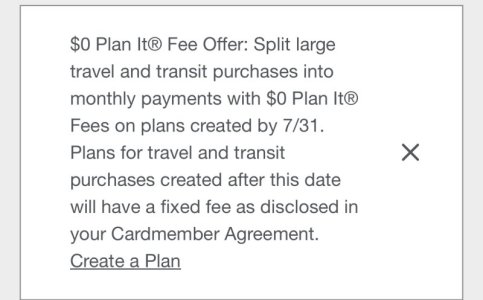

Where in your account did you see it? I have a Platinum but haven't received an email promoting it.If you have Amex check your cards, they're running a no fee Plan It promotion until 07/30 for travel purchases, which DVC triggers it. It's targeted, so not everyone will have it.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Creative Ways to Finance DVC

- Thread starter ARobyn

- Start date

davidhr

DIS Veteran

- Joined

- Dec 18, 2022

- Messages

- 1,068

in the app if you have a travel charge you can go to the plan it option and you’ll see an alert.Where in your account did you see it? I have a Platinum but haven't received an email promoting it.

In the web (desktop or mobile) you’ll see this alert on your Home Screen for the card if it’s available (you have to have the card selected, if you have multiple try switching to a different card)

Attachments

achinforsomebacon

Mouseketeer

- Joined

- Mar 8, 2021

- Messages

- 405

Does anyone know if the no fee Chase pay over time is limited to one per account? I have multiple cards that are eligible but wasn't sure if it would only be available one time between them.

Just want to follow up and say thanks for the tip! I was going to use my Chase Marriott plan but I'd rather get the Amex points. I found the offer in my account.in the app if you have a travel charge you can go to the plan it option and you’ll see an alert.

In the web (desktop or mobile) you’ll see this alert on your Home Screen for the card if it’s available (you have to have the card selected, if you have multiple try switching to a different card)

davidhr

DIS Veteran

- Joined

- Dec 18, 2022

- Messages

- 1,068

Awesome!Just want to follow up and say thanks for the tip! I was going to use my Chase Marriott plan but I'd rather get the Amex points. I found the offer in my account.

One other question - did rewards show up for the purchase? The fine print says "You will not earn additional points for purchases of timeshare properties."Awesome!

davidhr

DIS Veteran

- Joined

- Dec 18, 2022

- Messages

- 1,068

Can’t confirm that one because my green card didn’t have the offer and I used another one that doesn’t have extra multipliers for travel. My guess is that it will, as the plan it also says that timeshares don’t apply but it did anyways.One other question - did rewards show up for the purchase? The fine print says "You will not earn additional points for purchases of timeshare properties."

Robbie Cottam

DIS Veteran

- Joined

- Jun 15, 2015

- Messages

- 2,689

401k Loan

Pay yourself the interest, and add to your retirement in the process.....

Depending on your retirement management company loan may cost $50.

Yes opportunity cost,

But it is another options,

Pay yourself the interest, and add to your retirement in the process.....

Depending on your retirement management company loan may cost $50.

Yes opportunity cost,

But it is another options,

Traveling on cc points

DIS Veteran

- Joined

- Apr 27, 2016

- Messages

- 1,214

It could but just remember that even if it does, you would only earn 5% on the first $1,500.Hi All. Just realized that this quarters 5% for Chase Freedom is Entertainment, Disney being part of the merchant list. Wondering if DVC payment would trigger it?

LittleBitGoofy

DIS Veteran

- Joined

- Mar 14, 2023

- Messages

- 823

Some title companies will let you put the deposit on your credit card. Mason let us put $5K on ours. Rest had to be wired funds.Silly question, could I use a credit card to pay for a resale purchase?

WDWfantasy

WDW Fanatic

- Joined

- May 1, 2000

- Messages

- 471

I was able to put $7,500 on a credit card for the initial deposit with masontitle.com. That was on May 29th of this year.Silly question, could I use a credit card to pay for a resale purchase?

varyth

Mouseketeer

- Joined

- Apr 8, 2022

- Messages

- 303

Silly question, could I use a credit card to pay for a resale purchase?

Some title companies will let you put the deposit on your credit card. Mason let us put $5K on ours. Rest had to be wired funds.

Not sure if it had to do with the different brokers or if Mason changed their limits between my two resale purchases. I was allowed to put $7500 down for a deposit this year, but only up to $5000 last year.I was able to put $7,500 on a credit card for the initial deposit with masontitle.com. That was on May 29th of this year.

