VGCgroupie

Im in this photo

- Joined

- May 29, 2017

- Messages

- 10,657

So it will get the contract end dates accurately?AI engines do the math and spreadsheet setup - basically saving the time of setting up a spreadsheet. they are not "internet sourced"

So it will get the contract end dates accurately?AI engines do the math and spreadsheet setup - basically saving the time of setting up a spreadsheet. they are not "internet sourced"

I had to train it that the contracts end EOM Jan or it was giving points in 2070 for RIVSo it will get the contract end dates accurately?

Was joking around since someone here posted AI cost breakdown and it said a resort had like 8 years longer on its contract than it actually was.I had to train it that the contracts end EOM Jan or it was giving points in 2070 for RIV

Was it trying to get the cabins to break even?Was joking around since someone here posted AI cost breakdown and it said a resort had like 8 years longer on its contract than it actually was.

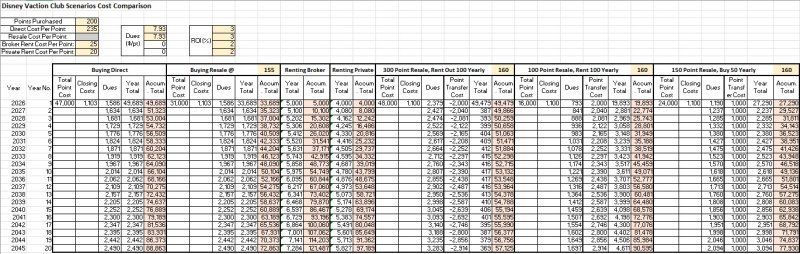

From my personal spreadsheet tab for DVC research, I have the following columns:

From these inputs, I have formulas generated in other columns to show:

- Home resort

- UY

- Years remaining

- Annual dues

- Price

- Points

- Listed $ per DVC pt

Resale contracts from Copper Creek, BLT, Sara Springs, and Poly can have an Est $/pt around $13.70 while Hilton Head, Vero Beach, and Beach Club can be much higher at $16.40 per point. Pretty much the contracts that expire in 2042 have much higher annual dues and the fewest years remaining. Contracts with more years remaining typically have lower annual dues.

- Estimated total dues (based on an assumed 2.7% annual increase)

- Estimated total cost (Estimated total dues plus Price)

- Total points (Points multiplied by Years remaining)

- Estimated price per point (Estimated total cost divided by Total points)

On the direct sales side, Poly seems to have lower dues than Disneyland Villas and Aulani which could be quite significant over the years.

I saw something that said the original dues in 1992 was $2.51 per point and then another article saying the dues were $3 per point in 1998. Now that I'm poking around, apparently there was a 7.6% increase in 2019 at some properties due to the increase in minimum wage?How did you get to the 2.7% dues increase? Seems to be lower than historical.

I'm looking for a spreadsheet that includes the effects of Addonitis and the costs of the DVC specific merchandise that seems to invade the budget.

This is where I got my historical dues and then we converted it to a spreadsheet to predict future increases. https://dvcnews.com/dvc-program-menu/financial/annual-dues-by-resortHow did you get to the 2.7% dues increase? Seems to be lower than historical.

Yea I modelled off of that. 4-5% seems to be the norm for most resorts, but I did get specific by resort.This is where I got my historical dues and then we converted it to a spreadsheet to predict

Agree on that number I use 4.5%. The real challenge is what percent do you use for the change in hotel cash rates , I assume a 30% discount off rack and I do not use RIV cash rates at all since when booking a cash trip I would never pay their rates when BC /YC and BW are less. I have been using 3% for my numbers but that may be a bit conservative.Yea I modelled off of that. 4-5% seems to be the norm for most resorts, but I did get specific by resort.

Agree on that number I use 4.5%. The real challenge is what percent do you use for the change in hotel cash rates , I assume a 30% discount off rack and I do not use RIV cash rates at all since when booking a cash trip I would never pay their rates when BC /YC and BW are less. I have been using 3% for my numbers but that may be a bit conservative.

And… let’s see it, what’s your outcome or results?I came to the conclusion that buying resale was the best fit for us. From there, I needed to build a spreadsheet to compare resale contracts against each other. It’s a little more complicated comparing stripped contracts to loaded contracts.

I also used AI pretty extensively and dealt with errors.

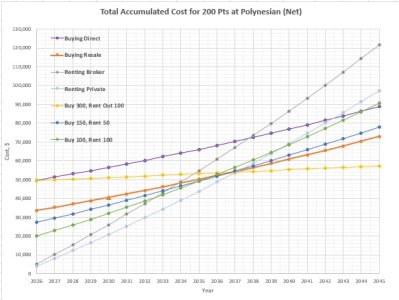

Quick question: How are you accounting for the $/pt? Are you dividing the initial price by the number of annual points? I ask because a direct contract has 50 years of usability versus a resale for Poly would 40 years left. So wouldn't it make sense to multiply the annual points by the number of years left to calculate the total points on the contract, then divide that by the total cost (price+accumulated dues)?I started assuming I would need 200 points per year at the Poly. I wanted to look at all the realistic options, even looking into combos of buying and renting. There are pros and cons to all options, but I wanted to weigh those after the numbers were crunched.

The data does not factor in discounts on tickets, dining, and merch. For us, the greatest monetary perk of direct is the Sorcerer Pass, but I am hesitant to rely on that too much. It's a significant discount, but it just hasn't been around long enough for me to feel comfortable factoring it in for the next 10+ years. I may throw in AP costs at some point to see how it shakes out. We tend to buy APs every other year and take our big trips at the beginning and end to maximize it. Just running quick math, it would take 16-17 years to break even on the $20k-ish extra for buying direct over resale.

View attachment 993662View attachment 993663

This spreadsheet just calculates how much you are paying year by year. Direct and resale obviously have a high up-front cost, compared to renting. I wanted to see when renting surpassed direct and resale and lines started crossing over. I really only looked at a 20 year window because I figured that would tell me what I wanted to know.Quick question: How are you accounting for the $/pt? Are you dividing the initial price by the number of annual points? I ask because a direct contract has 50 years of usability versus a resale for Poly would 40 years left. So wouldn't it make sense to multiply the annual points by the number of years left to calculate the total points on the contract, then divide that by the total cost (price+accumulated dues)?

Just asking because my calculation was that buying direct is not significantly more than buying resale...perhaps a 10% premium compared to a relatively good deal on a resale contract. I've yet to buy DVC but I'm getting close.