achinforsomebacon

Mouseketeer

- Joined

- Mar 8, 2021

- Messages

- 397

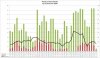

I didn't want to hijack pangyal's great ROFR thread so I decided to start another with some ROFR statistics. I'm trying to compile additional information and put together more robust charts, but I'll start with a few simple ones. The first one shows the breakdown of contracts between passed/waiting/taken by the week they were sent to ROFR. It also includes the average number of days for ROFR. Note that the more recent weeks are skewed downwards since contracts that are still waiting will increase the average # of days as they go through ROFR. It looks like it's been fairly consistent at around a 3 week wait for ROFR over the past couple of months.

ETA - all data is coming from the ROFR threads so it's only a subset of all contracts being sent.

ETA - all data is coming from the ROFR threads so it's only a subset of all contracts being sent.

Last edited: