ehh

the sound a shrug makes

- Joined

- Aug 3, 2019

- Messages

- 1,517

How much more should a loaded contract be worth? How much less should a stripped contract be worth?

One of the more common questions or subtexts on these forums. And there's a ton of schools of thought here, from 'bonus points are worth whatever you can rent them at' to, effectively, random guesses.

And I'll start off by acknowledging the obvious: yes, points are worth whatever you value them at or can exchange them for cash at (by definition). If that means you're good with 'whatever you can rent them at' or some other value, you do you.

But does that number ever feel wrong? Do you value all of your contract's points at rental value? Or just bonus/missing points? If you just value bonus/missing points at rental value (or some other arbitrary value), why do you treat them differently?

The underlying premise of DVC is that we're buying in to get a longterm value. We want to at least feel like we're paying less for something than it's valued by others. Buying points and valuing them at rental value ain't that. That's just a wash transaction if you actually rent them and (almost always) an overvaluation if you don't.

So I'd like to challenge the 'rental value' and similar schools of thought and put some math behind valuing bonus/missing points. But first, a detour.

Usage-based Valuation

Quick points on the flaws with usage-based valuation, including rental value:

Practical Valuation of Bonus Points

The principle I'm positing here is that bonus points should be valued similarly to all the rest of the points! In some cases they should actually be valued lower due to usability defects (e.g., points that are expiring soon).

But the general idea here is that bonus points should be valued like the rest of the points being purchased.

The simplest representation of this is a flat valuation. If you're buying a contract that has 30 years of points and is listed for $120/pt, then every point is worth $4/pt. With this method, a contract with 1 year of bonus points should go for $124/pt and a contract with 1 year of missing points should go for $116/pt.

But this ignores the time value of money. It also ignores dues. You probably shouldn't do that.

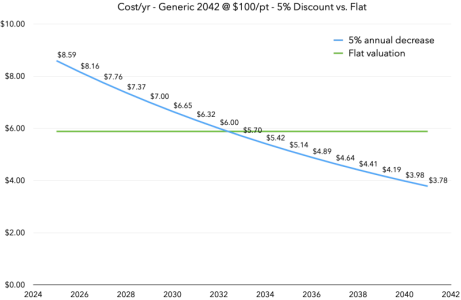

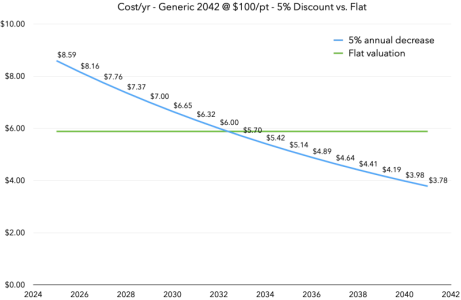

So let's throw in some time value of money into this and discount future years at 5%/yr compounded. This way, distant future points are worth less but, critically, not zero (or negative). Let's also make up a resort, named Generic 2042, and its nominal resale value is $100/pt after closing costs but before 2025 dues.

Generic 2042 expires in 2042, so now that we're in 2025 (with 2025 UYs beginning in a few weeks), a standard contract will have 17 years of points left, with the final points coming in 2041.

At $100/pt for 17 years, that's $5.88/pt for a flat valuation. But what about a 5% discount?

Early years are worth more, later years are worth less. And it still adds up to $100/pt. This is the same discounting methodology used in my Most Economical Resort - Beyond Year 1 thread (but in that thread I add in dues predictions! fun stuff).

This year's points are worth $8.59/pt this way. Before dues. Let's say Generic 2042 has average WDW dues, so $8.86/pt in 2025. That means the 2025 points are really valued at $17.45/pt for purchases made today.

If 2024's points are fully usable for your UY, then they're essentially equally as good as the 2025 points and bonus 2024 points should be worth the same $17.45/pt in this example. If the 2024 points are less usable then you should discount them. You can also apply this to banked 2023 points, though surely those have usability defects at this point. You can also use 2024/2023 dues values instead of 2025.

What if your 2042 resort is not selling at $100/pt after closing costs? Well, that $8.59 also just happens to be 8.59%.

