071B) and 'Avengers: Infinity War' (#5, $2.052B). 'Avatar 2' is now the 6th highest grossing movie ever.

Prior to this weekend's accomplishment, Cameron shared the space with the Russo Bros. ... who directed both 'Avengers' films -- but he's surpassed them and is in a league of his own.

Remember, 'Way of Water' only came out in theaters a month and change ago -- so it's reached this massive amount of ticket sales in a record time ... although, the Russos technically got there faster. Whereas it only took 37 days for 'A2' to cross the $2-billion finish line, 'Endgame' swallowed that up back in 2019 ... ringing that bell in an astounding 11 days.

Safe to say, JC's latest installment has become profitable ... and there'll surely be more sequels. That wasn't necessarily guaranteed though -- in fact, the flick had a slow start when it opened on Dec. 16 ... and there were doubts if it had the legs to go to the distance.

In a time when box office numbers simply aren't what they used to be ... James Cameron seems to be a constant through and through. Get this man on another film set, STAT!

James Cameron Only Director With Three $2-Billion Movies!!!

1/22/2023 5:35 PM PST

James Cameron joined an exclusive club Sunday -- one that includes only himself ... he's the sole director in history with three movies that have crossed a huge money milestone.

That benchmark is the $2-billion line, which his latest film -- 'Avatar: The Way of Water' -- crossed Sunday ... now marking the third such flick of his to have achieved it at the international box office. His other two crown jewels ... 'Avatar' ($2.9B) and 'Titanic' ($2.1B).

Only three other films have passed $2 bil ... all of 'em Disney-owned. There's 'Avengers: Endgame' (#2, $2.7B), 'Star Wars: Episode VII - The Force Awakens' (#4, $2.071B) and 'Avengers: Infinity War' (#5, $2.052B). 'Avatar 2' is now the 6th highest grossing movie ever.

Prior to this weekend's accomplishment, Cameron shared the space with the Russo Bros. ... who directed both 'Avengers' films -- but he's surpassed them and is in a league of his own.

Remember, 'Way of Water' only came out in theaters a month and change ago -- so it's reached this massive amount of ticket sales in a record time ... although, the Russos technically got there faster. Whereas it only took 37 days for 'A2' to cross the $2-billion finish line, 'Endgame' swallowed that up back in 2019 ... ringing that bell in an astounding 11 days.

Safe to say, JC's latest installment has become profitable ... and there'll surely be more sequels. That wasn't necessarily guaranteed though -- in fact, the flick had a slow start when it opened on Dec. 16 ... and there were doubts if it had the legs to go to the distance.

In a time when box office numbers simply aren't what they used to be ... James Cameron seems to be a constant through and through. Get this man on another film set, STAT!

I’m sure Iger is breathing a huge sigh of relief About Avatar crossing the 2 billion mark, especially after James Cameron’s interviews Which indicated the movie might need to make 2 billion to “break even”. People have disputed that number since then, and it is good that the movie is profitable.

I’d love to know what the ROI is going to end up being on the movie, and how they even will calculate that!

I’d love to know what the ROI is going to end up being on the movie, and how they even will calculate that!

wabbott

DIS Veteran

- Joined

- Aug 4, 2021

- Messages

- 6,977

Robert Iger

@RobertIger

·

21h

Congratulations to @JimCameron, @JonLandau, & the entire @20thcentury team who worked on #AvatarTheWayOfWater

variety.com

‘Avatar: The Way of Water’ Becomes Sixth Film in History to Surpass $2 Billion Globally

After just six weeks of release, James Cameron's blockbuster sequel "Avatar: The Way of Water" has surpassed $2 billion in global ticket sales.

wabbott

DIS Veteran

- Joined

- Aug 4, 2021

- Messages

- 6,977

https://www.cnbc.com/2023/01/24/wells-fargo-gives-a-bullish-endorsement-to-beleaguered-disney-.html

Wells Fargo gives a bullish endorsement to a beleaguered Disney. We’re awaiting Iger’s turnaround plan

Published Tue, Jan 24 20234:45 PM EST

Paulina Likos

Wells Fargo on Tuesday said it expects Walt Disney (DIS) to “come out swinging” when the entertainment conglomerate reports fiscal first-quarter results early next month.

At the Club, we’re slightly more cautious and will be looking closely for a detailed turnaround plan from CEO Bob Iger.

When Disney releases its first-quarter earnings on Feb. 8, analysts expect earnings-per-share to come in at 80 cents a share, down 24.5% from the same period last year, while total revenue should climb 7% year-over-year, to $23.35 billion, according to estimates from Refinitiv.

“We think DIS management will come out swinging on the F1Q23 call to fend off criticism. We see a refocus on [intellectual property] instead of [subscriber targets], aggressive cost action and the potential for earnings upgrades. We like this setup into the print,” Wells Fargo analysts wrote in a research note.

The analysts predicted Disney’s financial performance could improve if the company revives its focus on generating revenue from intellectual property assets like brands, characters and properties associated the classic entertainment franchise, rather than chasing direct-to-consumer subscriber targets.

At the same time, Wells Fargo forecasted Disney could announce a roughly $2 billion cost-cutting plan at its direct-to-consumer (DTC) business — mainly comprised of its beleaguered streaming operations — to jump start profitability by early fiscal year 2024. The streaming division includes Disney+, Hulu and ESPN+.

Disney launched an advertising tier for Disney+ in early December, but the company has said it doesn’t expect to reap the rewards until later this year.

Disney suffered a $1.47 billion operating loss at its DTC unit in the company’s fiscal fourth — a dismal quarter that prompted the board to oust CEO Bob Chapek and return veteran Disney executive Bob Iger to the corner office.

The run-up to Disney’s next earnings release comes as Nelson Peltz, the CEO and founder of activist investment firm Trian Partners, has been waging an ongoing proxy battle to gain a seat on Disney’s board.

Peltz has said he wants to “work collaboratively with Bob Iger and other directors to take decisive action that will result in improved operations and financial performance.”

Disney’s board earlier this month unanimously decided against offering Peltz a seat, according to a recent SEC filing. Trian currently holds a nearly $1 billion stake in Disney.

Like other investors — including the Club — Trian has expressed frustration over Disney’s streaming losses, overspending and a share price decline of more than 44% last year. Shares of Disney have climbed by more than 21% since the start of 2023.

“Trian wants a higher stock price and is going to push management to decisions that it believes will deliver that aim,” according to Wells Fargo.

