Paying cash for Moderates gives more flexibility to pick and choose with less lead time.

DVC is tighter in that regard though it has more choices to open.

Rates on moderates can vary wildly. At 12-13 days per year I assume you have an annual pass. I stayed recently at Coronado for about $180 with an AP discount. Even after taxes it was cheaper than maintenance fees for one night in many DVC studios. DVC is not an obvious yes.

Yes you can. That’s about as cheap as it gets, doubles and triples from there.

At 10 months out DH decided we’d visit the week before Christmas since kids will be out of college. Rack rates are eye watering! Plus as a cash party of 4 we’d be paying for the extra 2 guests 18+. All the moderates start at over $450/nt for just the

standard view before those extra fees.

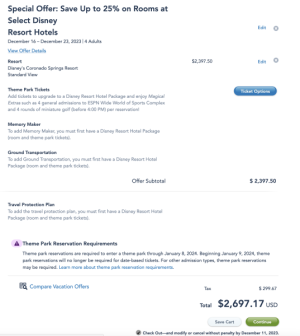

This is WDW high season (along with spring break), offers go nowhere near something like 35-40% off. The best offers will be on more expensive room categories like preferred view with 5th sleeper and lucky to find 20% off. The best offer will be the least popular rooms in the pack. Moderates for Dec 16-23 are looking at minimum $2,500 and easily can go over $3k.

These are the 2 ends of the spectrum. The lowest mod rates during slow season vs highest cash season that intersects DVC’s lower than average point season.

We booked a week split stay just under 150 pts DVC Poly and BWV in the highest view categories, 7 Seas Lagoon Lake View and Boardwalk View. Even taking a high estimate of TVM where we plump up our $12pp VGF direct points to $20pp to make up for lost opportunity, It’s costing us $1800 for that week (or $3000 at the plumped up $20pp).

I don’t know if anybody even got a moderate Dec 16-23 under $2500* total, probably not. I checked the deals for the rooms we booked, Poly was $1400/nt for what we booked, $1100/nt was the best deal. BW $1100, and $850 with the best deal. Neither include extra adult head beyond 2 fees that would apply to cash.

We would’ve never paid the

discounted $7,000 rate. The moderate for $3k? Maybe. With DVC I’m paying somewhere between $2k and $3k depending how you look at it for Poly Lakeview and Boardwalk View.

I’m not saving money. I’m getting access to more exciting inventory within my budget. DVC also opens more frugal options like OKW is only 80 points that week. AKL or SSR 95pts. Those will cost much less than any moderate.

*If anybody has a similar moderate booking I’d appreciate sharing the real world price.