NorCalFanatic

DIS Veteran

- Joined

- Apr 19, 2023

- Messages

- 896

.

Last edited:

Don't forget that the 2ish dues difference (more like $2.25) also grows over time as dues grow, which pretty much offsets the benefit from the Treasuries.

In fact, at a modest 3% annual dues growth rate, the dues difference will be over $7 by 2062... Unsubsidized dues will be about $29 and subsidized dues about $22... Scary thought!

We passed over a lot of stripped Aulani contracts (and GCV) as we want to travel NOW. Not have to wait as the contract was stripped.

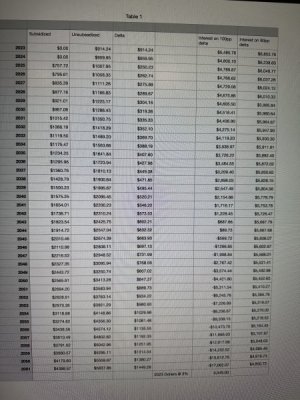

I just threw together a spreadsheet.

Assumptions:

Subsidized ppp $130

Unsubsidized ppp $100 and $90. 2 years worth of points are sold at $17pp.

Break even for $100pp is 22 years. Total delta by contract end is -$17,062 (-$5,549 in todays dollars).

Break even for $90pp is never. Total delta by contract end is +$4,851 ($1,578 in todays dollars).

View attachment 780670

It's a bit hard to read the screenshot but I think I follow most of it. Looks like you did this for 100 points and assume dues grow at 5% annually? And that you're able to get 5% on treasuries for the next 40 years (maybe not so sustainable given the recent 15 years)?

Assumptions aside, regarding the $90 vs $100 options, I may be missing something. Shouldn't the difference between the two options in year 0 be just $1000 - i.e., 100 points and you gain an extra $10 per point? You still sell the same number of points for the same price either way. If that's an error, maybe that's why you never break even on the $90?

Good point.That may be tricky on a fully loaded contract given the desire for 100ish points and a lower inventory use year. But, you never know!

Given that the out of pocket difference is essentially $10pp or $1000… I’d try and get the contract sooner so that I could get through ROFR and get my vacation booked sooner.

Of course, I try to spend as many days of my life in Hawaii as I possibly can…

Meh. I only have one UY. I've heard everything between 2 UY's being easy to manage to 2 UY's being a huge PITA. I work a 60+ hour a week job - so any complication/extra-time-consumption is not worth it to me. I would rather not add-on at all than get into a different UY. Thanks though.Use year for a WDW and Aulani should not matter much - you can transfer and October u/y sucks for finding good resale.

I just saw a 100 point subsidized double loaded ROFR for $123 in ROFR. That is a fair price.

I think some people are overpaying for the hype of the subsidized contract. But it is a free country and people can spend it on whatever they want.

IMO it’s not apples to apples. My unsubsidized points can get the same room during the same window as someone else’s subsidized points. So the Ocean Front vs Ocean View analogy doesn’t hold.Yeah, that was a great deal for the buyer, especially for a small contract. Not my one of my use years though, so I wouldn't have bought it even for that price. Two use years is plenty for me to deal with.

When something is scarce and limited in supply it commands a premium just due to supply and demand imbalances, whether it's a subsidized Aulani contract, or a deeded week resort with 24 oceanfront units versus 200 ocean view units (check out resale prices on Redweek for the Westin Kaanapali Villas of ocean view versus oceanfront deeded weeks - the latter sell for $40K vs $11K-$15K for oceanview with similar dues). There are just so many contracts sold before July 2011 and, unlike the unsubsidized contracts, that number is not getting bigger over time so I wouldn't be surprised if the subsidized/unsubsidized premium even grew over time.

Personally, I probably disagree with you about the value of these subsidized contracts and view the stripping as a very temporary minor inconvenience rather than a dealbreaker. You really don't know what treasuries will pay over the next 40 years - they're attractive now but haven't been for the prior 15 years. The only thing you know with certainty when you run the numbers is that you will save 25% on the annual dues for as long as you own it.