The bank reiterated its overweight, or buy, rating on Disney, with a price target of $125 a share. Disney closed out Tuesday up 0.29%, at $106 apiece.

The Club take

Disney’s upcoming earnings will be a chance for Iger to recalibrate the company’s strategy and address some of the pain points investors are worried about, including excess spending, debilitating losses in streaming and a deteriorating balance sheet. If the company announces a robust and comprehensive plan to rein in costs, it could help improve Disney’s profitability over the long run and allow the stock to move higher. As we have argued for months, many companies — particularly those in the technology space — need to make a pivot toward profitability, and we think cost reductions would be well received by the market.

We remain guardedly optimistic that Iger, who in his prior postings as CEO and chairman helped generate value for an iconic company, can right the ship at this pivotal moment. But we are also in support of Peltz joining the board because he would push for the cost discipline the company sorely needs.

(Jim Cramer’s Charitable Trust is long DIS. See here for a full list of the stocks.) As a subscriber to the CNBC Investing Club with Jim Cramer, you will receive a trade alert before Jim makes a trade. Jim waits 45 minutes after sending a trade alert before buying or selling a stock in his charitable trust’s portfolio. If Jim has talked about a stock on CNBC TV, he waits 72 hours after issuing the trade alert before executing the trade

Wells Fargo gives a bullish endorsement to a beleaguered Disney. We’re awaiting Iger’s turnaround plan

Published Tue, Jan 24 20234:45 PM EST

Paulina Likos

Wells Fargo on Tuesday said it expects Walt Disney (DIS) to “come out swinging” when the entertainment conglomerate reports fiscal first-quarter results early next month.

At the Club, we’re slightly more cautious and will be looking closely for a detailed turnaround plan from CEO Bob Iger.

When Disney releases its first-quarter earnings on Feb. 8, analysts expect earnings-per-share to come in at 80 cents a share, down 24.5% from the same period last year, while total revenue should climb 7% year-over-year, to $23.35 billion, according to estimates from Refinitiv.

“We think DIS management will come out swinging on the F1Q23 call to fend off criticism. We see a refocus on [intellectual property] instead of [subscriber targets], aggressive cost action and the potential for earnings upgrades. We like this setup into the print,” Wells Fargo analysts wrote in a research note.

The analysts predicted Disney’s financial performance could improve if the company revives its focus on generating revenue from intellectual property assets like brands, characters and properties associated the classic entertainment franchise, rather than chasing direct-to-consumer subscriber targets.

At the same time, Wells Fargo forecasted Disney could announce a roughly $2 billion cost-cutting plan at its direct-to-consumer (DTC) business — mainly comprised of its beleaguered streaming operations — to jump start profitability by early fiscal year 2024. The streaming division includes Disney+, Hulu and ESPN+.

Disney launched an advertising tier for Disney+ in early December, but the company has said it doesn’t expect to reap the rewards until later this year.

Disney suffered a $1.47 billion operating loss at its DTC unit in the company’s fiscal fourth — a dismal quarter that prompted the board to oust CEO Bob Chapek and return veteran Disney executive Bob Iger to the corner office.

The run-up to Disney’s next earnings release comes as Nelson Peltz, the CEO and founder of activist investment firm Trian Partners, has been waging an ongoing proxy battle to gain a seat on Disney’s board.

Peltz has said he wants to “work collaboratively with Bob Iger and other directors to take decisive action that will result in improved operations and financial performance.”

Disney’s board earlier this month unanimously decided against offering Peltz a seat, according to a recent SEC filing. Trian currently holds a nearly $1 billion stake in Disney.

Like other investors — including the Club — Trian has expressed frustration over Disney’s streaming losses, overspending and a share price decline of more than 44% last year. Shares of Disney have climbed by more than 21% since the start of 2023.

“Trian wants a higher stock price and is going to push management to decisions that it believes will deliver that aim,” according to Wells Fargo.

The bank reiterated its overweight, or buy, rating on Disney, with a price target of $125 a share. Disney closed out Tuesday up 0.29%, at $106 apiece.

The Club take

Disney’s upcoming earnings will be a chance for Iger to recalibrate the company’s strategy and address some of the pain points investors are worried about, including excess spending, debilitating losses in streaming and a deteriorating balance sheet. If the company announces a robust and comprehensive plan to rein in costs, it could help improve Disney’s profitability over the long run and allow the stock to move higher. As we have argued for months, many companies — particularly those in the technology space — need to make a pivot toward profitability, and we think cost reductions would be well received by the market.

We remain guardedly optimistic that Iger, who in his prior postings as CEO and chairman helped generate value for an iconic company, can right the ship at this pivotal moment. But we are also in support of Peltz joining the board because he would push for the cost discipline the company sorely needs.

(Jim Cramer’s Charitable Trust is long DIS. See here for a full list of the stocks.) As a subscriber to the CNBC Investing Club with Jim Cramer, you will receive a trade alert before Jim makes a trade. Jim waits 45 minutes after sending a trade alert before buying or selling a stock in his charitable trust’s portfolio. If Jim has talked about a stock on CNBC TV, he waits 72 hours after issuing the trade alert before executing the trade

wabbott

DIS Veteran

- Joined

- Aug 4, 2021

- Messages

- 6,977

Another decent gain today, even as the major indices were close to flat.

https://finance.yahoo.com/quote/DIS?p=DIS

108.12+2.12 (+2.00%)

At close: 04:05PM EST

https://finance.yahoo.com/quote/DIS?p=DIS

108.12+2.12 (+2.00%)

At close: 04:05PM EST

Up more than 25% from it's low less than a month ago. And the S&P was only up 5% in that time. It seems the streamers all bottomed around a month ago, WBD is up almost 50%...that would have been a nice buy.Another decent gain today, even as the major indices were close to flat.

https://finance.yahoo.com/quote/DIS?p=DIS

108.12+2.12 (+2.00%)

At close: 04:05PM EST

wabbott

DIS Veteran

- Joined

- Aug 4, 2021

- Messages

- 6,977

https://www.fool.com/investing/2023...hoo-host&utm_medium=feed&utm_campaign=article

Netflix's Q4 Subscriber Growth Clearly Came at a Cost

By James Brumley – Jan 26, 2023 at 9:45AM

The company can't afford for last quarter's spending pattern to become the new norm.

The good news is that Netflix (NFLX -0.26%) added nearly 7.7 million paying customers during the fourth quarter of last year, handily topping expectations. The bad news is that net subscriber growth came at a price.

