lilsonicfan

DIS Veteran

- Joined

- Jan 20, 2003

- Messages

- 3,476

^^Not so much kickbacks, just not arms length.

The former is profiting directly through the recommendation and use of the latter.

Looking around and so far Magic's website lacks any disclosure of a business affiliation. Now I'm curious to review the initial paperwork received for affiliation disclosures.But that’s not a kickback. They are under the same company…just different divisions…basically, it’s an all inclusive situation that includes a broker, title and finance company.

It’s really no different than direct…the sales, title, and financing is all done by divisions of Disney…

Typo. Yes there are 2025 points.do you use the string tool? or there isn't 2025 points on this? so 2024 Annual Dues $1526.85, leaving closing at a big $848.15. Those fees add up!

I have one going through with them at the moment. So far so good, they got closing docs to me within 24 hours of ROFR, although I find it odd that you still need to print and sign documents rather than using electronic signatures like other title companies.Looking around and so far Magic's website lacks any disclosure of a business affiliation. Now I'm curious to review the initial paperwork received for affiliation disclosures.

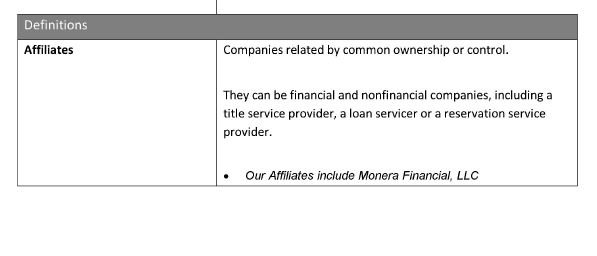

Edit: Nope, no disclosure of DVC Resale Market and Magic Vacation Title sharing common ownership. It's not included in the list of Affiliates that came from the docs to open escrow. They do include Monera Financial LLC, but not DVCRM.

View attachment 840029

When I was keeping track a year or so ago the high water I saw was 2700, so we have a ways to go to get back there. If anything I'm surprised that prices haven't held up better.Wow, well over 2000 active listings out there.

Used to always be 400-600 up to a couple of years ago. Over 400 SSR on its own now.

Prices will surely have to fall more if a seller wants quick sale.

Brokers keep posting listings based on historical values, not sure that will cut it going forward.

Lack of buyers is a risk to anyone who is planning to sell as part of their DVC exit plan.

You really need to lowball everything you can to offset some future risk.

Completely agree with this....Prices will surely have to fall more if a seller wants quick sale.

Brokers keep posting listings based on historical values, not sure that will cut it going forward.

Lack of buyers is a risk to anyone who is planning to sell as part of their DVC exit plan.

You really need to lowball everything you can to offset some future risk.

Well I'm really intrigued. Is your processor Emily?I have one going through with them at the moment. So far so good, they got closing docs to me within 24 hours of ROFR, although I find it odd that you still need to print and sign documents rather than using electronic signatures like other title companies.

I also had to sign paperwork acknowledging that they were affiliated with the broker at the start of the process.

Overall I’m finding much more paperwork on this one… I must have filled in my details and membership number at least 4 times already. Could definitely do with streamlining the process!

I’m now in the final stages of completing my first resale purchase and it had me curious about flipping our SSR contract for somewhere closer to the parks but sounds like it’s going to be tough even if willing to commit a decent outlay for the equivalent number of points.Wow, well over 2000 active listings out there.

Used to always be 400-600 up to a couple of years ago. Over 400 SSR on its own now.

Prices will surely have to fall more if a seller wants quick sale.

Brokers keep posting listings based on historical values, not sure that will cut it going forward.

Lack of buyers is a risk to anyone who is planning to sell as part of their DVC exit plan.

You really need to lowball everything you can to offset some future risk.

I would expect to pay about $40 to $45 less per point for a contract at SSR than for a BLT contract. There is also a good chance that difference could be $50-55.I’m now in the final stages of completing my first resale purchase and it had me curious about flipping our SSR contract for somewhere closer to the parks but sounds like it’s going to be tough even if willing to commit a decent outlay for the equivalent number of points.

Yup, given we plan our trips a year in advance and therefore have a decent chance of swapping at 7mo it’s not worth it.I would expect to pay about $40 to $45 less per point for a contract at SSR than for a BLT contract. There is also a good chance that difference could be $50-55.

That has been my plan and our initial 2 trips it has worked.Yup, given we plan our trips a year in advance and therefore have a decent chance of swapping at 7mo it’s not worth it.

I’ll probably end up with addonitis instead though!

Sounds like a great approach! I don’t like SSR I just prefer other options particularly with having a young family but we also own at PVB and have BCV in the family to stay at, just means a bit of work at 7mo which I do enjoy when it all works out well!That has been my plan and our initial 2 trips it has worked.

I posted previously that in about 10 years I would expect SSR/Disney Springs will be our most likely stay so if I can use SSR points for the next 10 years we are fine.

I think next year we try BLT/Kidani 1-bedroom split stay or a 2 bedroom at CCV or BRV.

| $102-$19031-160-AKV-Feb-0/23, 160/24, 160/25, 160/26- sent 2/18, passed 3/5; received docs 3/7 |

| $102-$19022-160-AKV-Feb-0/23, 159/24, 160/25, 160/26- sent 2/20, passed 3/4; received docs 3/5 |

| $95-$26323-250-SSR-Oct-0/22, 99/23, 163/24, 250/25- sent 2/28 |

You might need to use the string tool linked at the first page of this thread in order to generate a string that can be added to the frontjcolvin5 - DVC Resale Market/Magic Vacation Title

$102-$16320-160 AKL-Feb 0/23, 160/24, 160/25- sent 2/18, passed 3/5, received docs 3/7

$102-$16320-160 AKL-Feb 0/23, 159/24, 160/25- sent 2/20, passed 3/4, received docs 3/5

$95-$23750-250 SSR-Oct 99/23, 163/24, 250/25-sent 2/28

Don't even get me started on them right now, lol. As a seller, it's been an extremely frustrating process, with them starting closing before receiving the buyer's money, not paying off my dues immediately upon closing which caused my membership to be locked, etc., with no communication unless I followed up to ask what's going on. I have another contract that should have closed on 2/27 but hasn't gotten buyer's money and I had to email repeatedly to get them to reach out to the buyer to try to find out what's going on.Today I was promised by https://magicvacationtitle.com/ to get the docs by the end of Monday, March 11th... we passed ROFR on February 29th. So it'll be 11 days from passing to just getting the docs.

How is that company in business? Other settlement companies could easily be closed and recorded in 11 days by the time we just receive our docs. I can only imagine the pace they'll have on setting a closing date and recording.

PSA reminder: You can pick your settlement company. It does *not* have to be the one the broker company prefers. (kickbacks are a heck of a drug)

Done! Thank youYou might need to use the string tool linked at the first page of this thread in order to generate a string that can be added to the front

jcolvin5 - DVC Resale Market/Magic Vacation Title

$102-$19031-160-AKV-Feb-0/23, 160/24, 160/25, 160/26- sent 2/18, passed 3/5; received docs 3/7

$102-$19022-160-AKV-Feb-0/23, 159/24, 160/25, 160/26- sent 2/20, passed 3/4

$95-$26323-250-SSR-Oct-0/22, 99/23, 163/24, 250/25- sent 2/28