And regardless of whether people overpay or underpay for these subsidized contracts, it's probably dwarfed by how much people are (over?) paying for 2042 resorts like BWV and BCV and even BRV - you can sometimes buy a 2060 BLT or 2066 PVB for less... We can argue over the value of 1-2 stripped years on a 39-year Aulani contract, and whether that's really a dealbreaker, but with 2042 resorts buyers are paying ballpark price of 38- to 44-year contracts on a 19-year contract (17 if stripped) that also has higher annual dues. On a pure numbers sense, that's much harder to justify, even with the cheaper rooms and all that included. But, like you said, it's a free country and every buyer has their own reasons behind the offers they choose to make, or not make...

I've never been there, but for me its resale restrictions. (but if you love it, that shouldn't matter)I say go with Aulani... or, just get the cheapest SAP (SSR?). Personally, we just didn't care for RIV.

(Maybe we just had an off-stay. It was after the COVID restart and we went to the skyliner and it took over 45 minutes to get on to go to EPCOT. They were all full coming from CBR/POP/AOA and they were only loading every other one, it was a nightmare. Also, we just didn't care for the vibe of RIV, but I can see why people like it...)

I realize the tough thing of a resort not being a home resort is that you don't get standard views/cheap rooms, but for me, I don't vacation a ton, I'm totally fine with going to Hawaii and having a view of something other than the parking garage.

Yeah. That's us - we use the points at RIV and will likely always book higher-point rooms at AUL (at least for the foreseeable future), so we will either go with more RIV points, or maybe just do nothing and wait for that perfect AUL subsidized contract to come along, I think. Thanks again.

Meh. I only have one UY. I've heard everything between 2 UY's being easy to manage to 2 UY's being a huge PITA. I work a 60+ hour a week job - so any complication/extra-time-consumption is not worth it to me. I would rather not add-on at all than get into a different UY. Thanks though.

We have 3 resorts and 2UY - that's enough. We use our August UY for Christmas, and our Feb UY for spring, and we have lots o points if we want to go in August. I was entertaining the idea of a 3rd UY when I was considering buying VGC, but that went all out the window once the summer incentives hit for VGF and RIV. We like both resorts a lot but RIV was a few $ per point more and we already had a lot of VGF points, so now we have 2/3 of our points there. But it could just as easily have been RIV if the price had been the same. (But I had to sell DH on the per point cost, so there you go...)Do they intentionally block off the gondolas so people at RIV can have space to utilize the gondolas in the morning? If not, they really should.

Meant to respond earlier - Back in 2021 I was in an ECV (scooter) due to an ankle injury that wasn't obvious. We were staying at RIV and I got quite an education in how they block off gondolas (or don't)!RIV is a very polarizing resort lol. Do they intentionally block off the gondolas so people at RIV can have space to utilize the gondolas in the morning? If not, they really should. Fortunately for us we're not early morning people so we usually get to the park like at 10 or later after early morning crowds have died but I can definitely see how annoying it is for each gondola to show up completely filled.

Meant to respond earlier - Back in 2021 I was in an ECV (scooter) due to an ankle injury that wasn't obvious. We were staying at RIV and I got quite an education in how they block off gondolas (or don't)!

1. Going to Epcot at most hours is usually fine - back then, even in the morning, were was enough space and they would occasionally send empty gondolas if there was a need. It doesn't really "feel" like it because even if they immediately stat blocking a few gondolas at CBR, a few minutes will have passed by the time those gondolas get to RIV, and it's possible by then the line has died down a little. For us - if it looked really crowded, we'd sometimes walk to/from CBR and we've "raced" - sending half the group by foot to Riviera and half on the gondola. It's pretty much a tie, though walking feels faster because you're not just standing there.

2. There are specific gondolas they use for ECVs because they have the wooden blocks they stick under the wheels to make sure the scooter doesn't move. It's not clear they know in advance which ones have the blocks. They can take them out of line at the terminals but they can't do that at RIV. So again, if really busy they they may need to radio ahead and may even need to get a scooter-able gondala into the line. And if there's already people in scooters in the gondolas who are not getting out at RIV, that can lead to a looooong wait. One time we waited for around 20 minutes to go to Epcot for dinner. I ended up sending DH with the stroller (yeah, we were a little encumbered that trip), and they made it to the restaurant 30 minutes before I did. (This is when I ended up talking to the CM about the gondolas and how they moved people and ECVs!)