Some partners i would have never thought of. Not sure if the conflicts of interest could ever be overcome, though.

https://www.cnbc.com/2023/07/21/espn-had-talks-with-nba-nfl-in-search-for-strategic-partner.html

ESPN held talks with NBA, NFL and MLB in search for strategic partner, sources say

Alex Sherman

As Disney considers a strategic partner for ESPN, Chief Executive Officer Bob Iger and ESPN head Jimmy Pitaro have held early talks about bringing professional sports leagues on as minority investors, including the National Football League, National Basketball Association and Major League Baseball, according to people familiar with the matter.

ESPN has held preliminary discussions with the NFL, NBA and MLB about a variety of new partnerships and investment structures, the people said. In a statement, an NBA spokesperson said, "We have a longstanding relationship with Disney and look forward to continuing the discussions around the future of our partnership."

related investing news

Hollywood strike may soon turn destructive for media stock investors, analysts say

CNBC Pro

Spokespeople for ESPN, the NFL and MLB declined to comment.

Talks with the NFL have occurred in conjunction with the league's own desire for a company to take a stake in its media assets, including the NFL Network, NFL.com and RedZone, said the people, who asked not to be named because the talks have been private.

The NBA and Disney have broached many potential structures around a renewal of media rights, the people said. Disney and Warner Bros. Discovery have exclusive negotiating rights with the NBA until next year.

Iger said last week in an interview with CNBC's David Faber that Disney is looking for a strategic partner for ESPN as it prepares to transition the sports network to streaming. He didn't elaborate on what exactly that meant beyond saying a partner could bring additional value with distribution or content. He acknowledged selling a stake in the business was possible.

Disney owns 80% of ESPN. Hearst owns the other 20%.

"Our position in sports is very unique and we want to stay in that business," Iger said to Faber. "We're going to be open minded about looking for strategic partners that could either help us with distribution or content. I'm not going to get too detailed about it, but we're bullish about sports as a media property."

Theoretically, a jointly owned subscription streaming service among multiple leagues could eventually give consumers new packages of games and other innovative ways to take in content.

The move would be a logical one for Disney as it tries to move past the traditional cable subscriber model and underscores how badly the company wants to find a solution for the sports network as its linear subscribers decline. Still, ESPN ratings have climbed in recent years on major sporting events. There's no better partner for sports content than the leagues, themselves.

Superficially, it may make less sense for the NBA, NFL and MLB which sign lucrative media rights deals with many media partners that fuel team revenue and player salaries with a range of media companies.

Professional sports leagues could face conflicts of interest if they take a minority stake in ESPN. Owning a stake in ESPN may irritate Disney's competitors, such as Comcast's NBCUniversal, Fox,

Amazon, Paramount Global and Apple, who help make the leagues billions of dollars by participating in bidding wars for sports rights. Taking an ownership stake in ESPN could give leagues the incentive to boost the value of that entity rather than striking deals with competitors.

There would also be hurdles for Disney. ESPN also employs hundreds of journalists that cover the major sports leagues. Selling an ownership stake to the leagues could cloud the perception of objectivity for ESPN's reporting apparatus.

Still, the leagues are already business partners with ESPN. It's possible ESPN could put measures in place to ensure reporters can continue to cover the leagues while minimizing conflicts, but it adds another layer of complexity to any deal.

A streaming-first ESPN

ESPN is trying to forge a new path as a digital-first, streaming entity. Disney realizes ESPN won't be able to make money like it previously has in a traditional TV model.

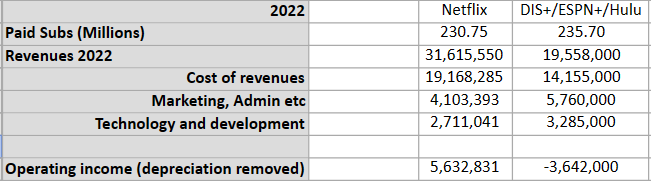

Selling a minority stake in ESPN to the leagues could mitigate future rights payments, allowing Disney to better compete with the big balance sheets of Apple, Google and Amazon. It would also guarantee ESPN a steady flow of premium content from the leagues.

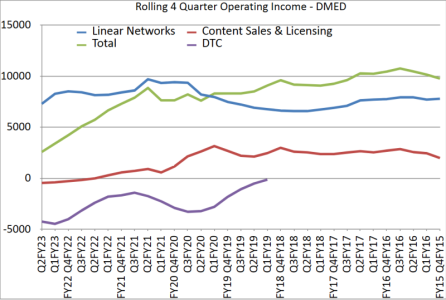

Until last quarter, Disney's bundle of linear TV networks still had revenue growth because affiliate fee increases to pay-TV providers — largely driven by ESPN — made up for the millions of Americans who cancel cable each year. That trend finally ended last quarter, according to people familiar with the matter. Accelerating cancellations have now overwhelmed fee increases, and linear TV revenue outside of advertising has begun to decline.

"A lot has been said about renting [sports right] versus owning," Iger said last week in his CNBC interview. "If you can rent it and continue to be profitable from renting, which we have been and we believe we will continue to be, then there's value in staying in it. We have great relationships with Major League Baseball, and the National Hockey League, and various college conferences, and of course the NFL and the NBA. It's not just about the live sports coverage of those leagues, those teams, it's also about all of the shoulder programming it throws off on ESPN and what you can do with it in a streaming world."

ESPN would like to morph itself into a streaming hub for all live sports. Management would like to launch a feature allowing ESPN.com or the ESPN app to funnel users to games no matter where they stream, CNBC reported earlier this year.

While striking a deal with professional sports leagues wouldn't be easy, Disney appears to be pushing the envelope on its thinking to prepare for a streaming-dominated world that includes its full portfolio of sports rights.

"If [a partner] comes to the table with value, whether it's content value, distribution value, whether it's capital, whether it just helps derisk the business — that wouldn't be the primary driver — but if they come to the table with value that enables ESPN to make a transition to a direct-to-consumer offering, we're going to be very open minded about that," Iger said.