That's the big takeaway from Netflix's quarterly results. The top line is now quietly contracting as is the bottom line, and the company can't afford for the crimped results to become the norm.

If this sort of spending is the shape of things to come (and it very likely could be), current and would-be shareholders might want to rethink their expectations.

For the first time in recent history (and despite the best subscriber growth seen in the past four quarters), Netflix's top line has now slumped for a second quarter in a row. That's because the bulk of its recent customer growth is overseas, where the company's monthly rates are lower.

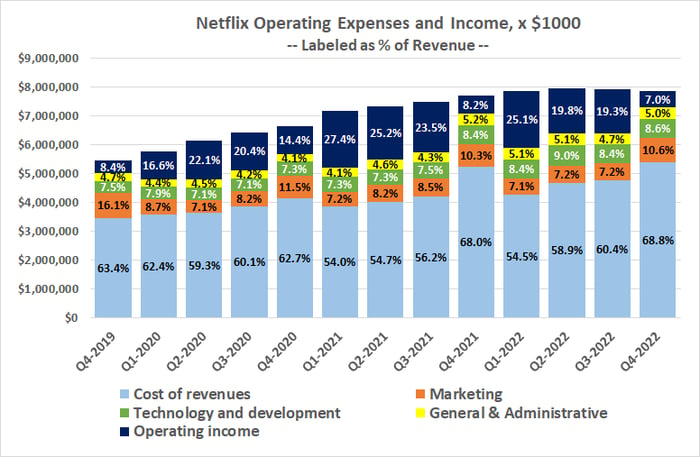

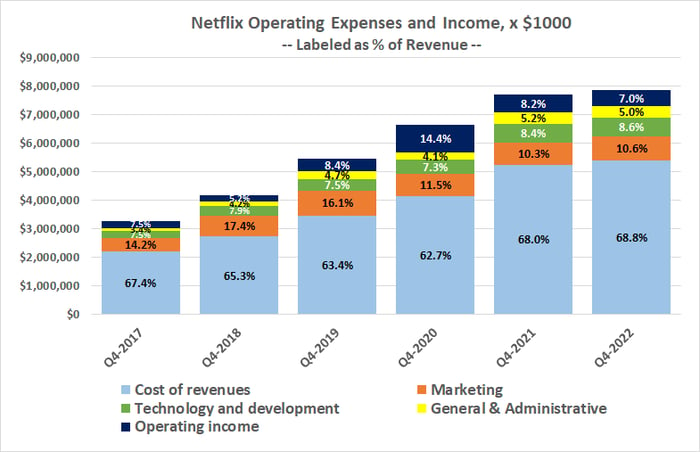

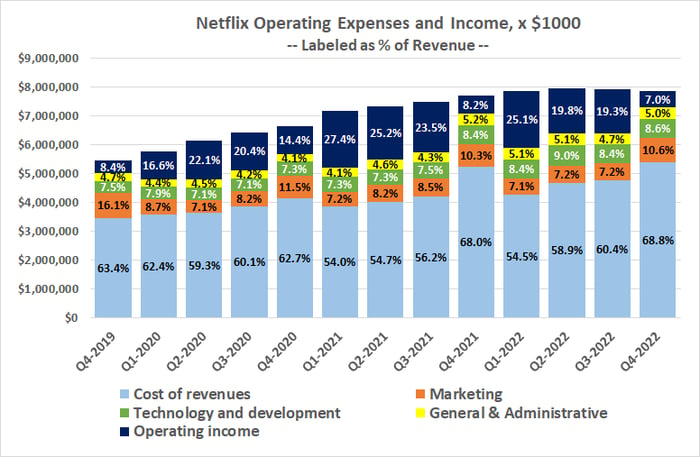

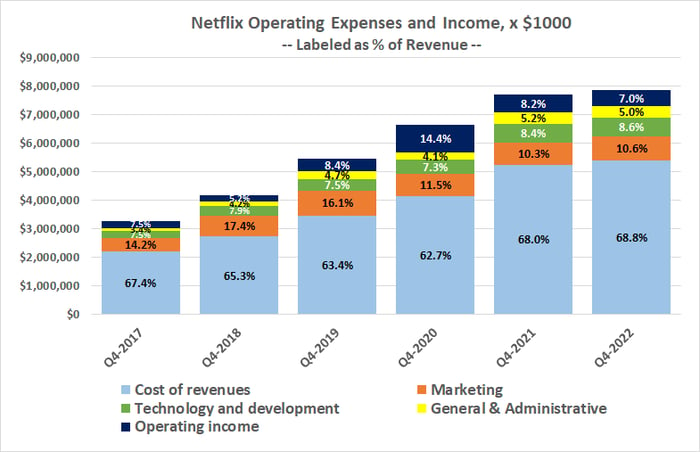

In the meantime, average revenue per user fell last quarter in all four of its key geographic markets. Also, Netflix's marketing and technology costs along with its cost of revenue (the price of buying or producing its programming) reached their highest relative levels in years. That drove operating-income margins to their weakest level in years.

Data source: Netflix. Chart by author.

To put that into perspective, the chart below shows the fourth-quarter operating expenses and income from the last six years. It shows that Netflix tends to spend heavily on marketing and content near the end of the year; it appears the company makes a big promotional push around the holidays. Nevertheless, even by fourth-quarter standards, the 2022 final quarter was alarmingly expensive, biting into profits.

Data source: Netflix. Chart by author.

It's a red flag simply because Netflix's revenue has more than doubled over the past five years. This sort of scale-up in the company's operating expenses should be driving wider profit margins and lower relative costs. But things are the other way around.

Amazon indicated there were over 200 million Prime subscribers in 2021. But that was in the throes of the pandemic, when the world was still doing much of its shopping online.

Also know that Netflix is cash flow positive, and believes it will at least improve last year's cash flow on the order of 50% this year. But that outlook is in question given how Netflix's share of the streaming market is shrinking.

Market researcher Kantar reports that Amazon's Prime, Paramount, Disney's Hulu, Warner Bros. Discovery's HBO Max, and Comcast's Peacock all saw more U.S. customer signups than Netflix has in every quarter between the third quarter of last year and the third quarter of this year.

Netflix's revenue peak and weakening margins are taking shape right as all of these and other streaming services are just reaching their full stride. That can't be a coincidence.

Netflix is hardly doomed. Indeed, the last quarter might simply reflect a highly unusual, circumstantial surge in operating expenses. But the fourth quarter might also be an indication of the spending needed to keep its platform competitive with so many streaming newcomers now finding their sea legs.

