https://www.nytimes.com/2023/09/19/business/media/disney-parks-expansion.html

Disney, Challenged Elsewhere, Plans to Spend $60 Billion on Parks and Cruises

Amid uncertainty for the company’s film and TV divisions, the investment over the next decade doubles the outlay in the last 10 years.

By

Brooks Barnes

Reporting from Lake Buena Vista, Fla.

Sept. 19, 2023, 9:02 a.m. EDT

Disney’s theme parks will generate an estimated $10 billion in profit this year, up from $2.2 billion a decade ago. Not bad for a 68-year-old business, especially considering the

devastation wrought by the pandemic just a couple of years ago.

But how much boom is left?

Last month, when Robert A. Iger, Disney’s chief executive officer, singled out the parks division as “a key growth engine” on an earnings-related conference call, Wall Street furrowed its brow.

Disneyland in Anaheim, Calif., has long been viewed as maxed out, with little room to expand. Walt Disney World near Orlando, Fla., has become a question mark, given that Mr. Iger has said the company’s

legal battle with Florida’s governor, Ron DeSantis, could

imperil $17 billion in planned expansion at the resort over the next decade. Disney’s overseas parks — aside from Tokyo Disney Resort, which it receives royalties from but does not own — have sometimes struggled to turn a profit.

On Tuesday, Disney offered a clearer picture of the opportunity it sees, which can only be described as colossal: The company disclosed in a security filing that it planned to spend roughly $60 billion over the next decade to expand its domestic and international parks and to continue building

Disney Cruise Line. That amount is double what Disney spent on parks and the cruise line over the past decade, which was itself a period of greatly increased investment.

In the past decade, Disney has opened the

Shanghai Disney Resort, more than doubled its cruise line capacity and

added rides based on intellectual properties like “Star Wars,” “Guardians of the Galaxy,” “Tron,” Spider-Man, “Avatar” and “Toy Story” to its domestic parks. Disney has also poured money into its Paris and Hong Kong parks, with themed expansions tied to “Frozen” and other Disney films scheduled to open soon. Three more ocean liners are on the way, bringing the Disney fleet to eight ships, and Disney is nearing completion of a

new port on a Bahamian island. (Disney already has

one private island port.)

If that is what $30 billion can buy, imagine what $60 billion might bring.

“There are far fewer limits to our parks business than people think,” Mr. Iger said in an email.

“The growth trajectory is very compelling if we do nothing beyond what we have already committed,” he continued, referring to attractions and ships that have been announced but are not yet operational. “By dramatically increasing our investment — building big, being ambitious, maintaining quality and high standards and using our most popular I.P. — it will be turbocharged.”

Image

Josh D’Amaro, chairman of the parks division, noted that films like “Coco” and “Zootopia” had not yet been incorporated into the parks in a meaningful way.Credit...Todd Anderson for The New York Times

Disney is expanding the investment after a stretch of trouble in almost all its divisions.

Cable television,

including ESPN, has become a shadow of its former self, the result of cord cutting, advertising weakness and rising sports programming costs. Disney had a

disappointing summer at the box office, with movies like “Indiana Jones and the Dial of Destiny” and “Haunted Mansion” selling sharply fewer tickets than anticipated. The company’s

Disney+ streaming service continues to lose money; Mr. Iger has said it will be profitable by fall 2024, but some investors are skeptical.

Disney shares closed on Monday at $85. Their price was $197 in 2021.

In contrast, Disney’s parks and cruise business has been a bright spot, in many ways propping up the whole company. In the most recent quarter, Disney Parks, Experiences and Products generated $2.4 billion in operating income, an 11 percent increase from a year earlier. Disney Media and Entertainment Distribution had $1.1 billion in operating profit, an 18 percent decline.

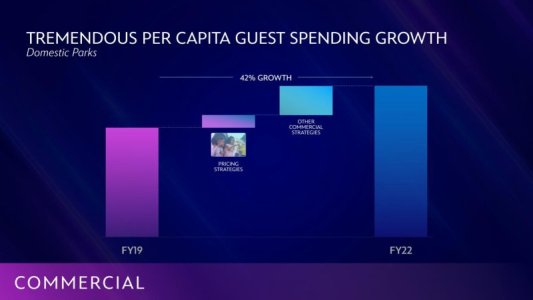

Spending per guest at Disney parks has increased 42 percent since 2019, in part because of higher prices for tickets, food, merchandise and hotel rooms.

“The stock is cheap given how good the parks are,” Michael Nathanson, an analyst at SVB MoffettNathanson, said on Monday, before the expansion was announced.

Still, increased investment in theme parks brings increased risk. It is a business that will always be sensitive to factors beyond Disney’s control: swings in the economy, gas prices, hurricanes, earthquakes, tension between the United States and China. Disney has greatly increased security, deploying undercover guards and

installing metal detectors, but these teeming resorts — Disney parks attracted an estimated 121 million visitors last year — could become ghost towns if a violent event took place.

Josh D’Amaro, chairman of Disney Parks, Experiences and Products, said people who focused on such risks overlooked the resilience of theme park fans. He noted that customers had come flooding back when Disney parks reopened during the pandemic.

“Every time there has been a moment of crisis or concern, we have managed to bounce back faster than anyone expected,” he said.

Mr. D’Amaro declined to specify how the company planned to spend the $60 billion. But he gave hints, noting that Disney movies like “Coco,” “Zootopia,” “Encanto” and others had not yet been incorporated into the company’s parks in meaningful ways.

“Imagine bringing Wakanda to life,” he said, referring to the fictional “Black Panther” kingdom. “In terms of bringing the latest Disney-Marvel-Pixar intellectual property to the parks, we haven’t come close to scratching the surface. And we have learned that incorporating Disney I.P. increases the return on investment significantly.”

Disney owns 1,000 undeveloped acres across its existing theme park resorts, Mr. D’Amaro noted. (For comparison, he said, that’s the size of seven Disneylands.) One of the biggest areas of opportunity, he said, involves the original Disneyland, which opened in 1955. If the company can

persuade the City of Anaheim to change a plan, adopted in the 1990s, that limits where hotels, parking lots and attractions can be built, Disney intends to redevelop land adjacent to Disneyland, greatly expanding capacity. Disney also plans to turn a parking area south of the park into a themed shopping, dining and hotel district.

Disney released a 17,000-page

environmental impact study for the project last week. The Anaheim City Council is expected to vote on the changes in mid- to late 2024.

How much Disney invests in Florida may depend on the courts, where the company is battling Mr. DeSantis and his allies for control over Disney World’s growth plan. Angered over Disney’s criticism of a Florida education law, Mr. DeSantis in April ended the company’s long-held ability to self-govern its 25,000-acre resort as if it were a county. Disney maintains that prior contracts preserve its ability to control development, however.

“We want to keep growing and investing and have ambitious plans in Florida,” Mr. D’Amaro said. “For the benefit of our guests, our cast members and the economy of central Florida, we hope the conditions will be there for us to do so.” He declined to comment further.

At the moment, Disney does not plan to build parks in new countries or cities. (In the past, the company looked at building a park in India, for instance, and expanding beyond Hong Kong and Shanghai in China.) Rather, the company will focus on developing new ports for its ships.

Starting in 2025, a new cruise ship — the biggest in Disney’s fleet so far, with space for more than 6,000 guests — will be

based in Singapore. Disney’s ships have grown increasingly themed, with characters and artwork from franchises like “Frozen,” “Star Wars” and Marvel’s Avengers incorporated into restaurants and entertainment zones.

“It’s like bringing a theme park to a new part of the world,” Mr. D’Amaro said of Disney

Cruise Line, which has recently been booked to 98 percent of capacity.

Brooks Barnes covers all things Hollywood for The New York Times. He has reported on the entertainment business for two decades and lives in Los Angeles.

More about Brooks Barnes