ruadisneyfan2

DIS Legend

- Joined

- May 20, 2006

- Messages

- 17,664

Are There Any Partial Exemptions to Realty Transfer Fees?there's recording fees to the clerk's office but in NJ there's a realty transfer tax. can vary but typically 1% f rice

Yes. Property marked as low or moderate income, people with almost total or complete vision impairment, people with disability receive a partial exemption of the RTF. Senior citizens who are 62 or older and live on the property at least three months out of the year without renting out the property also qualify.

Copied from this page.

https://chamlinlaw.com/blog/key-information-about-the-realty-transfer-fee-in-nj/

Hopefully they have a similar exemption in Oklahoma.

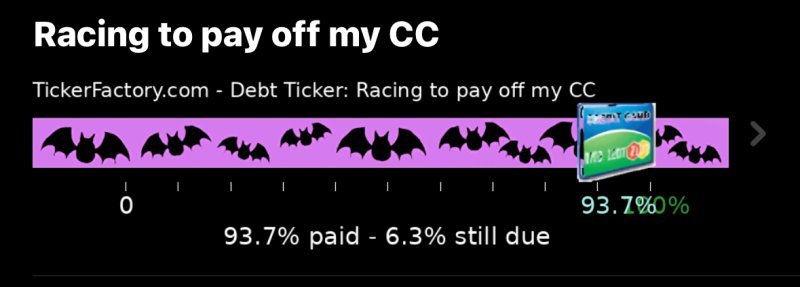

Congratulations! Doesn't it feel great to have a bill crossed off your list? Don't worry about raising your score/lowering your utilization. That high-fee card needed to go away. Your score will increase as you pay down your debt, and keep paying on time.

Congratulations! Doesn't it feel great to have a bill crossed off your list? Don't worry about raising your score/lowering your utilization. That high-fee card needed to go away. Your score will increase as you pay down your debt, and keep paying on time.

(added 43 this month)

(added 43 this month)