If you own Netflix or are considering it, you'll want to see clear progress in the other direction three months from now. It's a tough name to step into in the meantime.

Netflix's Q4 Subscriber Growth Clearly Came at a Cost

By James Brumley – Jan 26, 2023 at 9:45AM

Key Points

- The fourth-quarter margin was the lowest in several quarters, including during the pandemic.

- Netflix's costs have been growing and profitability has been shrinking in step with rising competition.

- Investors will want to ensure last quarter's required spending isn't an indication of what's to come.

The company can't afford for last quarter's spending pattern to become the new norm.

The good news is that Netflix (NFLX -0.26%) added nearly 7.7 million paying customers during the fourth quarter of last year, handily topping expectations. The bad news is that net subscriber growth came at a price.

That's the big takeaway from Netflix's quarterly results. The top line is now quietly contracting as is the bottom line, and the company can't afford for the crimped results to become the norm.

If this sort of spending is the shape of things to come (and it very likely could be), current and would-be shareholders might want to rethink their expectations.

Netflix's operating costs are on the rise

The fourth quarter might have been a one-off in terms of waning revenue and growing costs. But with the streaming market's maturing competition, dismissing last quarter's poor profit margins as a fluke is risky.For the first time in recent history (and despite the best subscriber growth seen in the past four quarters), Netflix's top line has now slumped for a second quarter in a row. That's because the bulk of its recent customer growth is overseas, where the company's monthly rates are lower.

In the meantime, average revenue per user fell last quarter in all four of its key geographic markets. Also, Netflix's marketing and technology costs along with its cost of revenue (the price of buying or producing its programming) reached their highest relative levels in years. That drove operating-income margins to their weakest level in years.

Data source: Netflix. Chart by author.

To put that into perspective, the chart below shows the fourth-quarter operating expenses and income from the last six years. It shows that Netflix tends to spend heavily on marketing and content near the end of the year; it appears the company makes a big promotional push around the holidays. Nevertheless, even by fourth-quarter standards, the 2022 final quarter was alarmingly expensive, biting into profits.

Data source: Netflix. Chart by author.

It's a red flag simply because Netflix's revenue has more than doubled over the past five years. This sort of scale-up in the company's operating expenses should be driving wider profit margins and lower relative costs. But things are the other way around.

The unsurprising sign of stiffer competition

More competitors are the reason for this trend -- even if Netflix is still the king of streaming. It had 230.7 million subscribers as of the end of last year. The nearest single platform with a confirmed figure of paying customers is Walt Disney's Disney+, with 152.1 million as of July.Amazon indicated there were over 200 million Prime subscribers in 2021. But that was in the throes of the pandemic, when the world was still doing much of its shopping online.

Also know that Netflix is cash flow positive, and believes it will at least improve last year's cash flow on the order of 50% this year. But that outlook is in question given how Netflix's share of the streaming market is shrinking.

Market researcher Kantar reports that Amazon's Prime, Paramount, Disney's Hulu, Warner Bros. Discovery's HBO Max, and Comcast's Peacock all saw more U.S. customer signups than Netflix has in every quarter between the third quarter of last year and the third quarter of this year.

Netflix's revenue peak and weakening margins are taking shape right as all of these and other streaming services are just reaching their full stride. That can't be a coincidence.

Netflix is hardly doomed. Indeed, the last quarter might simply reflect a highly unusual, circumstantial surge in operating expenses. But the fourth quarter might also be an indication of the spending needed to keep its platform competitive with so many streaming newcomers now finding their sea legs.

If you own Netflix or are considering it, you'll want to see clear progress in the other direction three months from now. It's a tough name to step into in the meantime.

D+ was the canary in the coal mine for the streamers - Comcast losing big in Peacock too...

https://finance.yahoo.com/news/comc...eacock-after-losing-978m-in-q4-170435589.html

https://finance.yahoo.com/news/comc...eacock-after-losing-978m-in-q4-170435589.html

Jrb1979

DIS Veteran

- Joined

- Dec 2, 2018

- Messages

- 5,086

I'm not at all surprised. I won't be shocked Disney+ will be in the same boat this quarter as well. The way all companies are using streaming doesn't work and it will continue to lose money. It costs way too much money to make new content and the price point for all streaming is too low for that to continue. IMO for any of these to be profitable they need to be at the $40-50 mark of higher. The problem with that is you're basically back to what cable cost.D+ was the canary in the coal mine for the streamers - Comcast losing big in Peacock too...

https://finance.yahoo.com/news/comc...eacock-after-losing-978m-in-q4-170435589.html

It's why I don't see streaming ever being a replacement for regular TV. I have always been of the belief if should be an add on to regular TV not the replacement. Keep your regular shows on regular networks and release the season on your streaming service when the season is over. Same goes for movies. Stop giving them away just for new content. Put it in theatres to get some money, then make it as an additional cost to view for the first 6 to 7 months.

Agreed. I think I said it on one of our stock threads a while back that I always thought the original concept of Hulu made the most sense - all the major broadcast/cable networks putting their aired shows all in one place. Make it a value add - give it away for free or a nominal amount to your cable subscribers and charge more for it to streaming only customers. Air everything exclusively on linear networks first then move them to streaming - no extra cost for streaming only stuff, since your already making stuff for the networks.I'm not at all surprised. I won't be shocked Disney+ will be in the same boat this quarter as well. The way all companies are using streaming doesn't work and it will continue to lose money. It costs way too much money to make new content and the price point for all streaming is too low for that to continue. IMO for any of these to be profitable they need to be at the $40-50 mark of higher. The problem with that is you're basically back to what cable cost.

It's why I don't see streaming ever being a replacement for regular TV. I have always been of the belief if should be an add on to regular TV not the replacement. Keep your regular shows on regular networks and release the season on your streaming service when the season is over. Same goes for movies. Stop giving them away just for new content. Put it in theatres to get some money, then make it as an additional cost to view for the first 6 to 7 months.

Similarly, D+ could work as a low cost way to acccess 100 years of the Disney library (and Fox, Lucas, etc) and add new stuff after theatrical runs. Again, no extra productions needed and its a great value proposition to the consumer - for the price of a few DVD's you get access to it all for a year.

wabbott

DIS Veteran

- Joined

- Aug 4, 2021

- Messages

- 6,977

https://www.fool.com/investing/2023...hoo-host&utm_medium=feed&utm_campaign=article

Disney and SeaWorld Investors Should Pay Attention to Comcast's New Report

By Rick Munarriz – Jan 26, 2023 at 11:45AM

Theme parks account for just 6% of Comcast's business, but they're a bigger part of the Disney and SeaWorld Entertainment business models.

