At the end of the day, all of us are justifying our Disney spend in one way or another.

I’m sure a hardcore FIRE type would judge all of us for taking regular

Disney vacations at all.

I cringe every time we shell out for

Genie+, and yet we still do it because I put a subjective value on spending less time standing in line.

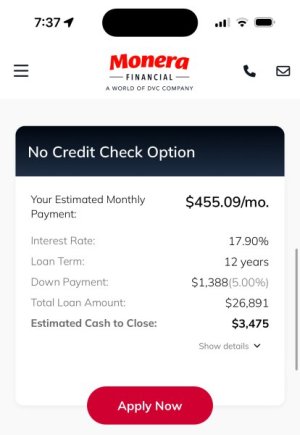

I tend to believe that all financing for

DVC is a bad idea—but practically speaking, if your option was financing the summer VGF deal at $161/pt (or $183 with Magical Beginnings) vs saving 6 months but then paying $230/pt— you probably came our way ahead with even a 15% APR (assuming you then pay it off around 6mo). Having said that, financing with a plan to pay off inside a year is a totally different animal than planning to pay off over a decade or two— ESPECIALLY with Disney changing its model to make resale less valuable with restricted points, which makes the debt riskier.

I recognize that some people on these boards are very aggressive in lecturing about “no financing ever”, but many others are just trying to caution people who’ve never lived/invested in high interest rate environments to be aware of how much a 15% interest rate is going to add to the total cost of a purchase over 10 years (more than doubles the purchase price).