Jiminycricket86

Earning My Ears

- Joined

- Sep 8, 2021

- Messages

- 11

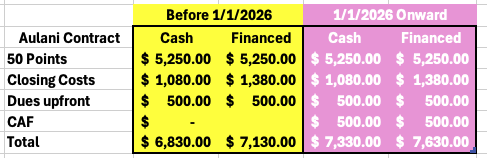

Just wondering, the article states that contracts that are signed and sent to Disney before 1/1/26 won't have to pay the $500 fee. Does anyone know if this is contracts signed and sent for ROFR before 1/1/26, or does it need to be that the contract is out of ROFR and closing documents sent to Disney before 1/1/26? Thanks!