Comcast tends to set the tone ahead of the regional amusement park operators that will also report shortly, but Cedar Fair and Six Flags have limited seasonal operations at many of their parks in the fourth quarter.

Comcast's theme parks deliver double-digit growth ahead of the other publicly traded players offering their quarterly updates.

Universal Studios parent Comcast (CMCSA 0.77%) reported fresh financials on Thursday morning. There are many moving parts to the media and connectivity giant. It's the country's leading provider of internet access and cable TV through its Xfinity banner. It's a major player in content through NBCUniversal.

Comcast also operates several popular gated attractions, and as the first of the five publicly traded companies with major interests in theme parks and amusement parks that reports every earnings season it's an update that shareholders in Walt Disney (DIS 1.46%) and SeaWorld Entertainment (SEAS 0.52%) can't ignore. Six Flags (SIX -0.22%) and Cedar Fair (FUN 1.11%) investors should also pay attention, but that's more important during the springtime and summertime quarters when the largely seasonal regional amusement park operators derive most of their revenue and all of their profits.

Image source: Comcast.

Like Disney+, Peacock keeps growing. Its subscriber base has doubled to 20 million over the past year with revenue tripling in that time. The 5 million net additions it landed during the fourth quarter is a record for the fledgling streaming platform. However, also like Disney+, losses continue to widen as investments are made to to grow the audience.

In light of all of the ho-hum in the Comcast report, its theme parks segment is a relative winner. Revenue rose 12% for the final three months of 2022 compared to the prior year's holiday quarter. Adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) climbed an even healthier 16%. Only Comcast's studio -- benefiting from a couple of successful releases and folks returning to the multiplex -- and its nascent wireless subsidiaries fared better than the theme parks segment.

Investors with a keen sense of short-term financial history will point out that this is a big step down from where the Universal Studios theme parks were just three months ago. The segment clocked in with 42% year-over-year growth in revenue for the third quarter with an 89% surge in adjusted EBITDA. This shouldn't be a deal breaker.

Universal Studios Beijing opened in September 2021, making this the first time in which the Chinese resort was open for the entirety of the two comparable quarters. The parks in Japan and California also had COVID-19-related closures earlier in 2021 and reopened with tighter capacity controls. Investors are now seeing comparisons on an apples-to-apples -- or coasters-to-coasters -- basis. Low double-digit growth is a good thing, especially in the current climate as consumers are getting a little tighter with their disposable income.

Disney and SeaWorld won't report their quarterly results until next month. They should also match the sequential deceleration that Comcast just reported. SeaWorld shareholders would be delighted if they were able to match Comcast's performance. Analysts are holding out for a mere 3% year-over-year increase in revenue on a 21% decline in earnings per share. Wall Street pros offer quarterly targets for Disney as a whole, and not its individual segments.

Disney, SeaWorld, Six Flags, and Cedar Fair investors still need to pay attention, and perhaps even more so than Comcast where theme parks made up just 6% of the revenue and 7% of the adjusted EBITDA for all of 2022. It's a small part of the Comcast report, but gated attractions are a much larger part of the Disney revenue mix and make up the entirety of the financials for SeaWorld, Six Flags, and Cedar Fair. Take notes now. They will come in handy with four financial updates that will happen in the coming weeks.

Disney and SeaWorld Investors Should Pay Attention to Comcast's New Report

By Rick Munarriz – Jan 26, 2023 at 11:45AM

Key Points

Comcast's theme parks segment saw its revenue and adjusted EBITDA rise 12% and 16%, respectively, in its latest quarter.Theme parks account for just 6% of Comcast's business, but they're a bigger part of the Disney and SeaWorld Entertainment business models.

Comcast tends to set the tone ahead of the regional amusement park operators that will also report shortly, but Cedar Fair and Six Flags have limited seasonal operations at many of their parks in the fourth quarter.

Comcast's theme parks deliver double-digit growth ahead of the other publicly traded players offering their quarterly updates.

Universal Studios parent Comcast (CMCSA 0.77%) reported fresh financials on Thursday morning. There are many moving parts to the media and connectivity giant. It's the country's leading provider of internet access and cable TV through its Xfinity banner. It's a major player in content through NBCUniversal.

Comcast also operates several popular gated attractions, and as the first of the five publicly traded companies with major interests in theme parks and amusement parks that reports every earnings season it's an update that shareholders in Walt Disney (DIS 1.46%) and SeaWorld Entertainment (SEAS 0.52%) can't ignore. Six Flags (SIX -0.22%) and Cedar Fair (FUN 1.11%) investors should also pay attention, but that's more important during the springtime and summertime quarters when the largely seasonal regional amusement park operators derive most of their revenue and all of their profits.

Image source: Comcast.

Let's go for a ride

Thursday morning's fourth-quarter results weren't exactly impressive. Comcast's baseline numbers were largely flat with revenue rising a mere 0.7% and adjusted net income slipping 0.4%. Cord-cutters continue to eat into its flagship cable TV business. It suffered a rare sequential dip in broadband accounts, but argues that it would've been marginally positive if not for the negative impact of Hurricane Ian displacing some of its customers.Like Disney+, Peacock keeps growing. Its subscriber base has doubled to 20 million over the past year with revenue tripling in that time. The 5 million net additions it landed during the fourth quarter is a record for the fledgling streaming platform. However, also like Disney+, losses continue to widen as investments are made to to grow the audience.

In light of all of the ho-hum in the Comcast report, its theme parks segment is a relative winner. Revenue rose 12% for the final three months of 2022 compared to the prior year's holiday quarter. Adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) climbed an even healthier 16%. Only Comcast's studio -- benefiting from a couple of successful releases and folks returning to the multiplex -- and its nascent wireless subsidiaries fared better than the theme parks segment.

Investors with a keen sense of short-term financial history will point out that this is a big step down from where the Universal Studios theme parks were just three months ago. The segment clocked in with 42% year-over-year growth in revenue for the third quarter with an 89% surge in adjusted EBITDA. This shouldn't be a deal breaker.

Universal Studios Beijing opened in September 2021, making this the first time in which the Chinese resort was open for the entirety of the two comparable quarters. The parks in Japan and California also had COVID-19-related closures earlier in 2021 and reopened with tighter capacity controls. Investors are now seeing comparisons on an apples-to-apples -- or coasters-to-coasters -- basis. Low double-digit growth is a good thing, especially in the current climate as consumers are getting a little tighter with their disposable income.

