MamaBear12

DIS Veteran

- Joined

- Jul 19, 2016

- Messages

- 513

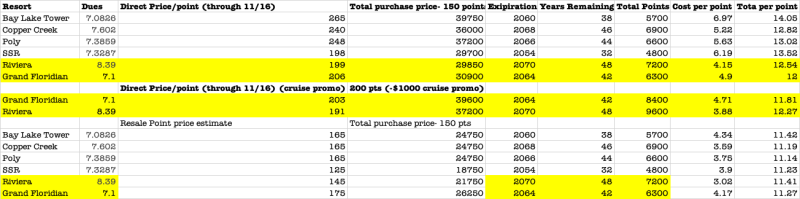

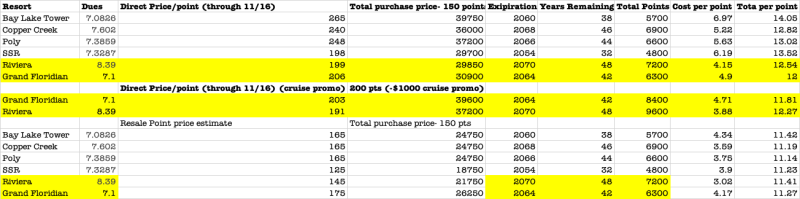

We just went on a cruise and I learned from contacting DVC that we're eligible for additional promotions ($1K off and additional per point price reduction on Riviera and Grand FL) if we buy 200 points. We are considering 150-200 and debating between direct and resale. This is the comparison I've come up with, though resale prices are a guesstimate. Anything I'm missing or should adjust? Over lifetime of contracts, the difference in point value between direct and resale is less than $1/point, so not insignificant, but not 10s of thousands. Poly, Copper Creek, SSR, and Grand FL are lowest per my resale estimates with Grand FL the clear winner for direct purchase (factoring in current dues which I know could change). Thoughts?