In summary, bonus 2024 points on a 2042 resort should increase the value of the contract by 8.59%, plus the value of any dues the seller paid. Decrease the amount if the bonus points have any usability defects (e.g., expiring soon, can't be used at home resort for your desired travel period, etc.).

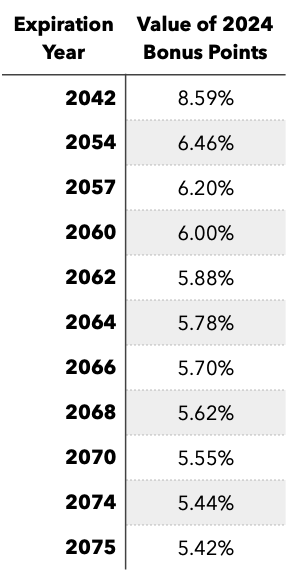

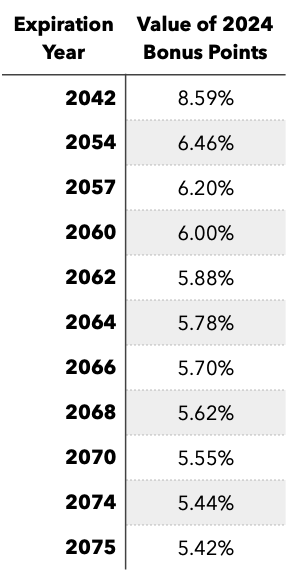

Of note, this 8.59% definitely shouldn't be applied to all contract lengths.

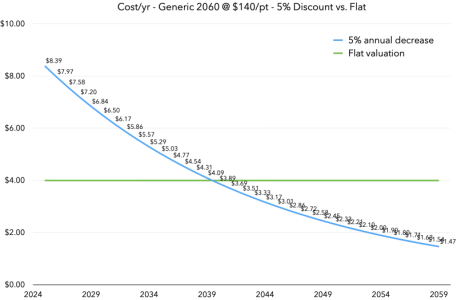

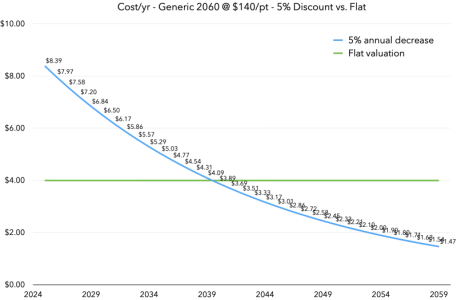

Let's look at a Generic 2060 resort next, with 35 years of points remaining. Let's price this resort at $140/pt after closing costs. This is what its annual value of points looks like with a 5% decrease each year:

Coincidentally, 2025 points are actually fairly similar in value at $8.39! But as a percentage it's lower. $8.39 is 6% of $140.

We can apply the same principle here, though: bonus 2023 or 2024 points on a 2060 resort should increase the value of a contract by 6% plus the value of any dues the seller paid. Decrease the amount if the bonus points have any usability defects (e.g., expiring soon, can't be used at home resort for your desired travel period, etc.).

What about other expirations? I have a whole table of expiration dates just for you:

Can also apply it to 2023 points if they're included. Then add any dues on usable points the seller paid. Then discount for any usability defects (how much is up to you and your scenario).

Practical Valuation of Missing Points

The principle and methods also work in reverse! The numbers are essentially the same.

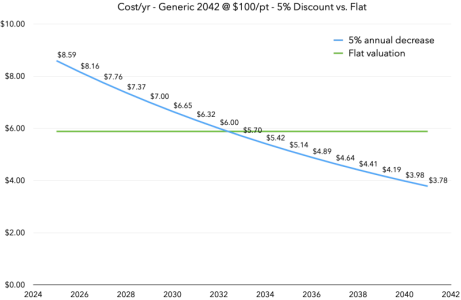

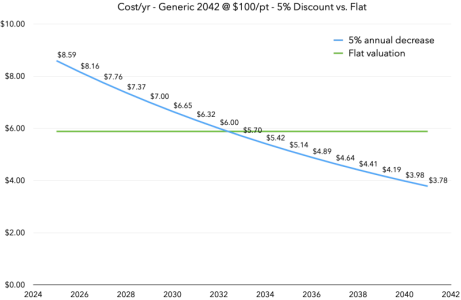

Let's breakdown why the numbers are the same. Going back to this chart for Generic 2042:

This is what the points are worth each year from 2025 through 2041 for a contract that has points from 2025 through 2041 and is properly priced at $100/pt after closing costs. As a reminder, there's a 5% decrease in value each year to take into account some time value of money.