Disney and SeaWorld won't report their quarterly results until next month. They should also match the sequential deceleration that Comcast just reported. SeaWorld shareholders would be delighted if they were able to match Comcast's performance. Analysts are holding out for a mere 3% year-over-year increase in revenue on a 21% decline in earnings per share. Wall Street pros offer quarterly targets for Disney as a whole, and not its individual segments.

Disney, SeaWorld, Six Flags, and Cedar Fair investors still need to pay attention, and perhaps even more so than Comcast where theme parks made up just 6% of the revenue and 7% of the adjusted EBITDA for all of 2022. It's a small part of the Comcast report, but gated attractions are a much larger part of the Disney revenue mix and make up the entirety of the financials for SeaWorld, Six Flags, and Cedar Fair. Take notes now. They will come in handy with four financial updates that will happen in the coming weeks.

wabbott

DIS Veteran

- Joined

- Aug 4, 2021

- Messages

- 6,977

I'm not at all surprised. I won't be shocked Disney+ will be in the same boat this quarter as well. The way all companies are using streaming doesn't work and it will continue to lose money. It costs way too much money to make new content and the price point for all streaming is too low for that to continue. IMO for any of these to be profitable they need to be at the $40-50 mark of higher. The problem with that is you're basically back to what cable cost.

It's why I don't see streaming ever being a replacement for regular TV. I have always been of the belief if should be an add on to regular TV not the replacement. Keep your regular shows on regular networks and release the season on your streaming service when the season is over. Same goes for movies. Stop giving them away just for new content. Put it in theatres to get some money, then make it as an additional cost to view for the first 6 to 7 months.

The problem is there is an almost unlimited inventory of content (intellectual property) out there free for the taking.that the new streaming content has to compete against. Stuff on which the copyright has expired, and a lot of it very good tv shows and movies.

For example, for the past few weeks, we've been watching the old Roger Moore series from the 60s, The Saint. So we watch that instead of Hulu, or Netflix, or D+

Back when cable tv controlled what you saw and when, you only got to see what they chose for you. There are only so many eyeballs, and they have many, many more choices than just five years ago.

One of the articles upthread noted that every single day, more content is uploaded to youtube than is in the entire D+ library.

wabbott

DIS Veteran

- Joined

- Aug 4, 2021

- Messages

- 6,977

https://deadline.com/2023/01/disney-restructuring-layoffs-bob-iger-return-1235241668/

Disney Reorganization Looms Ahead Of First Earnings Report Since Bob Iger’s Return

By Dade Hayes, Nellie Andreeva, Dominic Patten

January 26, 2023 6:17pm PST

The initial exuberance and relief following Bob Iger’s return as Disney CEO has been replaced by anxiety as speculation about a pending corporate restructuring is intensifying — and with it, rumors about the layoffs that are likely to follow.

Rumblings of a new org-chart unveiling are growing louder amid mounting pressure on the company (including from activist investor Nelson Peltz) to stage a rebound with Iger back at the controls. Details on the restructuring moves, which could potentially include some sort of consolidation within the company’s marketing operations as well as at Disney Television Studios, are likely to emerge soon and could coincide with the company’s next quarterly earnings report February 8, sources tell Deadline.

And then there is the future of the Disney Media and Entertainment Distribution executive ranks.

Iger didn’t waste time issuing one high-profile pink slip after replacing Bob Chapek last November; not even a full day after his restoration to the corner office, DMED chairman Kareem Daniel left the company. Iger had made no secret of his dislike of DMED, which was created by Chapek as a way of centralizing distribution decisions under Daniel, a Chapek loyalist. The division mainly succeeded in fomenting resentment and mistrust, taking decision-making power away from the company’s creative leaders and straining creative relationships.

Disney did not respond to a request for comment from Deadline.

While DMED is going to be dismantled, there are questions about how the unwinding will happen and about the fate of the remaining executives. Atop the list are Debra OConnell, president of Networks for Disney Media & Entertainment Distribution, and her top lieutenant, head of business operations Chuck Saftler, both of whom highly respected within the company and beyond.

The longest-tenured FX employee having joined the network in December 1993, Saftler was an integral part of FX Networks chairman John Landgraf’s team before he was promoted to the DMED post. Saftler has been closely involved with the networks in his current role – he is credited with the recent ratings resurgence at FXX through the programming of off-network comedies and movie acquisitions. There are different takes on what would happen to him, but it is conceivable he could remain part of the close-knit group of FX executives who have been together for decades.

Another area drawing a lot of speculation is Disney Television Studios, which consists of 20th Television, ABC Signature, 20th Animation and Walt Disney Television Alternative. (Additionally, there are two other separate TV production arms, FXP and Searchlight Television.)

The situation is reviving questions raised at the time of Disney’s $71.3 billion acquisition of Fox assets as to whether Disney would keep then-ABC Studios and 20th Century Fox Television separate. Ultimately, they did remain stand-alone studios with their own infrastructures, though Fox 21 Studios was folded into 20th TV, which is now run by Karey Burke. Meanwhile, 20th Television Animation was made a separate division led by Marci Proietto, and ABC Studios was rebranded as ABC Signature with Jonnie Davis at the helm.

The consolidation chatter is even stronger this time around, with various scenarios circulated about what divisions could be merged. Everything seems to be on the table.

A successful potential consolidation of 20th TV and ABC Signature will depend on melding their two very different cultures. “Can two fried eggs become an omelet?” a well-positioned observer asked. Dana Walden, who has risen to the role of chairman of Disney General Entertainment Content, does know plenty about bridging divides as the highest-ranking former Fox exec now in Burbank.

Walden just recently consolidated another area of the division she took over last summer, bringing back together publicity and communications years after they had been split. One position was eliminated as a result, with more cuts likely.

Deadline has heard that the movie studio, currently riding the success of Avatar: The Way of Water, is not expected to be part of the pending cuts. Any Disney layoffs out of the reorg may be smaller and more targeted than what we have seen from other Hollywood outlets in recent months, we hear. Part of that is the sprawling nature of the company. Now that some of the Chapek-era pricing issues have been addressed, and Iger has gone on a few team-building visits to Anaheim and Orlando, the ruptures at the revenue-rich Parks, Experiences and Products division seem to be starting to heal.

