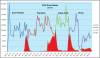

COVID also did a number on RIV sales.

In its first 12 months of sales, RIV averaged

114,400 points per month. After WDW reopened in July 2020, RIV has averaged only 64,200 points per month (August 2020 to July 2021).

CCV averaged

78,300 points per month during its first 12 months. (It averaged 142,400 in its second year of sales.)

PVB averaged

79,400 points per month. (128,800 its second year.)

VGF averaged

108,000 points per month. (95,600 its second year.)

So, at least for the first 12 months, RIV outsold all other recent

DVC resorts.

With the resale restrictions, high cost per point, high MF, and high

point chart, I was really surprised at how well RIV sold.

This might show that most first-time buyers aren't looking at price as much as the hotel itself. You described RIV as gorgeous. It appears others thought the same.

In addition, I suspect the new Skyliner was a selling point too.