eticketplease

DIS Veteran

- Joined

- Aug 24, 2021

- Messages

- 6,377

Don’t they give annual pass discount as well or DVC?Looks like the female version is still on the website.

Could always plan a trip just to burn the credit in DS.

Don’t they give annual pass discount as well or DVC?Looks like the female version is still on the website.

Could always plan a trip just to burn the credit in DS.

The issue with the $6,000 cap isn't that you need $6,000 of gift cards, though that would also be a problem. It's that you're cannibalizing your NORMAL grocery points-earning. If you're going to spend at least $6,000 on groceries every year, you're already going to receive the full $360 benefit that the card allows. Meaning the marginal benefit of using that card to also buy your Disney gift cards is $0.You mentioned that the BCP caps out at $6,000 and while that is true the original poster, @muppets3d didn't specify how much in GC was needed

Even within FICO, there are different scores. FICO 8, FICO 9, FICO Bankcard, FICO Auto, etc. You can never be 100% sure which a lender will look at, but it's certainly never be VantageScore.A small aside on credit scores.

The "free" scores I get from the bureaus are VantageScore, not FICO. I recently applied for a mortgage, and the lender used FICO scores, all of which were lower and in one case by a non-trivial amount. It didn't make any difference to the loan terms, I still qualified for the lowest rate for the term I was financing.

The lesson I took away from this: I don't need to pay much attention to small movements in my credit score, despite the breathless advertising from the three bureaus and the associated credit-monitoring ecosystem. First, because the score I have access to is meaningless. Second, because those small differences are immaterial anyway.

Yup, that's what I tell everyone who gets overwhelmed with understanding credit.I can, but that would be spending attention I will never get back.

Instead, I'll just pay my cards off each month and make sure I don't miss a mortgage payment. The rest will sort itself out.

While that can be true (I don't personally come close to $6,000 in groceries without GC Spend) the original post was alternatives to the target red cards 5%The issue with the $6,000 cap isn't that you need $6,000 of gift cards, though that would also be a problem. It's that you're cannibalizing your NORMAL grocery points-earning. If you're going to spend at least $6,000 on groceries every year, you're already going to receive the full $360 benefit that the card allows. Meaning the marginal benefit of using that card to also buy your Disney gift cards is $0.

I buy more DGC than your average person. I feed a household of 6 people. I am at 5700 spend on groceries on my Amex blue cash YTD. I buy a lot of my groceries at Walmart, Costco and Sam’s club which no credit card recognizes as a grocery store.The issue with the $6,000 cap isn't that you need $6,000 of gift cards, though that would also be a problem. It's that you're cannibalizing your NORMAL grocery points-earning. If you're going to spend at least $6,000 on groceries every year, you're already going to receive the full $360 benefit that the card allows. Meaning the marginal benefit of using that card to also buy your Disney gift cards is $0.

That's an important distinction that confuses a lot of people.which no credit card recognizes as a grocery store.

A friend of mine has limited grocery options near her said she actually get the 2% for Groceries on her Disney premier card when shopping at Walmart.I buy a lot of my groceries at Walmart, Costco and Sam’s club which no credit card recognizes as a grocery store.

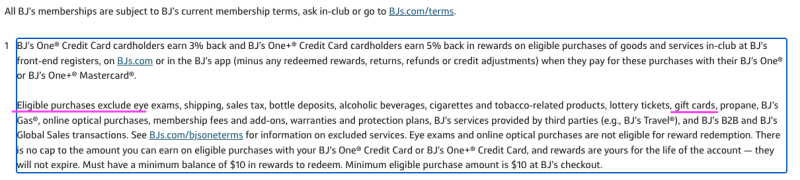

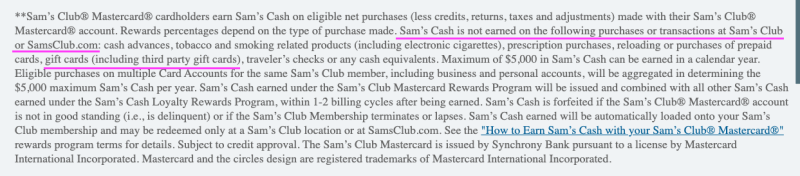

Neither the 3% or the 5% credit card will earn you anything on gift cards unfortunately.There's also the higher level BJ's Capital One card that offers 5% back at BJ's.

Thanks for pointing that out, didn't know.Neither the 3% or the 5% credit card will earn you anything on gift cards unfortunately.

If you are buying gift cards at BJ's it is best to use another card just like at Sam's it is best to use a different card.

From https://www.capitalone.com/credit-cards/bjs-wholesale-club/

View attachment 1023581

From https://www.samsclub.com/credit

View attachment 1023586

Note that they WILL give you incorrect information at the customer service desk when they try to sell you the credit card. I don't think they're lying, it's either that they don't know any better and/or their systems give them bad information.Neither the 3% or the 5% credit card will earn you anything on gift cards unfortunately.

If you are buying gift cards at BJ's it is best to use another card just like at Sam's it is best to use a different card.

From https://www.capitalone.com/credit-cards/bjs-wholesale-club/

View attachment 1023581

From https://www.samsclub.com/credit

View attachment 1023586

No problem it’s a mistake many have made myself included.Thanks for pointing that out, didn't know.

Yea I’m sure the person at the desk is just seeing that large number, not the breakdown and thinks they can convert someone to open an account. I don’t know if BJ’s does but many moons ago when I worked retail in college the company would give us cash for every card we opened.Note that they WILL give you incorrect information at the customer service desk when they try to sell you the credit card. I don't think they're lying, it's either that they don't know any better and/or their systems give them bad information.

But they'll tell you "You spent $15,000 last year, this is worth $X in rewards if you get the BJ's credit card," and the $15,000 will include all of the gift cards you bought.