If you don't get the 2025 points, you're not getting $8.59 worth of points from your purchase and therefore the contract price should be reduced $8.59 to $91.41/pt. But that's only if the seller is paying the dues for the points you're not getting.

If you're on the hook for the 2025 dues while not receiving the points, then that $91.41/pt needs to be negotiated down by the amount of the dues, otherwise your future years points are coming at a higher price vs. a $100/pt contract with 2025 points.

What if 2026 points are also missing? Price should go down by $16.75 plus dues credits due to losing $8.59 of 2025 points and $8.16 of 2026 points.

Putting it all together

Okay, I've laid out the concept for my opinion for what bonus/missing points should be worth above. Putting it into practice, what does this work out to in 2025 for each resort?

Taking the last 3 months of resale pricing from dvcresalemarket.com's blog posts on the topic, plus the 2025 dues, we get this for each resort:

* Bonus points should be discounted if there's any usability defects. Applying 2023/2024 dues to bonus points also is suggested. If 2026 points are missing, the base value decreases but the dues will likely increase by a similar amount, so the After Dues figures above are probably close enough™.

If you read all the way to the bottom, you'll also spot that some resorts are over the commonly cited $20/pt rental value. In these cases the $20/pt rental value is undervaluing the missing/bonus points. Maybe that works out for you if there's bonus points though!

The keen-eyed among you might also notice that the After Dues figures above are the same as what you'll find from the 'Year 1' values in my Most Economical Resort - Beyond Year 1 thread's January 2025 update. What a coincidence...or not

One of the more common questions or subtexts on these forums. And there's a ton of schools of thought here, from 'bonus points are worth whatever you can rent them at' to, effectively, random guesses.

And I'll start off by acknowledging the obvious: yes, points are worth whatever you value them at or can exchange them for cash at (by definition). If that means you're good with 'whatever you can rent them at' or some other value, you do you.

But does that number ever feel wrong? Do you value all of your contract's points at rental value? Or just bonus/missing points? If you just value bonus/missing points at rental value (or some other arbitrary value), why do you treat them differently?

The underlying premise of DVC is that we're buying in to get a longterm value. We want to at least feel like we're paying less for something than it's valued by others. Buying points and valuing them at rental value ain't that. That's just a wash transaction if you actually rent them and (almost always) an overvaluation if you don't.

So I'd like to challenge the 'rental value' and similar schools of thought and put some math behind valuing bonus/missing points. But first, a detour.

Usage-based Valuation

Quick points on the flaws with usage-based valuation, including rental value:

- It's pretty easy to get $40/pt of value from a point by booking a DVC room with points and comparing to cash rates

- And yet we all instictively know this is not the value of bonus/missing points

- Similarly, just because points can be rented out at $20/pt doesn't mean they should be valued this way

- This is true even if you intend to rent out bonus points. The rental value should generally be a ceiling.

- Other abritrary values of $14/pt, $16/pt, $18/pt, etc. have the same flaw, even if they're valued in some sort of concrete cash exchange

Practical Valuation of Bonus Points

The principle I'm positing here is that bonus points should be valued similarly to all the rest of the points! In some cases they should actually be valued lower due to usability defects (e.g., points that are expiring soon).

But the general idea here is that bonus points should be valued like the rest of the points being purchased.

The simplest representation of this is a flat valuation. If you're buying a contract that has 30 years of points and is listed for $120/pt, then every point is worth $4/pt. With this method, a contract with 1 year of bonus points should go for $124/pt and a contract with 1 year of missing points should go for $116/pt.

But this ignores the time value of money. It also ignores dues. You probably shouldn't do that.

So let's throw in some time value of money into this and discount future years at 5%/yr compounded. This way, distant future points are worth less but, critically, not zero (or negative). Let's also make up a resort, named Generic 2042, and its nominal resale value is $100/pt after closing costs but before 2025 dues.