Reshaping the company won’t be easy, of course. Disney, like other media companies, is contending with the ongoing decline of linear television and the high cost of streaming, against the backdrop of a fragile economy and uncertain advertising climate.

At the heart of Disney’s bottom line issue, we’re told, is that sexiest of business lines: accounting.

Under the Byzantine nature of the company’s current system, the production company of a particular program or series sends a program to DMED. Then, via an inter-company transaction, DMED reimburses the production for the cost of said program or series. Most importantly to Wall Street, all losses sit on DMED’s books – which is not a good look. “How we fix that will determine in no small way, how Wall Street reacts,” said a Tinseltown dealmaker of Disney’s dilemma.

A primary focus of the cost-cutting effort is stimulating the stock price, whose decline prompted Peltz to initiate a proxy battle. Shares at the end of 2022 bottomed out at a multi-year low after Chapek presided over a disastrous quarterly report. As SEC filings after his exit made clear, he had lost the confidence of the board earlier in the year, further preventing a smooth re-emergence from the Covid cave. Peltz says he wants a seat on the company’s board of directors, a pitch that will go to a vote in March during what is apt to be the liveliest shareholder meeting since the Roy Disney-Michael Eisner affair in 2004.

Regaining the trust of the Street is Job 1 for Iger and the board. “Whatever it takes, whatever costs they have to cut, that’s what they’ll do,” one industry insider told Deadline. “Getting back in the Street’s good graces solves the Peltz and other activist investor issues, it solves shareholder grumbling, it solves everything, for now,” the insider added.

Disney stock, like many media issues at the start of this year, seems refreshed. While still well off its recent high point of $189 in early 2021, it closed Thursday up 1.5% at $108.45 and has risen 24% in 2023 to date.

Anthony D’Alessandro and Jill Goldsmith contributed to this report.

Disney Reorganization Looms Ahead Of First Earnings Report Since Bob Iger’s Return

By Dade Hayes, Nellie Andreeva, Dominic Patten

January 26, 2023 6:17pm PST

The initial exuberance and relief following Bob Iger’s return as Disney CEO has been replaced by anxiety as speculation about a pending corporate restructuring is intensifying — and with it, rumors about the layoffs that are likely to follow.

Rumblings of a new org-chart unveiling are growing louder amid mounting pressure on the company (including from activist investor Nelson Peltz) to stage a rebound with Iger back at the controls. Details on the restructuring moves, which could potentially include some sort of consolidation within the company’s marketing operations as well as at Disney Television Studios, are likely to emerge soon and could coincide with the company’s next quarterly earnings report February 8, sources tell Deadline.

And then there is the future of the Disney Media and Entertainment Distribution executive ranks.

Iger didn’t waste time issuing one high-profile pink slip after replacing Bob Chapek last November; not even a full day after his restoration to the corner office, DMED chairman Kareem Daniel left the company. Iger had made no secret of his dislike of DMED, which was created by Chapek as a way of centralizing distribution decisions under Daniel, a Chapek loyalist. The division mainly succeeded in fomenting resentment and mistrust, taking decision-making power away from the company’s creative leaders and straining creative relationships.

Disney did not respond to a request for comment from Deadline.

While DMED is going to be dismantled, there are questions about how the unwinding will happen and about the fate of the remaining executives. Atop the list are Debra OConnell, president of Networks for Disney Media & Entertainment Distribution, and her top lieutenant, head of business operations Chuck Saftler, both of whom highly respected within the company and beyond.

The longest-tenured FX employee having joined the network in December 1993, Saftler was an integral part of FX Networks chairman John Landgraf’s team before he was promoted to the DMED post. Saftler has been closely involved with the networks in his current role – he is credited with the recent ratings resurgence at FXX through the programming of off-network comedies and movie acquisitions. There are different takes on what would happen to him, but it is conceivable he could remain part of the close-knit group of FX executives who have been together for decades.

Another area drawing a lot of speculation is Disney Television Studios, which consists of 20th Television, ABC Signature, 20th Animation and Walt Disney Television Alternative. (Additionally, there are two other separate TV production arms, FXP and Searchlight Television.)

The situation is reviving questions raised at the time of Disney’s $71.3 billion acquisition of Fox assets as to whether Disney would keep then-ABC Studios and 20th Century Fox Television separate. Ultimately, they did remain stand-alone studios with their own infrastructures, though Fox 21 Studios was folded into 20th TV, which is now run by Karey Burke. Meanwhile, 20th Television Animation was made a separate division led by Marci Proietto, and ABC Studios was rebranded as ABC Signature with Jonnie Davis at the helm.

The consolidation chatter is even stronger this time around, with various scenarios circulated about what divisions could be merged. Everything seems to be on the table.

A successful potential consolidation of 20th TV and ABC Signature will depend on melding their two very different cultures. “Can two fried eggs become an omelet?” a well-positioned observer asked. Dana Walden, who has risen to the role of chairman of Disney General Entertainment Content, does know plenty about bridging divides as the highest-ranking former Fox exec now in Burbank.

Walden just recently consolidated another area of the division she took over last summer, bringing back together publicity and communications years after they had been split. One position was eliminated as a result, with more cuts likely.

Deadline has heard that the movie studio, currently riding the success of Avatar: The Way of Water, is not expected to be part of the pending cuts. Any Disney layoffs out of the reorg may be smaller and more targeted than what we have seen from other Hollywood outlets in recent months, we hear. Part of that is the sprawling nature of the company. Now that some of the Chapek-era pricing issues have been addressed, and Iger has gone on a few team-building visits to Anaheim and Orlando, the ruptures at the revenue-rich Parks, Experiences and Products division seem to be starting to heal.

Reshaping the company won’t be easy, of course. Disney, like other media companies, is contending with the ongoing decline of linear television and the high cost of streaming, against the backdrop of a fragile economy and uncertain advertising climate.

At the heart of Disney’s bottom line issue, we’re told, is that sexiest of business lines: accounting.

Under the Byzantine nature of the company’s current system, the production company of a particular program or series sends a program to DMED. Then, via an inter-company transaction, DMED reimburses the production for the cost of said program or series. Most importantly to Wall Street, all losses sit on DMED’s books – which is not a good look. “How we fix that will determine in no small way, how Wall Street reacts,” said a Tinseltown dealmaker of Disney’s dilemma.