And the deposit with Mason does NOT code as travel with Chase, unfortunately.

LittleBitGoofy

DIS Veteran

- Joined

- Mar 14, 2023

- Messages

- 823

That's a nice bump in depost cc limits. This April ('23) I was told a max of $5K, so sounds like they up'd that recently (or my contact at Mason was just behind in the info they had).I was able to put $7,500 on a credit card for the initial deposit with masontitle.com. That was on May 29th of this year.

jess2022

Mouseketeer

- Joined

- Dec 18, 2022

- Messages

- 242

I was told 5k last month with Mason. I asked my broker though not Mason so maybe I was given outdated information.That's a nice bump in depost cc limits. This April ('23) I was told a max of $5K, so sounds like they up'd that recently (or my contact at Mason was just behind in the info they had).

TheLyinKing

Mouseketeer

- Joined

- Apr 18, 2022

- Messages

- 207

Unless you have a 401k ROTH, do not do this unless its a last resort. A 401k uses pre-tax money contributions. If you take out a loan on that 401k, you'll have to pay the loan back with post-tax money, and then the 401k will once again be taxed when you take out your disbursement. Furthermore, the money you withdraw will not gain interest based on any stock gains. Yeah you'll pay back interest, but again that's your money you're paying interest on, instead of getting it for "free" via the market. A 401k ROTH is a different proposition as the money is already taxed, but still don't recommend it unless you really need to. Best way to do this imo would be to open a credit card that has no interest for 18-24 months and pay it monthly that way. Save a 401k loan for a real emergency.401k Loan

Pay yourself the interest, and add to your retirement in the process.....

Depending on your retirement management company loan may cost $50.

Yes opportunity cost,

But it is another options,

Robbie Cottam

DIS Veteran

- Joined

- Jun 15, 2015

- Messages

- 2,689

you would have to pay the credit card back with post tax money too,Unless you have a 401k ROTH, do not do this unless its a last resort. A 401k uses pre-tax money contributions. If you take out a loan on that 401k, you'll have to pay the loan back with post-tax money, and then the 401k will once again be taxed when you take out your disbursement. Furthermore, the money you withdraw will not gain interest based on any stock gains. Yeah you'll pay back interest, but again that's your money you're paying interest on, instead of getting it for "free" via the market. A 401k ROTH is a different proposition as the money is already taxed, but still don't recommend it unless you really need to. Best way to do this imo would be to open a credit card that has no interest for 18-24 months and pay it monthly that way. Save a 401k loan for a real emergency.

Kinda seems like a wash....

Also, your claim that the withdrawn money will not gain interest although correct, over looks the simple fact that in the last two years, "gains" in the stock market have not be a sure thing.

Also you car completely overlooking the "cost" to your credit rating of a new credit card, with 20, or 25000 dollars sitting on your credit report.

What happens if you can't pay the credit card off during the introductory period?

Bottom line if you are looking for "creative ways:" to finance DVC your are most likely not a cookie cutter consumer.

All situations are different and

FOR SOME PEOPLE LOOKING FOR CREATIVE FINANCING, A 401K LOAN MAY BE THE BEST OPTION, imo.

Last edited:

-

The New Loungefly Disney Drop You'll Want to See Now

-

LAST CALL for 2 Free Nights & Theme Park Days at Disney World!

-

This Week's Last-Minute Disney Cruise Line Deals

-

Affection Section Closing at Disney World Ahead of New Bluey Experience

-

Disney Adventure Set to Stop in Los Angeles Before Asia Debut

-

New Disney Merch: Parks Apparel & Walt Disney Studios Series

-

Seahawks Stars Heading to Disneyland After Super Bowl LX Win

New Threads

- Replies

- 0

- Views

- 25

- Replies

- 0

- Views

- 122

- Replies

- 0

- Views

- 109

New Posts

-

-

Help me decide about Velocicoaster and Stardust Racers

- Latest: michellej47

-

-

Points for Rent: 500 Points available (300 BLT and 200 AKV) @ $20/pt

- Latest: Memories2make

-

New Posts

- Replies

- 188

- Views

- 35K

- Replies

- 19

- Views

- 7K

- Replies

- 2

- Views

- 558

- Replies

- 4

- Views

- 407

- Replies

- 90

- Views

- 33K

- Replies

- 32

- Views

- 2K

- Replies

- 8

- Views

- 2K

- Replies

- 110

- Views

- 17K