Generic 2042 expires in 2042, so now that we're in 2025 (with 2025 UYs beginning in a few weeks), a standard contract will have 17 years of points left, with the final points coming in 2041.

At $100/pt for 17 years, that's $5.88/pt for a flat valuation. But what about a 5% discount?

Early years are worth more, later years are worth less. And it still adds up to $100/pt. This is the same discounting methodology used in my Most Economical Resort - Beyond Year 1 thread (but in that thread I add in dues predictions! fun stuff).

This year's points are worth $8.59/pt this way. Before dues. Let's say Generic 2042 has average WDW dues, so $8.86/pt in 2025. That means the 2025 points are really valued at $17.45/pt for purchases made today.

If 2024's points are fully usable for your UY, then they're essentially equally as good as the 2025 points and bonus 2024 points should be worth the same $17.45/pt in this example. If the 2024 points are less usable then you should discount them. You can also apply this to banked 2023 points, though surely those have usability defects at this point. You can also use 2024/2023 dues values instead of 2025.

What if your 2042 resort is not selling at $100/pt after closing costs? Well, that $8.59 also just happens to be 8.59%.

In summary, bonus 2024 points on a 2042 resort should increase the value of the contract by 8.59%, plus the value of any dues the seller paid. Decrease the amount if the bonus points have any usability defects (e.g., expiring soon, can't be used at home resort for your desired travel period, etc.).

Of note, this 8.59% definitely shouldn't be applied to all contract lengths.

Let's look at a Generic 2060 resort next, with 35 years of points remaining. Let's price this resort at $140/pt after closing costs. This is what its annual value of points looks like with a 5% decrease each year:

Coincidentally, 2025 points are actually fairly similar in value at $8.39! But as a percentage it's lower. $8.39 is 6% of $140.

We can apply the same principle here, though: bonus 2023 or 2024 points on a 2060 resort should increase the value of a contract by 6% plus the value of any dues the seller paid. Decrease the amount if the bonus points have any usability defects (e.g., expiring soon, can't be used at home resort for your desired travel period, etc.).

What about other expirations? I have a whole table of expiration dates just for you:

Can also apply it to 2023 points if they're included. Then add any dues on usable points the seller paid. Then discount for any usability defects (how much is up to you and your scenario).

Practical Valuation of Missing Points

The principle and methods also work in reverse! The numbers are essentially the same.

Let's breakdown why the numbers are the same. Going back to this chart for Generic 2042:

This is what the points are worth each year from 2025 through 2041 for a contract that has points from 2025 through 2041 and is properly priced at $100/pt after closing costs. As a reminder, there's a 5% decrease in value each year to take into account some time value of money.

If you don't get the 2025 points, you're not getting $8.59 worth of points from your purchase and therefore the contract price should be reduced $8.59 to $91.41/pt. But that's only if the seller is paying the dues for the points you're not getting.

If you're on the hook for the 2025 dues while not receiving the points, then that $91.41/pt needs to be negotiated down by the amount of the dues, otherwise your future years points are coming at a higher price vs. a $100/pt contract with 2025 points.

What if 2026 points are also missing? Price should go down by $16.75 plus dues credits due to losing $8.59 of 2025 points and $8.16 of 2026 points.

Putting it all together

Okay, I've laid out the concept for my opinion for what bonus/missing points should be worth above. Putting it into practice, what does this work out to in 2025 for each resort?

Taking the last 3 months of resale pricing from dvcresalemarket.com's blog posts on the topic, plus the 2025 dues, we get this for each resort:

* Bonus points should be discounted if there's any usability defects. Applying 2023/2024 dues to bonus points also is suggested. If 2026 points are missing, the base value decreases but the dues will likely increase by a similar amount, so the After Dues figures above are probably close enough™.

If you read all the way to the bottom, you'll also spot that some resorts are over the commonly cited $20/pt rental value. In these cases the $20/pt rental value is undervaluing the missing/bonus points. Maybe that works out for you if there's bonus points though!

The keen-eyed among you might also notice that the After Dues figures above are the same as what you'll find from the 'Year 1' values in my Most Economical Resort - Beyond Year 1 thread's January 2025 update. What a coincidence...or not