A primary focus of the cost-cutting effort is stimulating the stock price, whose decline prompted Peltz to initiate a proxy battle. Shares at the end of 2022 bottomed out at a multi-year low after Chapek presided over a disastrous quarterly report. As SEC filings after his exit made clear, he had lost the confidence of the board earlier in the year, further preventing a smooth re-emergence from the Covid cave. Peltz says he wants a seat on the company’s board of directors, a pitch that will go to a vote in March during what is apt to be the liveliest shareholder meeting since the Roy Disney-Michael Eisner affair in 2004.

Regaining the trust of the Street is Job 1 for Iger and the board. “Whatever it takes, whatever costs they have to cut, that’s what they’ll do,” one industry insider told Deadline. “Getting back in the Street’s good graces solves the Peltz and other activist investor issues, it solves shareholder grumbling, it solves everything, for now,” the insider added.

Disney stock, like many media issues at the start of this year, seems refreshed. While still well off its recent high point of $189 in early 2021, it closed Thursday up 1.5% at $108.45 and has risen 24% in 2023 to date.

Anthony D’Alessandro and Jill Goldsmith contributed to this report.

wabbott

DIS Veteran

- Joined

- Aug 4, 2021

- Messages

- 6,977

https://deadline.com/2023/01/avatar...gs-all-time-titanic-james-cameron-1235241579/

International Box Office Editor/Senior Contributor

January 26, 2023 11:10am PST

With Wednesday’s worldwide box office grosses included, James Cameron’s Avatar: The Way of Water has surpassed $2.054B globally, and jumped up a notch on the all-time worldwide chart.

Globally through yesterday, the epic sci-fi adventure passed Avengers: Infinity War ($2,052M) with $2,054.7M to become the No. 5 highest-grossing movie ever worldwide.

As we wrote on Sunday, this advance was expected this week, while the next film in the sights for Avatar: The Way of Water to beat is Star Wars: The Force Awakens. That will happen across the coming days and give James Cameron three of the top four highest-grossing titles globally.

After that, can the filmmaker’s Way of Water beat his own Titanic? Through Wednesday, Way of Water is about $135M away, and is expected to pass the tragic story of Rose and Jack. However, there’s an asterisk here since Paramount is doing a Titanic global rerelease in time for Valentine’s Day — so, maybe it’s a jockeying as we saw not too long ago with Avengers: Endgame and the original Avatar .

We’ll see how things shake out over the coming days, but there’s no denying that WoW (and its predecessors like Top Gun: Maverick and others) are giving everyone a reason to go back to the movies

At the international box office, Way of Water currently stands as the 4th highest-grossing release of all time with $1,451.3M.

On Wednesday, Way of Water added $7.8M overseas where its top markets are: China ( $232.8M), France ($132.2M), Germany ($118.5M), Korea ($100.7M), the UK ($82.8M), India ($58.2M), Australia ($56.4M), Mexico ($52M), Spain ($47.5M) and Italy ($45.6M).

‘Avatar 2’ Rises To No. 5 On All-Time Global Chart; Will It Overtake ‘Titanic’ Next?

By Nancy TartaglioneInternational Box Office Editor/Senior Contributor

January 26, 2023 11:10am PST

With Wednesday’s worldwide box office grosses included, James Cameron’s Avatar: The Way of Water has surpassed $2.054B globally, and jumped up a notch on the all-time worldwide chart.

Globally through yesterday, the epic sci-fi adventure passed Avengers: Infinity War ($2,052M) with $2,054.7M to become the No. 5 highest-grossing movie ever worldwide.

As we wrote on Sunday, this advance was expected this week, while the next film in the sights for Avatar: The Way of Water to beat is Star Wars: The Force Awakens. That will happen across the coming days and give James Cameron three of the top four highest-grossing titles globally.

After that, can the filmmaker’s Way of Water beat his own Titanic? Through Wednesday, Way of Water is about $135M away, and is expected to pass the tragic story of Rose and Jack. However, there’s an asterisk here since Paramount is doing a Titanic global rerelease in time for Valentine’s Day — so, maybe it’s a jockeying as we saw not too long ago with Avengers: Endgame and the original Avatar .

We’ll see how things shake out over the coming days, but there’s no denying that WoW (and its predecessors like Top Gun: Maverick and others) are giving everyone a reason to go back to the movies

At the international box office, Way of Water currently stands as the 4th highest-grossing release of all time with $1,451.3M.

On Wednesday, Way of Water added $7.8M overseas where its top markets are: China ( $232.8M), France ($132.2M), Germany ($118.5M), Korea ($100.7M), the UK ($82.8M), India ($58.2M), Australia ($56.4M), Mexico ($52M), Spain ($47.5M) and Italy ($45.6M).

Jrb1979

DIS Veteran

- Joined

- Dec 2, 2018

- Messages

- 5,086

Unlike YouTube where it costs them nothing for new content, it's costing Disney a fortune to do the same. Why not put more of the library they have up.The problem is there is an almost unlimited inventory of content (intellectual property) out there free for the taking.that the new streaming content has to compete against. Stuff on which the copyright has expired, and a lot of it very good tv shows and movies.

For example, for the past few weeks, we've been watching the old Roger Moore series from the 60s, The Saint. So we watch that instead of Hulu, or Netflix, or D+

Back when cable tv controlled what you saw and when, you only got to see what they chose for you. There are only so many eyeballs, and they have many, many more choices than just five years ago.

One of the articles upthread noted that every single day, more content is uploaded to youtube than is in the entire D+ library.

-

If You Only See One Disney Parade, This Is the One

-

Trailer Revealed for 'The Muppet Show' Special Event Debuting Feb. 4

-

FIRST LOOK: 2026 runDisney Princess Half Marathon Weekend Merch

-

Disney Cruise Photos Now Available to Purchase After Disembarkation

-

Disney CEO Bob Iger's Pay Increased to $45.8 Million in 2025

-

Reimagined Napa Rose to Reopen Feb. 6 at Disneyland Resort

-

New 2026 Disney World Merchandise Arrives at Walt Disney World

New Threads

- Replies

- 2

- Views

- 35

- Replies

- 1

- Views

- 208

- Replies

- 0

- Views

- 591

Disney Vacation Planning. Free. Done for You.

Our Authorized Disney Vacation Planners are here to provide personalized, expert advice, answer every question, and uncover the best discounts.

Let Dreams Unlimited Travel take care of all the details, so you can sit back, relax, and enjoy a stress-free vacation.

Start Your Disney Vacation

New Posts

- Replies

- 46

- Views

- 3K

- Replies

- 2

- Views

- 35

- Replies

- 18

- Views

- 5K

- Replies

- 8

- Views

- 942

- Replies

- 7K

- Views

- 485K